- United States

- /

- Electrical

- /

- NasdaqCM:BWEN

Broadwind, Inc.'s (NASDAQ:BWEN) Low P/S No Reason For Excitement

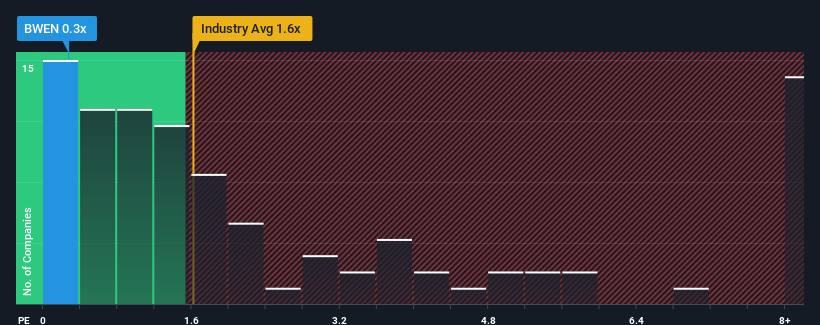

With a price-to-sales (or "P/S") ratio of 0.3x Broadwind, Inc. (NASDAQ:BWEN) may be sending bullish signals at the moment, given that almost half of all the Electrical companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Broadwind

How Broadwind Has Been Performing

Broadwind certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Broadwind will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Broadwind's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 5.1% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 12% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 25%, which paints a poor picture.

With this information, we are not surprised that Broadwind is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Broadwind's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Broadwind's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Broadwind (2 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Broadwind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BWEN

Broadwind

Manufactures and sells structures, equipment, and components for clean tech and other specialized applications primarily in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives