- United States

- /

- Machinery

- /

- NasdaqGM:BLBD

Will Blue Bird's (BLBD) Joint Venture Exit Refocus Its Clean Energy Strategy?

Reviewed by Sasha Jovanovic

- In the past week, Blue Bird Corporation announced the termination of its Clean Bus Solutions joint venture with Generate Capital, stating that this underperforming initiative will be wound down by its board and is not expected to affect the company’s financial condition, results, or cash flow.

- This move follows heightened industry focus on Blue Bird’s clean bus portfolio, recent client deployments, and evolving regulatory frameworks that influence alternative-fuel offerings across North America.

- We’ll take a closer look at how the decision to exit the joint venture may influence Blue Bird’s clean energy growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Blue Bird Investment Narrative Recap

Blue Bird’s investment narrative centers on the company's ability to ride the ongoing shift toward clean and alternative-fuel school transportation, underpinned by supportive government policies and school fleet modernization. The recent termination of its Clean Bus Solutions joint venture does not appear material to near-term results or the company’s capacity to seize industry tailwinds, with ongoing government funding and fleet replacement cycles remaining the key catalysts; policy changes and funding delays continue to pose the largest risks.

The most relevant recent development is the Guilford County Schools’ purchase of 10 Blue Bird Vision Propane buses, highlighting both customer demand for lower-operating-cost, low-emission alternatives, and the importance of alternative-fuel sales as a short-term driver. Ongoing client wins and product deployments in propane and electrics reinforce Blue Bird’s competitive position as school districts seek cost-effective solutions that support stricter emissions standards and improve total cost of ownership.

But for investors, it is vital to keep in mind that if government incentives or clean energy funding are reduced or delayed...

Read the full narrative on Blue Bird (it's free!)

Blue Bird's narrative projects $1.6 billion revenue and $152.3 million earnings by 2028. This requires 4.0% yearly revenue growth and a $36.4 million earnings increase from $115.9 million.

Uncover how Blue Bird's forecasts yield a $59.12 fair value, a 5% upside to its current price.

Exploring Other Perspectives

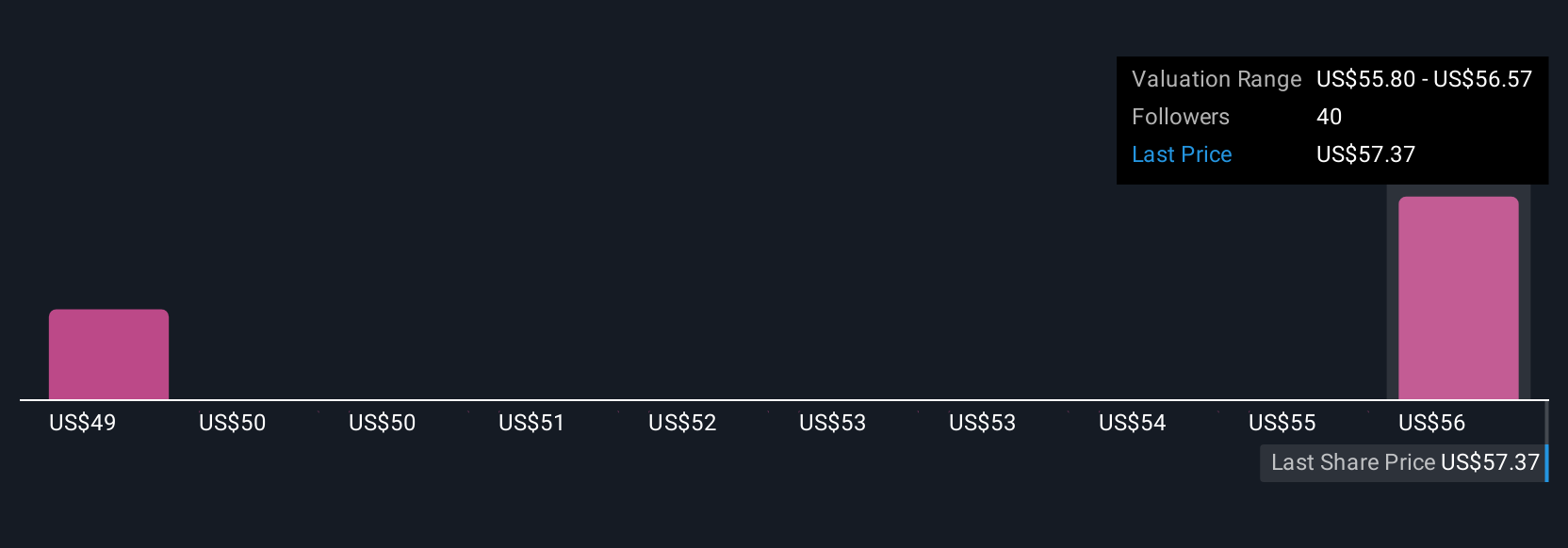

Simply Wall St Community members provided three fair value estimates for Blue Bird, ranging from US$59.13 to US$94.78. While market participants see clean bus incentives driving growth, there is broad disagreement among investors about future earnings potential, explore diverse viewpoints to weigh the potential risks and opportunities.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth as much as 68% more than the current price!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BLBD

Blue Bird

Designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives