- United States

- /

- Machinery

- /

- NasdaqGM:BLBD

Will Analyst Forecast Revisions Around Blue Bird's (BLBD) Earnings Reveal a Shift in Market Expectations?

Reviewed by Sasha Jovanovic

- In recent trading sessions, Blue Bird drew heightened investor focus ahead of its upcoming earnings disclosure, as market participants anticipated better earnings per share and revenue growth. An interesting aspect is the close scrutiny of analyst forecast revisions, which often highlight new business trends investors are watching closely.

- We'll now look at how the increased anticipation around Blue Bird’s forthcoming earnings report and analyst forecast updates could influence its broader investment outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Blue Bird Investment Narrative Recap

To be a shareholder in Blue Bird, you need confidence in the shift toward cleaner school transportation, continued government support, and the company’s ability to innovate profitably amid variable policy and cost pressures. The latest news about anticipated higher earnings and close-watched analyst forecasts does not fundamentally alter the primary near-term catalyst, the impact and sustainability of government incentives for electric and alternative-fuel bus sales, or the outsized risk stemming from possible reductions or delays in such funding. Of recent company developments, Blue Bird’s August tightening of full-year 2025 revenue guidance stands out. This move reaffirmed management’s visibility into sales pipelines and indicated a degree of operational control, which aligns with the expectations for revenue growth and margin improvement highlighted by investors awaiting the upcoming earnings disclosure. Yet, even with positive guidance, investors should be aware that funding delays or policy uncertainties could quickly...

Read the full narrative on Blue Bird (it's free!)

Blue Bird's outlook anticipates $1.6 billion in revenue and $152.3 million in earnings by 2028. This scenario assumes a 4.0% annual revenue growth rate and a $36.4 million increase in earnings from the current $115.9 million.

Uncover how Blue Bird's forecasts yield a $62.38 fair value, a 21% upside to its current price.

Exploring Other Perspectives

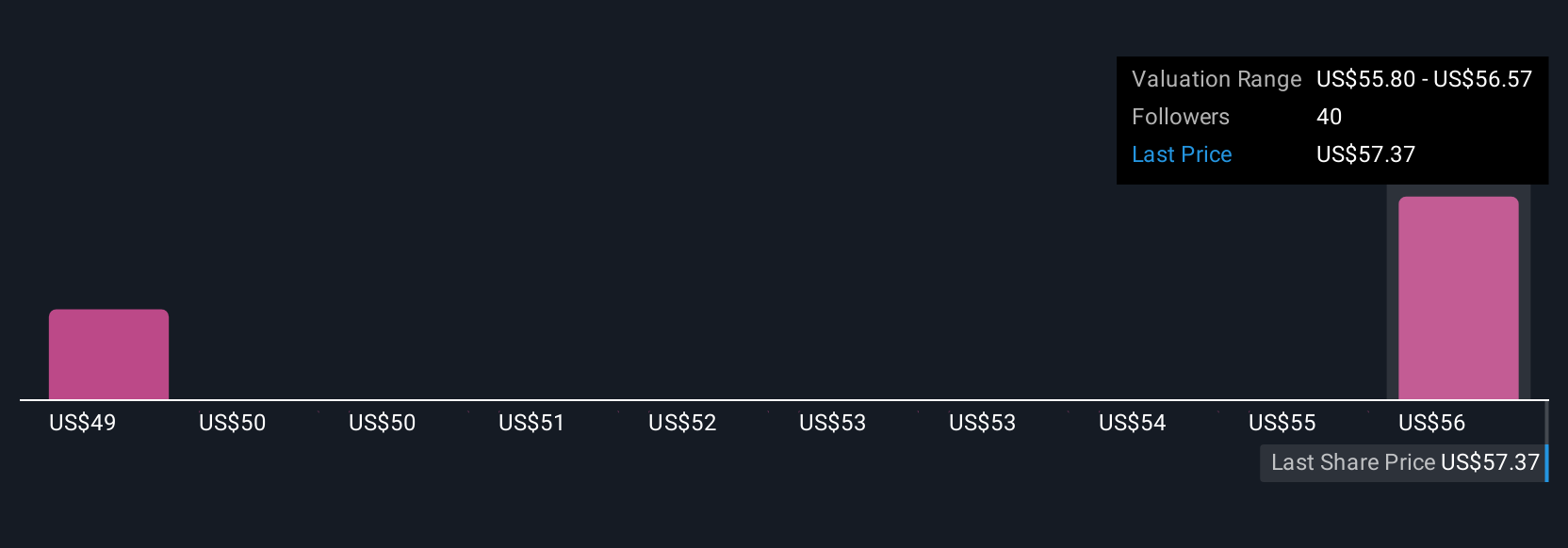

Three Simply Wall St Community members placed fair values between US$62.38 and US$92.29 for Blue Bird, highlighting a broad range of potential outcomes. With such differences and ongoing reliance on sustained government incentives, it pays to compare diverse views before deciding where you stand.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth as much as 79% more than the current price!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BLBD

Blue Bird

Designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives