- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Market Participants Recognise Axon Enterprise, Inc.'s (NASDAQ:AXON) Revenues

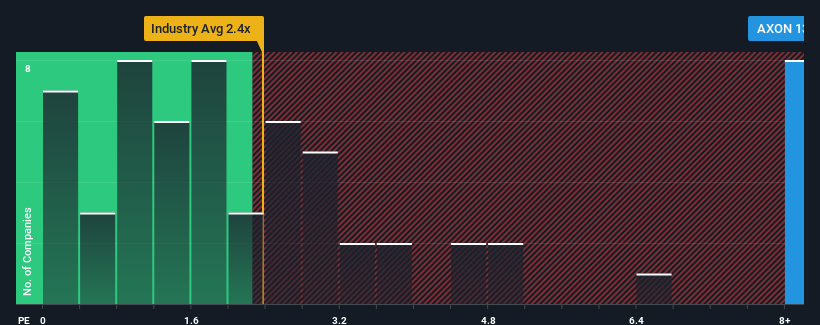

When close to half the companies in the Aerospace & Defense industry in the United States have price-to-sales ratios (or "P/S") below 2.4x, you may consider Axon Enterprise, Inc. (NASDAQ:AXON) as a stock to avoid entirely with its 13.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Axon Enterprise

How Axon Enterprise Has Been Performing

With revenue growth that's superior to most other companies of late, Axon Enterprise has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Axon Enterprise.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Axon Enterprise's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. The latest three year period has also seen an excellent 131% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 24% during the coming year according to the eleven analysts following the company. That would be an excellent outcome when the industry is expected to decline by 3.3%.

With this information, we can see why Axon Enterprise is trading at such a high P/S compared to the industry. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What We Can Learn From Axon Enterprise's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we anticipated, our review of Axon Enterprise's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

Before you settle on your opinion, we've discovered 3 warning signs for Axon Enterprise that you should be aware of.

If these risks are making you reconsider your opinion on Axon Enterprise, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives