- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Axon (AXON) Valuation Check After Recent Pullback and Conflicting Fair Value Signals

Reviewed by Simply Wall St

Axon Enterprise (AXON) has had a choppy stretch, with the stock slipping over the past 3 months but still showing strong multi year gains, so it is worth asking what the market is really pricing in.

See our latest analysis for Axon Enterprise.

After a sharp pullback that left the 90 day share price return at negative 24.33 percent and the 1 year total shareholder return at negative 11.53 percent, Axon still sits on a powerful three year total shareholder return of 227.56 percent. This suggests that long term momentum remains intact even as sentiment cools in the near term.

If Axon’s recent swings have you rethinking concentration risk, this could be a good moment to scan fast growing stocks with high insider ownership for other compelling growth stories backed by committed insiders.

With growth still robust and the share price well below consensus targets, the key question now is whether Axon is quietly undervalued or if the market is already pricing in every ounce of its future expansion.

Most Popular Narrative Narrative: 30.9% Undervalued

With Axon Enterprise last closing at $568.39 against a narrative fair value of about $822.50, the story leans heavily toward upside and ambitious growth.

The total addressable market is viewed as both large and underpenetrated, with low current penetration in law enforcement and a long runway to expand into other frontline worker segments.

Recurring, sticky customer relationships in mission critical environments underpin confidence in durable cash flow growth and support price targets in the mid to upper $800s per share.

Want to see what kind of growth engine justifies such a steep climb from today’s price? The narrative leans on aggressive revenue expansion, evolving margins, and a punchy earnings multiple that would not look out of place among market darlings. Curious which assumptions really move the valuation needle and how they fit together over the next few years? Dive in to unpack the full playbook behind that fair value.

Result: Fair Value of $822.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or stricter global regulation on law enforcement tech could slow adoption and margins, quickly challenging today’s upbeat long term assumptions.

Find out about the key risks to this Axon Enterprise narrative.

Another Lens on Value

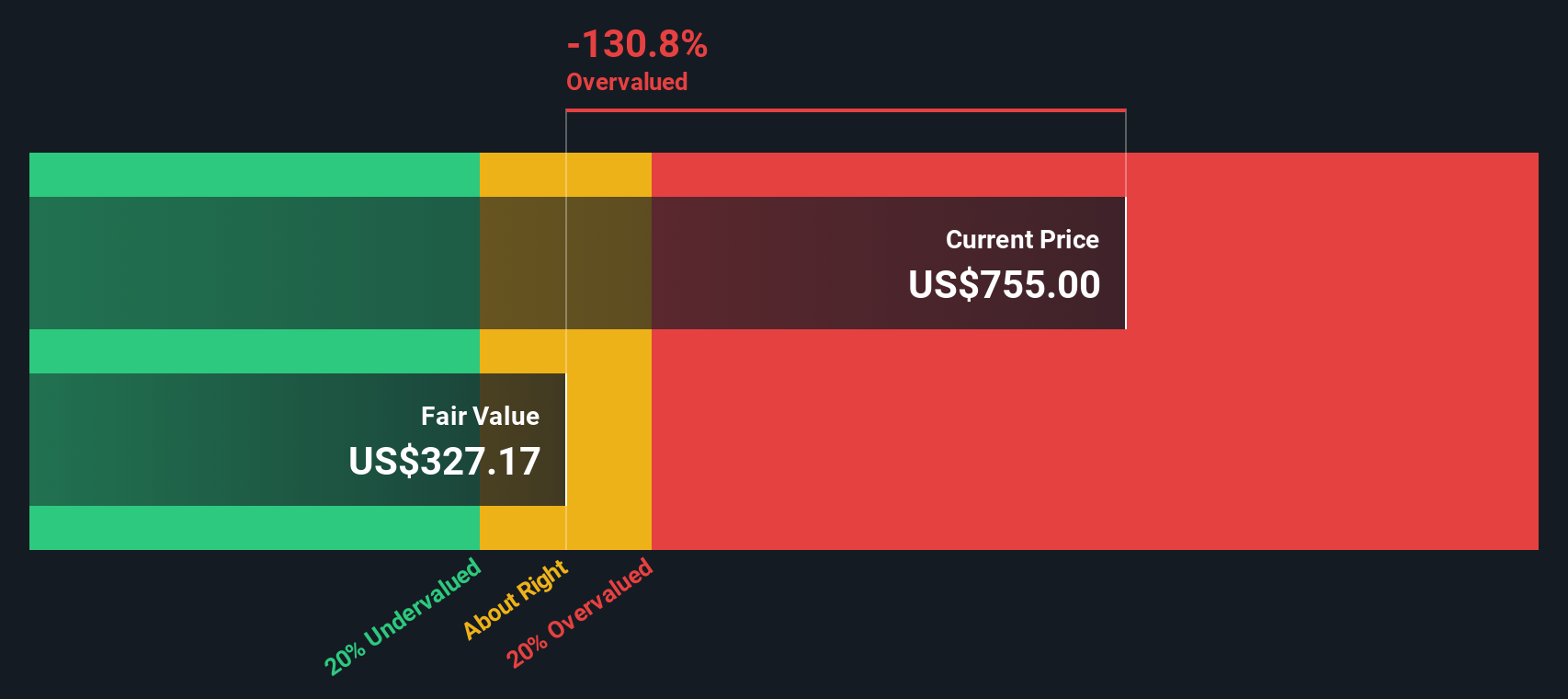

Not everyone sees Axon as a bargain. Our SWS DCF model, which projects cash flows rather than narratives, suggests fair value around $401.63 per share, implying the stock is actually overvalued at today’s $568.39 level. Is the market overpaying for growth, or is the model too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axon Enterprise Narrative

If the conclusions above do not quite match your view, you can dig into the numbers yourself and craft a custom narrative in minutes, Do it your way.

A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to uncover fresh opportunities beyond Axon, or you could miss some of the market’s most compelling setups.

- Capitalize on mispriced quality by scanning these 909 undervalued stocks based on cash flows that combine strong fundamentals with discounted valuations others have overlooked.

- Ride the AI adoption wave by reviewing these 25 AI penny stocks poised to benefit as intelligent automation reshapes entire industries.

- Lock in potential income streams by targeting these 12 dividend stocks with yields > 3% that balance attractive yields with sustainable payout capacity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Provides public safety technology solutions in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion