- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Axon (AXON) Valuation Check After a 23% Pullback From Its Multi‑Year Run

Reviewed by Simply Wall St

Axon Enterprise (AXON) has quietly pulled back over the past month, with the stock down about 23% after a strong multi year run. This raises the question of whether this is healthy consolidation or something more.

See our latest analysis for Axon Enterprise.

That pullback sits in sharp contrast to Axon’s powerful multi year run, where the 5 year total shareholder return is up 333.18% and even the 3 year total shareholder return is a hefty 216.55%. This suggests momentum is cooling, but the long term story remains very much intact.

If Axon’s ride has you rethinking where growth could come from next, it might be worth exploring high growth tech and AI stocks as potential new ideas for your watchlist.

With the share price well below analyst targets but still reflecting years of rapid growth, investors now face a key question: is Axon undervalued after this pullback, or is the market already pricing in its future expansion?

Most Popular Narrative: 33.9% Undervalued

With Axon closing at $543.55 versus a most popular narrative fair value of $822.50, the valuation gap hinges on aggressive growth and premium multiples.

Analysts are assuming Axon Enterprise's revenue will grow by 24.3% annually over the next 3 years.

Analysts assume that profit margins will shrink from 13.6% today to 10.4% in 3 years time.

Want to see why slower margins can still support a soaring valuation? The narrative leans on powerful revenue compounding and a daring future earnings multiple. Curious which assumptions really carry this price?

Result: Fair Value of $822.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, renewed regulatory scrutiny or slower government spending could quickly cool growth expectations and challenge the premium multiple that this narrative relies on.

Find out about the key risks to this Axon Enterprise narrative.

Another Lens on Valuation

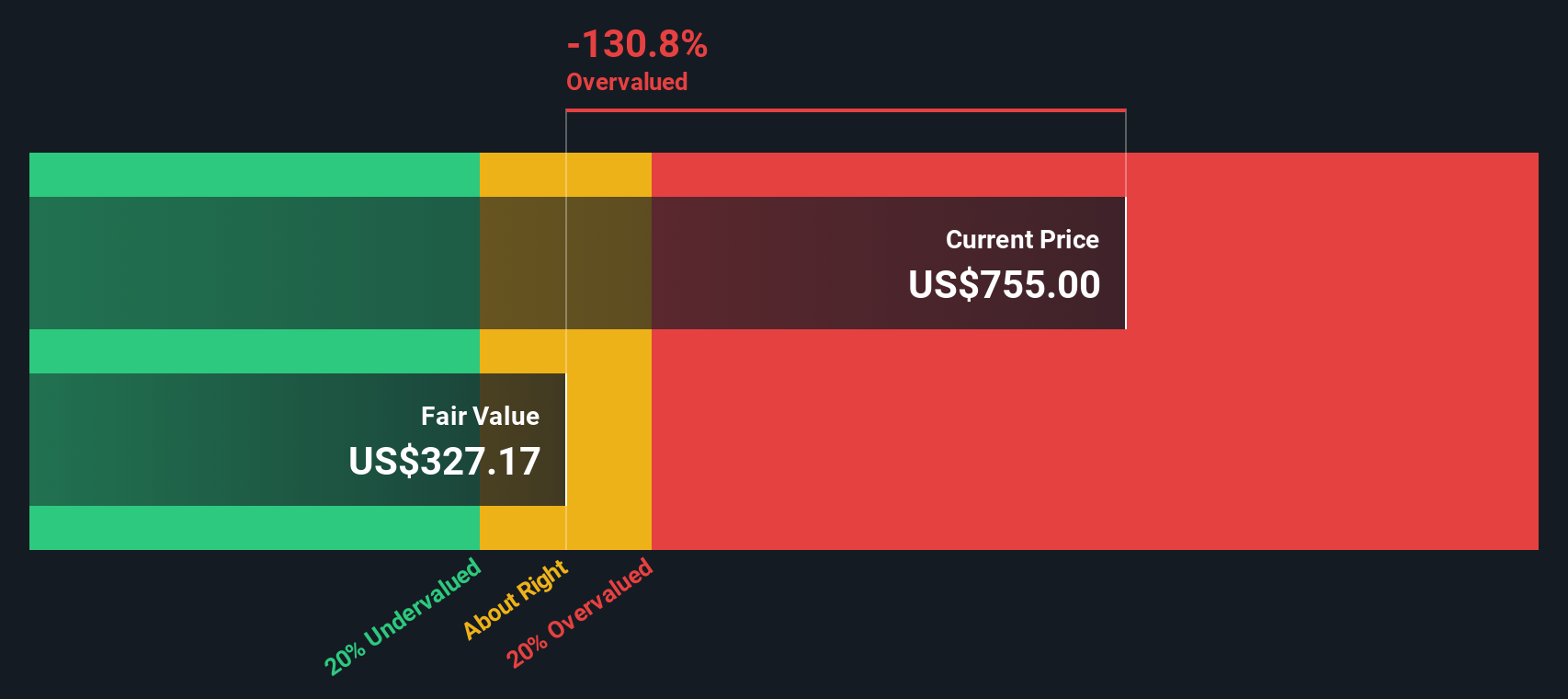

Our SWS DCF model paints a more cautious picture, with Axon’s fair value at $383.06 versus the current $543.55. On this view, the stock looks overvalued, not undervalued. This raises a tougher question: are growth hopes running ahead of what cash flows can realistically deliver?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axon Enterprise Narrative

If you prefer to dig into the numbers yourself and challenge these assumptions, you can build a custom Axon view in minutes: Do it your way.

A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Axon. Use the Simply Wall St screener to quickly uncover fresh, data driven opportunities that could sharpen your edge before others notice.

- Target reliable income streams by reviewing these 14 dividend stocks with yields > 3% that may strengthen your portfolio’s cash flow.

- Catch the next wave of innovation early by scanning these 26 AI penny stocks reshaping industries with intelligent automation.

- Position yourself ahead of the crowd by studying these 81 cryptocurrency and blockchain stocks riding real world adoption of blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026