- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (NasdaqGS:AVAV) Gains 18% In A Week After Army Contract Resumes

Reviewed by Simply Wall St

AeroVironment (NasdaqGS:AVAV) experienced a significant stock price increase of 18% over the last week, notably buoyed by the Department of the Army's cancellation of a stop-work order. This positive development for AeroVironment, which relates to important U.S. government contracts, appears to have counteracted broader market trends where the Nasdaq fell by 4% amidst overall market volatility due to tariff concerns. The company's upward movement reflects the market's response to the favorable resolution of contract suspension that prompted investors' confidence despite the prevailing market declines. AeroVironment's rise contrasts sharply with the broader negative market sentiment seen during this period.

Buy, Hold or Sell AeroVironment? View our complete analysis and fair value estimate and you decide.

The recent 18% stock price increase of AeroVironment (NasdaqGS:AVAV), following the cancellation of the Department of the Army's stop-work order, is significant for the company's broader narrative. This development, which involves key U.S. government contracts, aligns with AeroVironment's strategic moves to strengthen its market position through substantial contract wins and acquisitions, such as the upcoming BlueHalo acquisition. These efforts are anticipated to foster both revenue and earnings growth by enhancing production capacity and integrating new technologies, despite present challenges like production disruptions and international sales difficulties.

Over the past five years, AeroVironment's shareholders have experienced a total return of 159.61%. This growth is significant when contrasted with the company's performance against the broader market over the last year, where it underperformed the U.S. Market, which returned 4.7%. Moreover, compared to the U.S. Aerospace & Defense industry return of 17.7% over the same period, AeroVironment's performance highlights its challenges in keeping pace with industry peers.

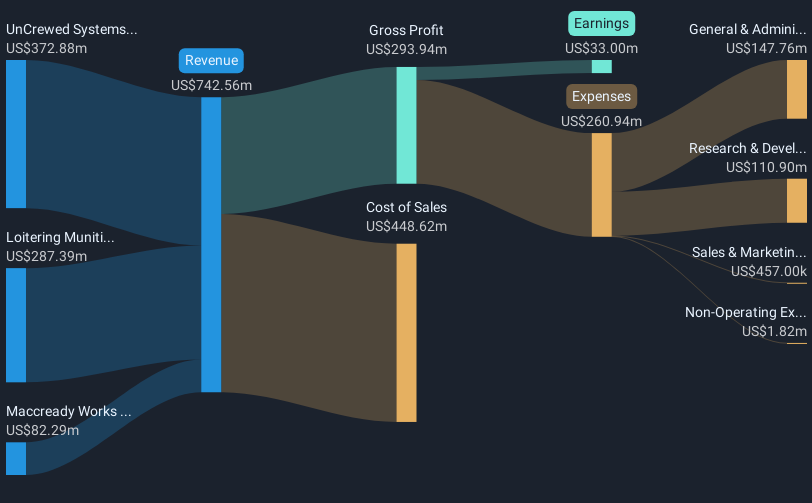

In light of recent company developments, analysts have projected AeroVironment's future revenue to increase by 15.1% annually, predicting earnings of $154.3 million by April 2028. Despite a current Price-To-Earnings Ratio (PE) of 118x, higher than the industry average of 30x, AeroVironment's projected growth may lead to improved valuation metrics. With a current share price of US$121.03 and an analyst consensus price target of US$203.28, there's a 40.5% potential upside, underscoring analyst confidence in the company's long-term growth trajectory, provided it navigates existing operational risks and maximizes its current opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AeroVironment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives