- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Astronics (ATRO) Is Up 6.5% After Global Defense Spending Hits New Record Is Its Growth Outlook Changing?

Reviewed by Sasha Jovanovic

- Global defense spending rose over 8% to a record US$2.3 trillion last year, with ongoing momentum into 2025, especially in Europe, Asia, and the Middle East.

- As major aerospace and defense leaders report significant revenue growth, niche providers like Astronics are also experiencing increased demand linked to sector-wide budget expansion.

- We'll explore how heightened global defense investment is shaping Astronics' investment outlook and prospects for sustained aerospace demand growth.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Astronics Investment Narrative Recap

Astronics shareholders are betting on enduring growth in commercial aerospace and defense demand, fueled by strong global defense spending and ongoing commercial aircraft production increases. While the recent surge in government budgets supports short-term demand, the most important near-term catalyst remains the pace of large OEM production ramps, whereas the biggest risk continues to be cost pressures, especially from tariffs and supply chain disruptions. The current defense spending momentum reinforces sector demand tailwinds, but does not materially change these immediate catalysts or risks.

A recent highlight is Astronics' updated 2025 revenue guidance, raised to US$840 million to US$860 million, building on increased sector demand tied to global investment in aerospace and defense. This announcement aligns closely with the broader trend of elevated industry budgets but underscores that realizing guidance remains highly dependent on effective execution amid cost and supply headwinds.

Yet against this optimism, investors should be aware that ongoing tariff uncertainties could still weigh on costs and margins...

Read the full narrative on Astronics (it's free!)

Astronics' forecast anticipates $956.5 million in revenue and $86.1 million in earnings by 2028. This outlook is based on a 5.1% annual revenue growth rate and a $89.8 million increase in earnings from the current level of -$3.7 million.

Uncover how Astronics' forecasts yield a $47.00 fair value, in line with its current price.

Exploring Other Perspectives

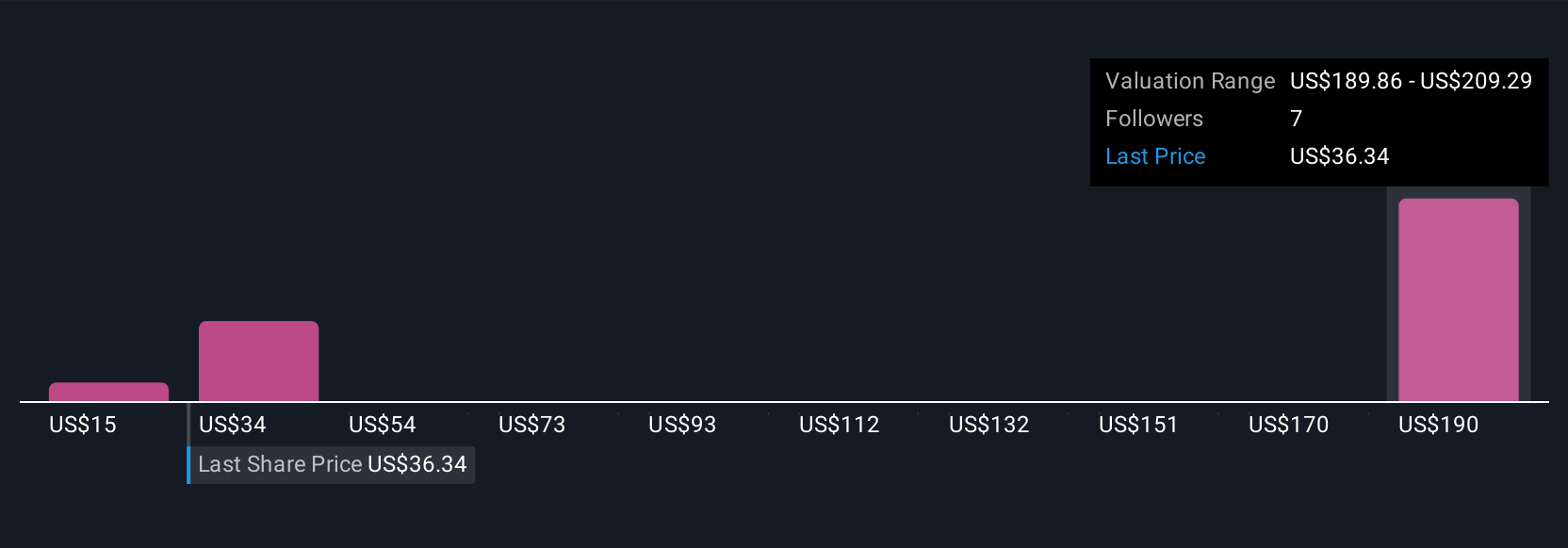

Simply Wall St Community members estimate Astronics’ fair value ranges from US$15 to US$210, showing broad divergence across four independent forecasts. With cost risks from global tariffs at the forefront, you may want to explore how investor opinions differ when considering future earnings potential.

Explore 4 other fair value estimates on Astronics - why the stock might be worth less than half the current price!

Build Your Own Astronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Astronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astronics' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives