- United States

- /

- Marine and Shipping

- /

- NYSE:SB

3 Growth Companies With High Insider Ownership Expecting Up To 67% Earnings Growth

Reviewed by Simply Wall St

In the midst of recent volatility, where major U.S. stock indexes have experienced significant shifts, investors are keenly observing companies that demonstrate resilience and potential for growth. Amidst this backdrop, stocks with high insider ownership often attract attention as they can signal confidence from those closest to the company’s operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 23% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 12.5% | 29.1% |

| AppLovin (APP) | 27.5% | 26.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

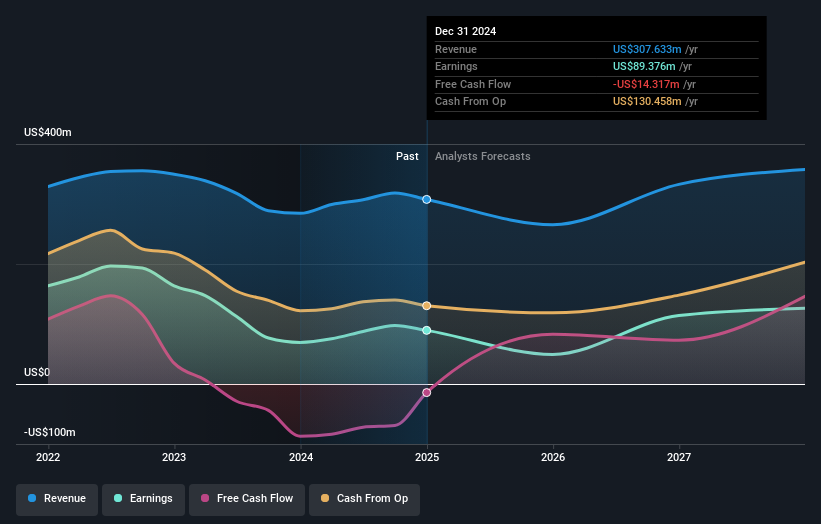

AerSale (ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to a diverse range of clients globally, including airlines and defense contractors, with a market cap of approximately $285.47 million.

Operations: AerSale's revenue is derived from several segments, including Tech Ops - MRO Services at $95.08 million, Tech Ops - Product Sales at $25.34 million, Asset Management Solutions - Engine at $185.29 million, and Asset Management Solutions - Aircraft at $33.38 million.

Insider Ownership: 27.4%

Earnings Growth Forecast: 67.8% p.a.

AerSale's insider ownership aligns with its growth potential, as earnings are expected to rise significantly at 67.8% annually, outpacing the US market. Despite a recent net loss of US$0.12 million in Q3 2025, the company's nine-month net income improved slightly to US$3.18 million from last year. Revenue forecasts suggest an 18% annual increase, faster than the broader market but below significant growth thresholds; however, return on equity remains low at 6.1%.

- Take a closer look at AerSale's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that AerSale is trading beyond its estimated value.

Bank First (BFC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., with a market cap of approximately $1.19 billion.

Operations: The company generates revenue primarily from its banking operations, totaling $168.78 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 25.2% p.a.

Bank First's growth outlook is strong, with earnings and revenue expected to grow significantly at over 25% annually, surpassing market averages. Despite trading below its estimated fair value, return on equity is forecasted to be modest at 12.8%. Recent board changes include the appointment of Todd A. Sprang, enhancing financial oversight and governance. The company reported increased net income for Q3 2025 and maintained a quarterly dividend of US$0.45 per share.

- Unlock comprehensive insights into our analysis of Bank First stock in this growth report.

- Upon reviewing our latest valuation report, Bank First's share price might be too optimistic.

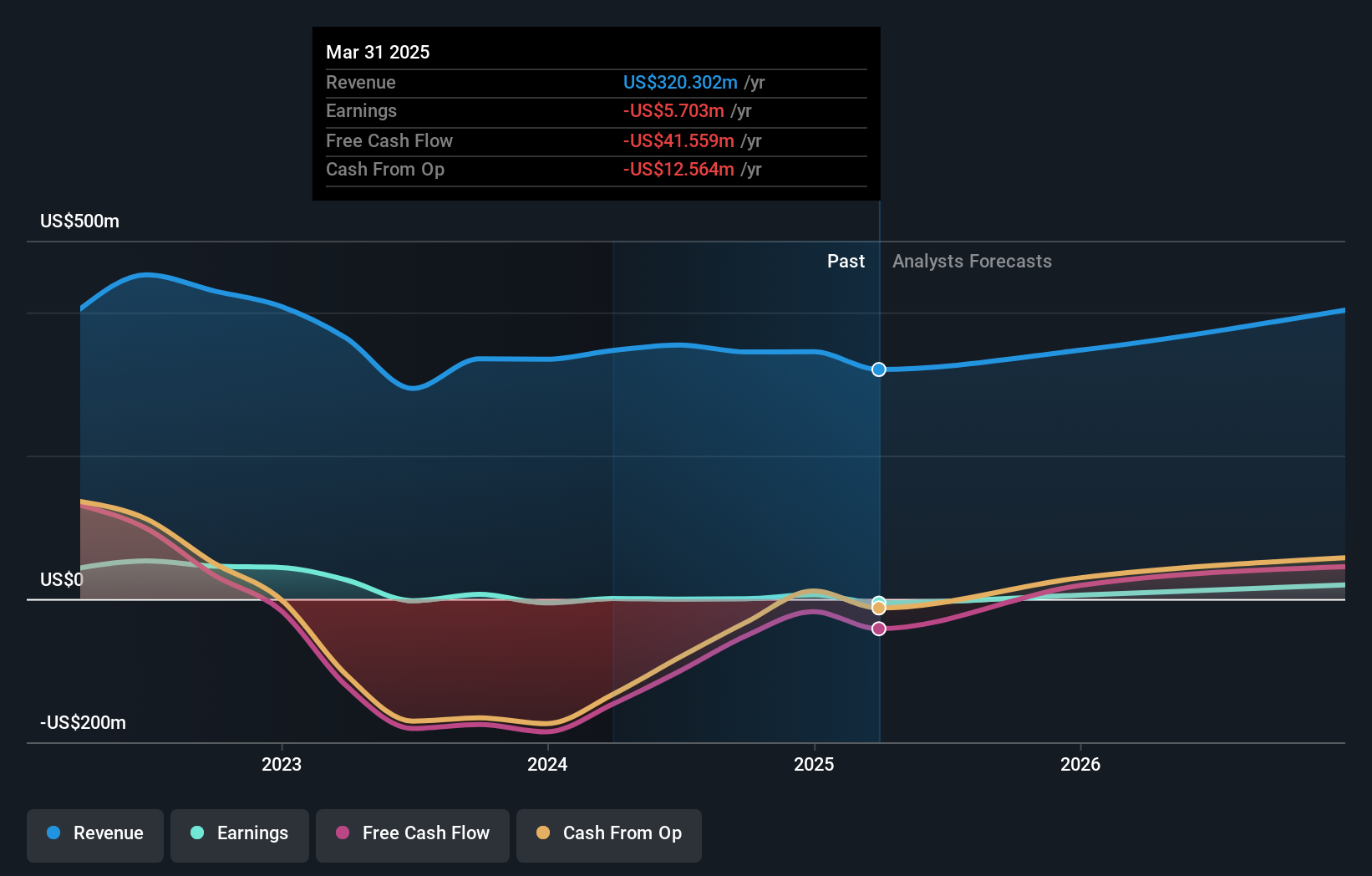

Safe Bulkers (SB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers international marine drybulk transportation services and has a market cap of $486.02 million.

Operations: The company generates $277.51 million in revenue from its transportation-shipping segment, focusing on marine drybulk transport services globally.

Insider Ownership: 31.4%

Earnings Growth Forecast: 43.1% p.a.

Safe Bulkers anticipates robust earnings growth of 43.06% annually, exceeding market averages, although revenue growth at 10.7% lags behind the highest benchmarks. Despite trading significantly below its estimated fair value, return on equity is projected to remain low at 11.3%. Recent events include preferred dividends declared for Series C and D shares, highlighting ongoing shareholder returns amid financial challenges such as interest payments not being well covered by earnings.

- Dive into the specifics of Safe Bulkers here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Safe Bulkers is priced lower than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Fast Growing US Companies With High Insider Ownership.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SB

Safe Bulkers

Provides marine drybulk transportation services internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives