- United States

- /

- Building

- /

- NasdaqGS:AMWD

What American Woodmark Corporation's (NASDAQ:AMWD) P/S Is Not Telling You

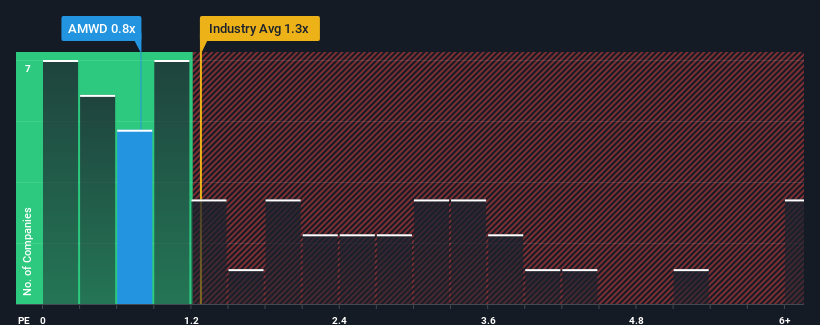

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Building industry in the United States, you could be forgiven for feeling indifferent about American Woodmark Corporation's (NASDAQ:AMWD) P/S ratio of 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for American Woodmark

How American Woodmark Has Been Performing

American Woodmark hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think American Woodmark's future stacks up against the industry? In that case, our free report is a great place to start.How Is American Woodmark's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like American Woodmark's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 6.4% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 4.6% during the coming year according to the seven analysts following the company. Meanwhile, the broader industry is forecast to expand by 4.7%, which paints a poor picture.

With this information, we find it concerning that American Woodmark is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What We Can Learn From American Woodmark's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our check of American Woodmark's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Before you settle on your opinion, we've discovered 1 warning sign for American Woodmark that you should be aware of.

If these risks are making you reconsider your opinion on American Woodmark, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMWD

American Woodmark

Manufactures and distributes kitchen, bath, and home organization products for the remodeling and new home construction markets in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives