- United States

- /

- Building

- /

- NasdaqGS:AAON

High Insider Ownership Growth Stocks On US Exchange In October 2024

Reviewed by Simply Wall St

As U.S. stock indexes experience fluctuations amid a wave of earnings reports and rising Treasury yields, investors remain focused on the broader economic landscape and the Federal Reserve's potential rate decisions. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those most familiar with the business, potentially offering resilience in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.6% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 33.3% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.7% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

We'll examine a selection from our screener results.

AAON (NasdaqGS:AAON)

Simply Wall St Growth Rating: ★★★★☆☆

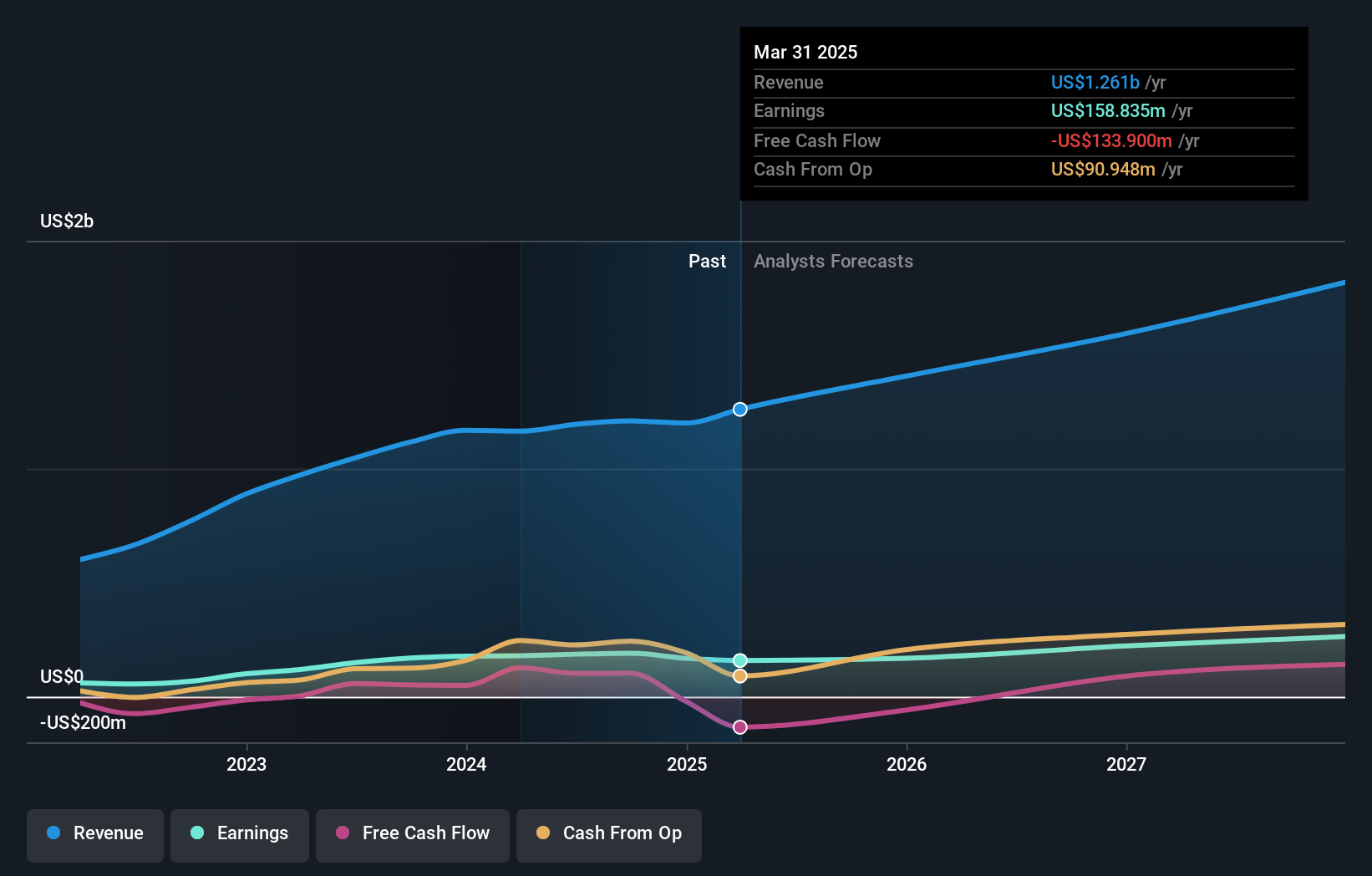

Overview: AAON, Inc. operates in the United States and Canada, focusing on engineering, manufacturing, marketing, and selling air conditioning and heating equipment with a market cap of $8.90 billion.

Operations: The company's revenue is primarily derived from its segments, with AAON Oklahoma contributing $918.18 million, Basx generating $176.46 million, and AAON Coil Products adding $144.74 million in the United States and Canada.

Insider Ownership: 17.6%

AAON's earnings are forecast to grow at 15.9% annually, slightly outpacing the US market's 15.3%. Despite significant insider selling in recent months, AAON maintains a strong growth trajectory with revenue expected to increase by 11% annually, surpassing the market average of 8.8%. Recent product innovations like the Delta Class DOAS technology highlight AAON’s commitment to efficiency and sustainability, potentially driving future growth amidst evolving industry regulations and increasing demand for eco-friendly solutions.

- Click here and access our complete growth analysis report to understand the dynamics of AAON.

- Our valuation report here indicates AAON may be overvalued.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

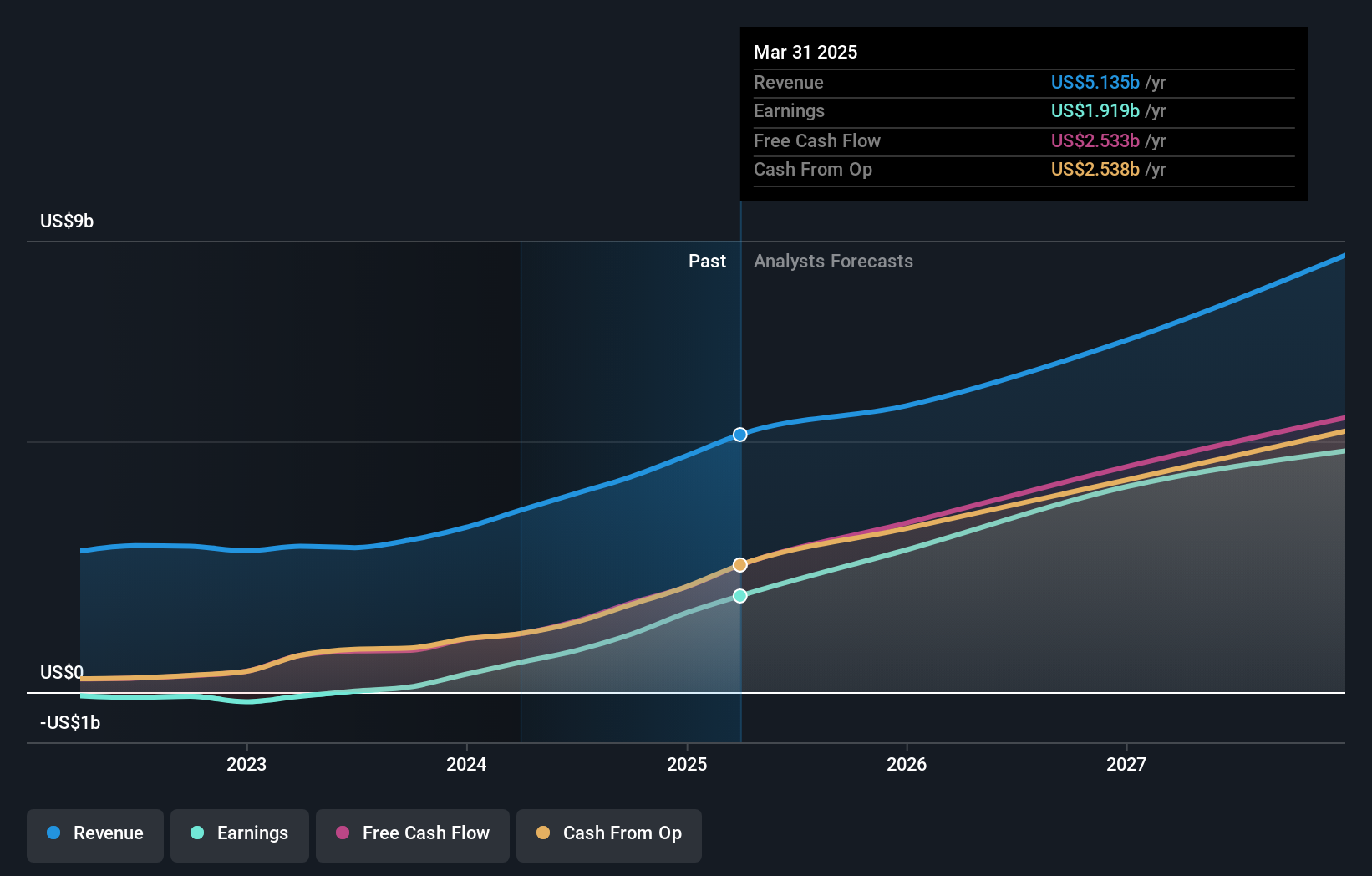

Overview: AppLovin Corporation develops a software-based platform that aids advertisers in improving the marketing and monetization of their content both in the United States and globally, with a market cap of approximately $53.10 billion.

Operations: The company's revenue is primarily derived from its Software Platform segment, generating $2.47 billion, and its Apps segment, contributing $1.49 billion.

Insider Ownership: 38.3%

AppLovin's earnings have surged dramatically, with a recent annual growth of over 4000%, and are forecasted to continue growing at 25.2% annually, outpacing the US market. Despite a slower revenue growth forecast of 13.7%, it remains above the market average. The company was recently added to the FTSE All-World Index, reflecting its expanding influence. Insider activity shows more buying than selling recently, although there is no substantial insider buying in the past three months.

- Click to explore a detailed breakdown of our findings in AppLovin's earnings growth report.

- Upon reviewing our latest valuation report, AppLovin's share price might be too optimistic.

New Oriental Education & Technology Group (NYSE:EDU)

Simply Wall St Growth Rating: ★★★★☆☆

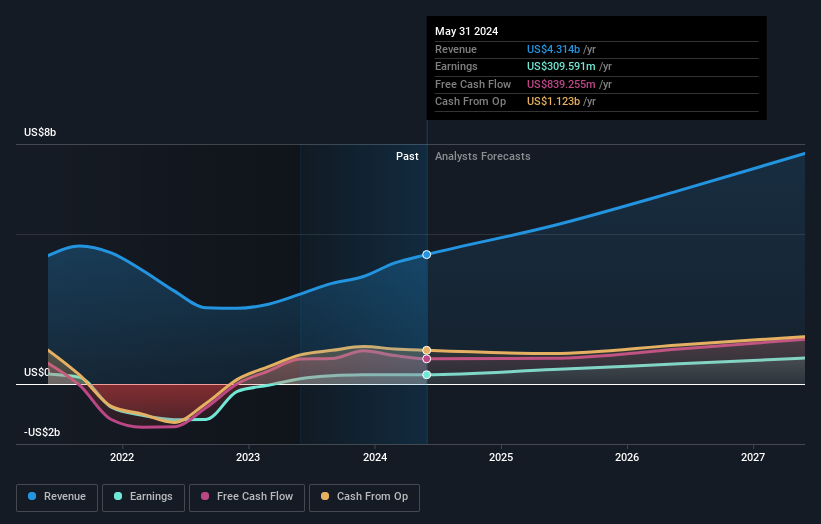

Overview: New Oriental Education & Technology Group Inc. operates as a provider of private educational services in China, with a market cap of approximately $11.12 billion.

Operations: The company's revenue segments include Educational Services and Test Preparation Courses at $2.72 billion, Overseas Study Consulting Services at $439.74 million, and Private Label Products and Livestreaming E-Commerce and Other Services at $900.61 million.

Insider Ownership: 12.2%

New Oriental Education & Technology Group's earnings have grown significantly, with a 74.6% increase over the past year, and are expected to continue growing at 25.06% annually, surpassing the US market average. The company recently completed a substantial share buyback program worth $457.9 million and provided strong revenue guidance for the upcoming quarter. Despite being undervalued by analysts' estimates, there is no recent substantial insider trading activity reported over the past three months.

- Take a closer look at New Oriental Education & Technology Group's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that New Oriental Education & Technology Group is priced lower than what may be justified by its financials.

Make It Happen

- Unlock our comprehensive list of 184 Fast Growing US Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Solid track record with excellent balance sheet.