- United States

- /

- Banks

- /

- OTCPK:TRCY

Tri City Bankshares (TRCY) Profit Margin Doubles, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

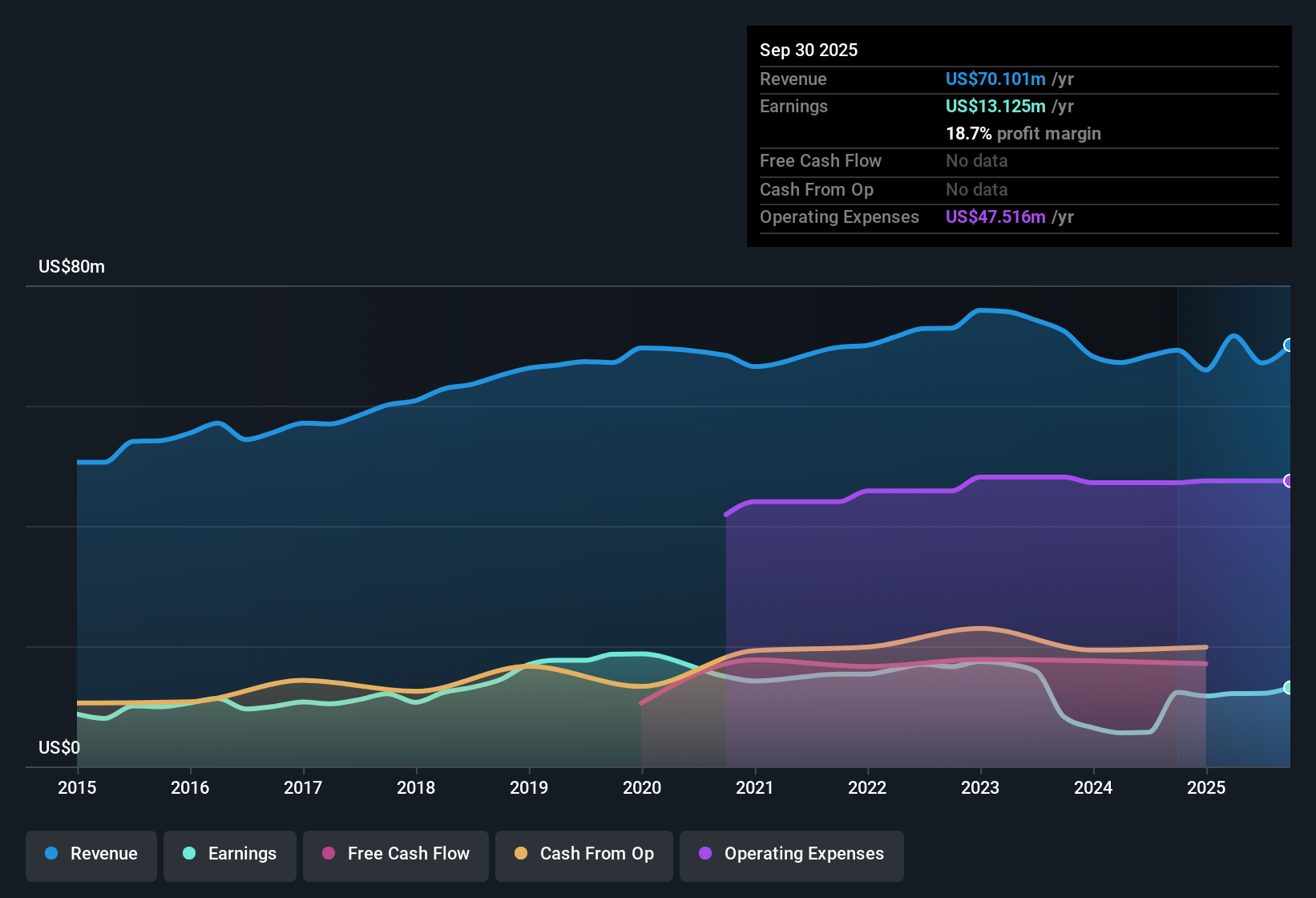

Tri City Bankshares (TRCY) delivered a net profit margin of 18.1% this period, more than doubling last year’s 8.4%. The company reported a remarkable 112.9% growth in earnings over the past twelve months, even as its five-year average annual earnings trend showed an 11.8% decline. With shares trading at $16.47, well below the estimated fair value of $23.57, and a P/E ratio of 12.1x, the latest results highlight both a sharp turnaround in profitability and an attractive value compared to direct peers. While recent margins point to high quality earnings, investors remain focused on whether this momentum can be sustained given the longer-term declining trend.

See our full analysis for Tri City Bankshares.Up next, we’ll see how the latest results fit with the dominant Simply Wall St community narratives. We will examine where the recent numbers confirm or challenge the consensus story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Trend Underscores Sustained Challenges

- The five-year average annual earnings trend for Tri City Bankshares shows an 11.8% decline per year, offering a stark contrast to the recent one-year earnings growth of 112.9%.

- What is notable is that, even after this large short-term recovery, the prevailing view highlights how the longer-term downward trajectory leaves questions about durability, since a single strong period does not outweigh half a decade of contraction.

- This tension suggests that while recent earnings momentum can be encouraging, prudent investors will consider whether such gains are likely to remain without more fundamental changes to the business over time.

- The risk in focusing on a single year of outperformance is evident, as the multi-year pattern remains a headwind for long-term confidence.

Net Profit Margin Doubles but Future Growth in Doubt

- Net profit margin increased from 8.4% to 18.1% in the latest period, indicating improved operational performance well above prior years.

- Despite these higher margins, the current market perspective notes that future revenue and earnings are not expected to climb, raising questions about the sustainability of this margin improvement.

- This margin expansion currently supports optimism about the quality of earnings, but the prevailing analysis also highlights the risk that, with no clear signs of ongoing growth, such performance may have limited staying power.

- Investors focused on consistency might hesitate, given that strong margins in a single period do not guarantee a shift in the company’s longer-term growth prospects.

Valuation Offers Peer Discount Despite Premium to Sector

- TRCY trades at a 12.1x P/E ratio, higher than the broader US Banks industry average of 11.2x, but much lower than the direct peer average of 30.2x and still at a discount to its DCF fair value of $23.57.

- Prevailing analysis finds that, while the stock may appear relatively expensive compared with the overall banking sector, it represents attractive value next to its immediate peers, with the current price at $16.47, showing a notable gap to estimated fair value.

- This value gap could appeal to investors seeking bargains in overlooked names, but it also brings attention to whether the discount reflects legitimate growth concerns identified elsewhere in the fundamentals.

- Any move toward sector averages or an improvement in sentiment could narrow the gap to fair value, but this would depend on more than just a strong short-term profit result.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tri City Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Tri City Bankshares delivered a sharp short-term profit rebound, its multi-year earnings decline raises doubts about the sustainability of this performance.

If you’re looking for companies with demonstrated consistency rather than unpredictable swings, check out stable growth stocks screener (2084 results) for reliable names showing steadier growth across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tri City Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TRCY

Tri City Bankshares

Through its subsidiary, Tri City National Bank, provides various banking products and services in Southeastern Wisconsin.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives