- United States

- /

- Banks

- /

- OTCPK:FMBL

Farmers & Merchants Bank of Long Beach (FMBL): Profit Margin Miss Challenges Dividend Reliability Narrative

Reviewed by Simply Wall St

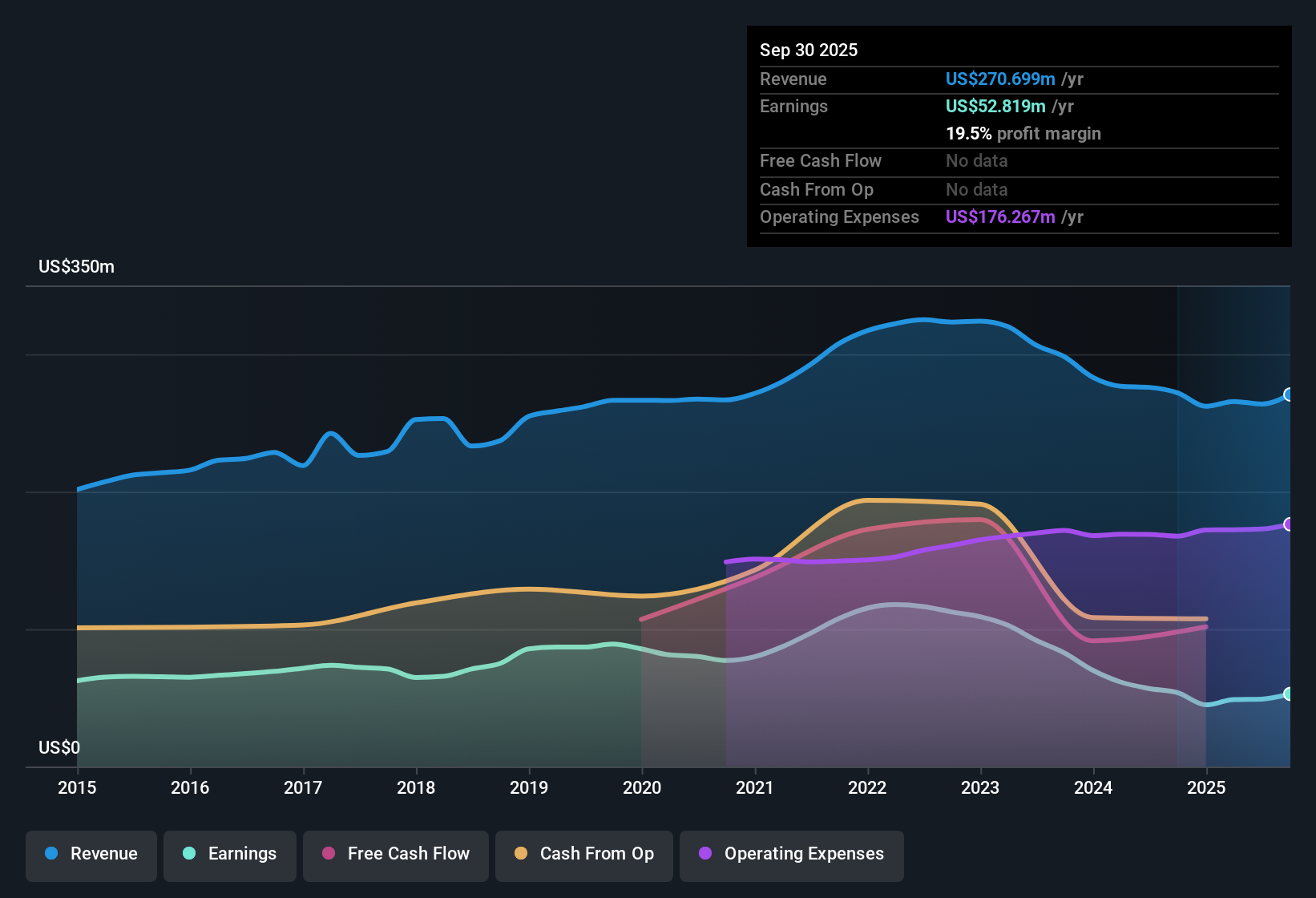

Farmers & Merchants Bank of Long Beach (FMBL) has seen its earnings decline by 13.9% per year over the last five years, with its net profit margin dropping to 18.6% from last year's 20.6%. The stock now trades at 19.1x earnings, notably higher than the peer average of 13.1x and the broader US Banks industry’s 11.3x. The share price of $7,700 also sits well above the estimated fair value of $3,862.64. With net profit margins compressing and earnings growth negative over the past year, the overall picture shows high quality, but weakening profitability. Investors face heightened risks, with no significant rewards currently flagged.

See our full analysis for Farmers & Merchants Bank of Long Beach.The next section puts these results head-to-head with the market’s most popular narratives, highlighting where the current numbers reinforce or challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Dividend Sustainability Faces Questions

- The current risk analysis highlights concerns over the sustainability of FMBL’s dividend, indicating this is now a potential weak point rather than a given strength.

- With no flagged rewards and clear signals that revenue and earnings are not expected to grow in the near term, the prevailing market view underscores that the high quality of earnings seen in filings may not be enough to protect shareholders if the dividend is cut or stagnates.

- Risk of a less reliable dividend payout is particularly meaningful for investors who value stable income streams.

- Cash flow discipline, which typically supports dividends, is challenged by shrinking net profit margins, now sitting at 18.6% compared to last year's 20.6%.

Margins Continue Steady Compression

- Net profit margin contracted to 18.6% this year, declining from 20.6% last year. This demonstrates that profitability pressures have not abated even though reported earnings remain “high quality.”

- The prevailing market view emphasizes that FMBL’s conservative management and strong reputation for stability help buffer some downside. However, persistent margin compression may signal that business as usual is not a guarantee.

- Long-term investors may stay patient, but headline margin declines could eventually weigh on sentiment, especially compared to banks with expanding profitability.

- The ongoing squeeze on margins positions FMBL as lower risk operationally, but at the cost of near-term growth opportunities.

Share Price Trades at a Premium

- At $7,700 per share, FMBL trades notably above both the peer Price-to-Earnings average and the latest DCF fair value of $3,130.04.

- Rather than confirming the bank’s premium as a badge of sector leadership, the prevailing market view notes that such elevated valuation levels can become a liability for future returns if earnings continue to shrink.

- Peers in the US Banks industry average a much lower P/E of 11.3x compared to FMBL’s 19.1x, deepening the value caution for new buyers.

- With no clear catalyst to support a higher earnings trajectory, investors may start to see the lofty price as pricing in more than the current operations deliver.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Farmers & Merchants Bank of Long Beach's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With shrinking net profit margins, overvaluation concerns, and a dividend now facing sustainability questions, Farmers & Merchants Bank of Long Beach no longer offers the income reliability many investors need.

If your priority is finding consistent and dependable dividends to support your portfolio, check out these 2009 dividend stocks with yields > 3% which may offer more reliable income opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FMBL

Farmers & Merchants Bank of Long Beach

Provides various banking products and services to individuals, professionals, and small to medium-sized businesses in the Los Angeles, Orange, and Santa Barbara Counties of the United States.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives