- United States

- /

- Banks

- /

- OTCPK:FFBB

FFB Bancorp (FFBB) Margin Decline Challenges Bullish Value Narrative

Reviewed by Simply Wall St

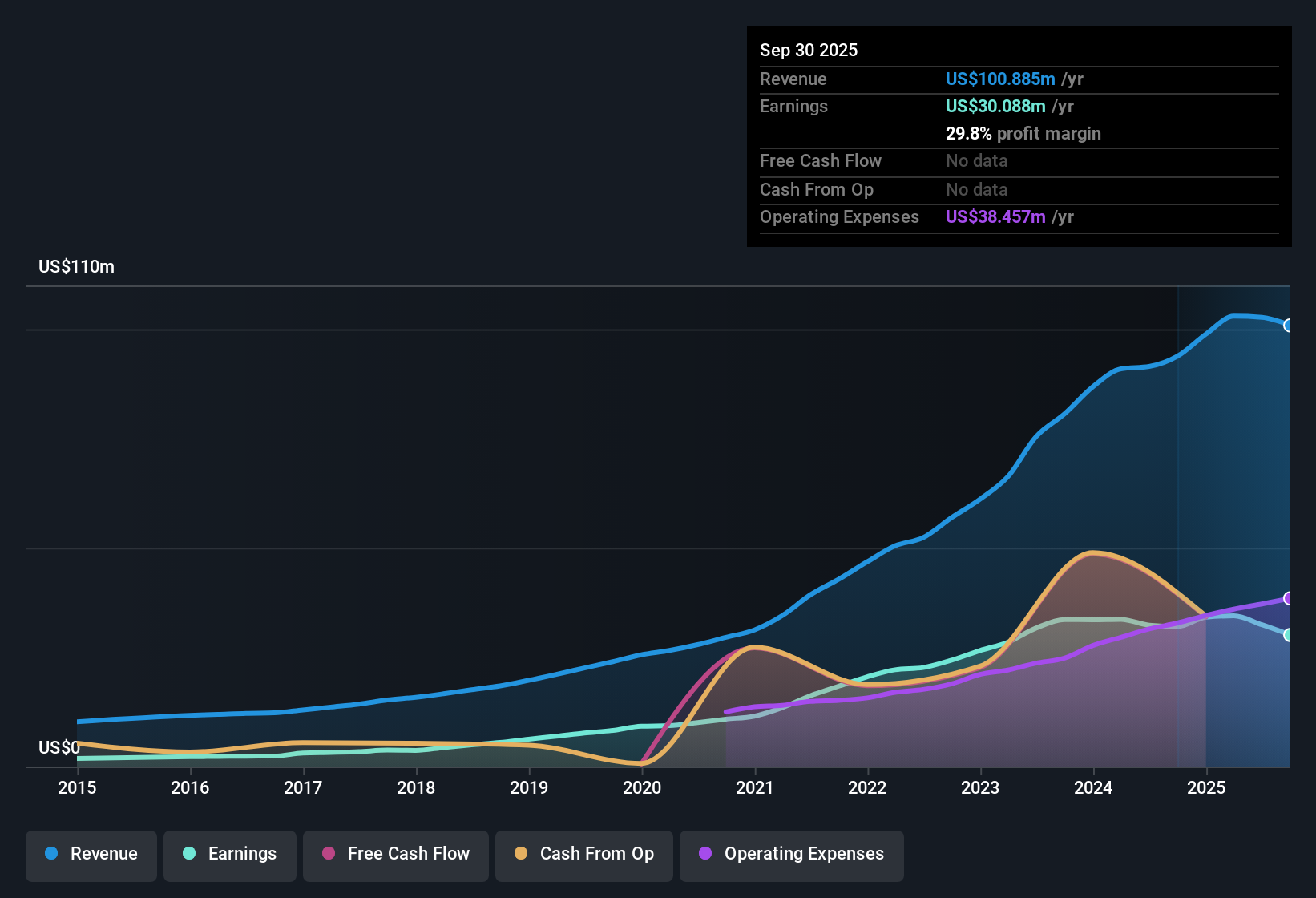

FFB Bancorp (FFBB) reported net profit margins of 29.8%, down from 34.1% in the prior year, signaling a reduction in profitability. Over the last five years, the company's earnings grew at an impressive annual rate of 18.4%, but the latest period reversed that growth trend, with negative earnings momentum. Shares now trade at a Price-to-Earnings Ratio of 8.4x, below both peers and the broader US banks sector, and the current $84.5 share price sits well below the estimated fair value of $238.86. This draws attention to the stock’s perceived value opportunity. While recent margin pressure and negative earnings growth are a cautionary note, investors may still view FFB Bancorp as attractively valued given its track record of earnings expansion and currently discounted trading levels.

See our full analysis for FFB Bancorp.Next, we will see how these headline results measure up against the market’s most widely held narratives about the company and whether the story is shifting.

Curious how numbers become stories that shape markets? Explore Community Narratives

Stable Five-Year Earnings Growth Rate of 18.4%

- Over the past five years, FFB Bancorp delivered an annual earnings growth rate of 18.4%, showing strong performance even though recent results reversed this trend.

- The prevailing market view emphasizes FFB Bancorp’s robust track record, with multi-year compounding earnings supporting its credibility. However, the latest negative growth raises questions about whether that momentum can be revived.

- This transition from consistent growth to a decline highlights how legacy strength may act as a buffer for investors, but only if profit drivers recover soon.

- While long-term investors may view the historical rate as a reason to stay optimistic, the divergence in the most recent year could limit near-term upside unless fundamentals stabilize.

Net Profit Margins Slide to 29.8%

- Net profit margins came down to 29.8% from 34.1% a year ago, illustrating recent pressure on core profitability even as efficiency levels remain above many small-cap peers.

- According to prevailing market perspectives, this margin decrease signals possible headwinds and urges investors to be cautious about expecting a rapid turnaround.

- What stands out is that, although margins dropped, they remain relatively strong versus sector norms, which may soften the impact for committed shareholders.

- Still, critics highlight that margin contraction in tandem with negative earnings growth intensifies focus on whether cost controls or revenue engines can improve in future periods.

Shares Trading 65% Below DCF Fair Value

- FFB Bancorp’s current share price of $84.50 is trading at a deep 65% discount to its DCF fair value of $238.86, with the company’s Price-to-Earnings Ratio (8.4x) below both the peer average (10.8x) and the US Banks sector (11.2x).

- The prevailing market perspective points to meaningful valuation upside, but warns that discounted multiples can persist if profitability continues to weaken.

- What is surprising is the scale of the valuation gap, which could attract value-oriented buyers, yet this only has staying power if earnings and margins stabilize from here.

- Consensus among investors is likely to hinge on whether the market believes FFB Bancorp can revert to its historic earnings trajectory or whether structural issues will limit recovery.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FFB Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

FFB Bancorp’s declining profit margins and recent reversal in earnings momentum raise concerns about the sustainability of its earlier growth trajectory.

Want a steadier path? Check out stable growth stocks screener (2090 results) to discover companies with a history of consistent earnings and revenues, delivering reliability in any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:FFBB

FFB Bancorp

Operates as a bank holding company for FFB Bank that provides various banking products and services for individuals and small and middle-market businesses in the United States.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion