- United States

- /

- Banks

- /

- OTCPK:CCFN

Muncy Columbia Financial (CCFN) Margin Jumps to 31.9%, Reinforcing Bullish Profitability Narratives

Reviewed by Simply Wall St

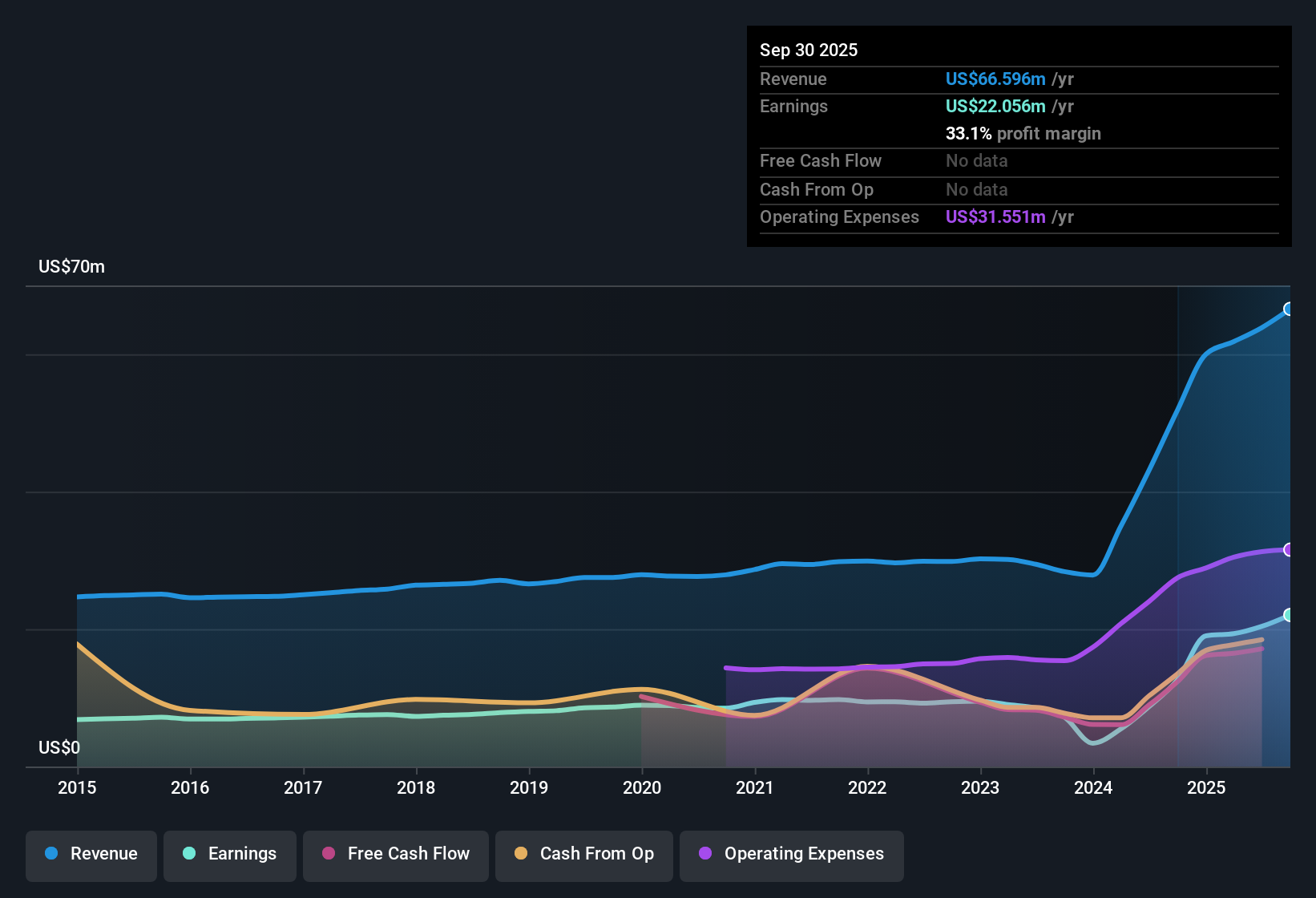

Muncy Columbia Financial (CCFN) recorded robust earnings growth, posting a 133.7% increase in earnings over the past year and achieving a 12.8% annual growth rate over the last five years. Net profit margin reached 31.9%, up sharply from last year's 20.2%. CCFN now trades at a price-to-earnings ratio of 9x, undercutting both peers and the broader US Banks industry average. For investors, the headline takeaways are strong profitability, high-quality earnings, and an attractive valuation profile compared to similar companies.

See our full analysis for Muncy Columbia Financial.The next section dives into how these results compare to the most widely followed narratives. This will highlight both where the story aligns and where it may diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion to 31.9% Raises Bar

- Net profit margin surged to 31.9%, up meaningfully from 20.2% the previous year, indicating the company is keeping more profit from every dollar earned than before.

- Recent margin gains strongly support the prevailing optimistic view that management’s operational execution is driving superior fundamentals.

- This kind of margin strength typically signals above-average control over both costs and revenue streams compared to peers.

- Bulls might have expected improvement, but the degree of margin expansion, combined with strong annual earnings growth of 12.8% over five years, far exceeds what is often seen in the regional banking space.

Price-To-Earnings at 9x Signals Value Gap

- The current P/E ratio stands at 9x, notably below both the peer average of 14.7x and the broader US Banks industry average of 11.2x, giving CCFN a relative discount on traditional valuation measures.

- Prevailing market analysis emphasizes that this undervaluation, in the context of high earnings quality, can draw value-focused investors.

- The low P/E positions CCFN firmly in the “inexpensive” category when investors compare it to other banks delivering robust profit margins.

- While bulls may highlight discounted multiples as a buying opportunity, the upside is tempered by the current share price of $51.97, which remains above the DCF fair value estimate of $24.66, casting some doubt on the pure value thesis.

Growth, Value, and Dividend All in Play

- Alongside 12.8% annual earnings growth over five years and a healthy margin profile, investors enjoy rewards on multiple fronts: sustained profit expansion, peer-beating valuation ratios, and an appealing dividend.

- The prevailing view is that the combination of income, growth, and value leans the scales positively for CCFN compared to its regional bank peers.

- Where sector volatility introduces risk for many regionals, CCFN’s metrics indicate resilience that supports bullish sentiment beyond simple price appreciation.

- The current data set includes no major risk flags, so the conversation remains focused on the strength and consistency of key financial drivers.

See our latest analysis for Muncy Columbia Financial.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Muncy Columbia Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust profitability and attractive valuation ratios, Muncy Columbia Financial’s share price remains significantly above the estimated fair value. This raises concerns about the risk of overvaluation.

If you want opportunities with stronger upside, check out these 878 undervalued stocks based on cash flows to discover stocks where pricing better matches their underlying fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CCFN

Muncy Columbia Financial

Operates as the bank holding company for Journey Bank that provides banking and financial products and services to individual, business, and government customers in Pennsylvania.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives