- United States

- /

- Banks

- /

- OTCPK:CBCY

Central Bancompany (CBCY) Jumps on Rare Regional Bank IPO News Is Investor Demand for Bank Liquidity Growing?

Reviewed by Sasha Jovanovic

- Central Bancompany has announced the launch of its initial public offering, offering 17,778,000 Class A shares at an expected price range of US$21.00 to US$24.00 per share, and will apply to list on the Nasdaq Global Select Market under the symbol CBC.

- This move is distinctive as regional bank IPOs are uncommon in the U.S., underscoring both the company's regional scale and heightened investor interest in financial-services listings.

- We'll explore how Central Bancompany's planned Nasdaq debut and focus on expanding liquidity shape its broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Central Bancompany's Investment Narrative?

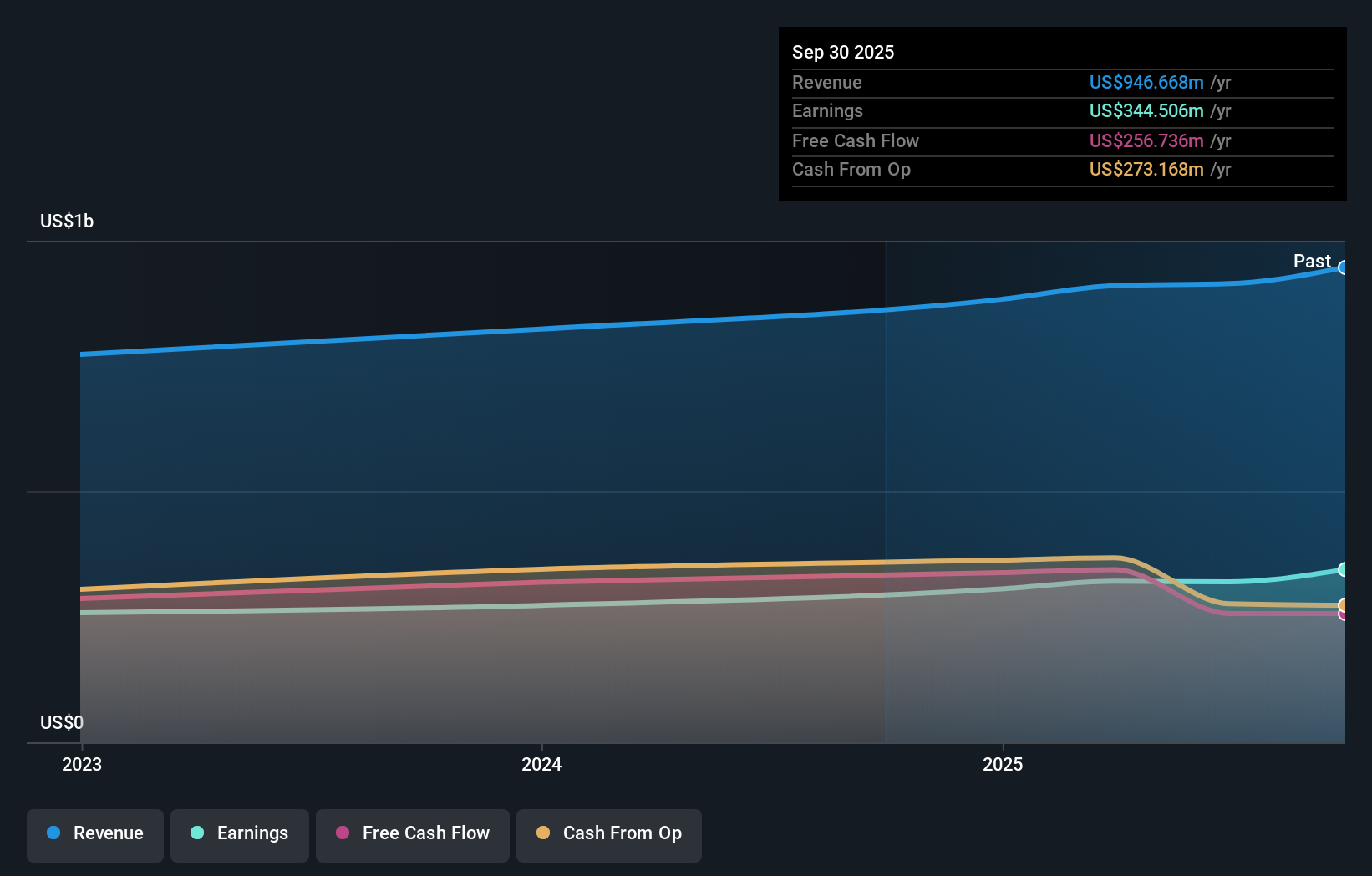

If you’re weighing Central Bancompany’s investment case, the main narrative centers on its strong regional banking scale, resilient earnings, and the confidence signaled by its rare regional bank IPO. The new public listing could reshape both the bank’s short-term catalysts and risk profile, as the expected US$426.7 million in fresh capital is likely to expand liquidity and possibly enable new business growth or strategic moves. This influx may moderate near-term funding risks and could shift the focus from capital stability to execution on post-IPO initiatives and integration with wider capital markets. However, the IPO also brings increased scrutiny, competitive pressures, and sensitivity to broader financial sector trends. Until the impact of this expanded liquidity on operations becomes clearer, it’s wise to keep an eye on valuation and market sentiment shifts driven by IPO excitement.

But, in contrast, increased public exposure may bring fresh volatility worth watching. Central Bancompany's shares have been on the rise but are still potentially undervalued by 13%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Central Bancompany - why the stock might be worth just $530.85!

Build Your Own Central Bancompany Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Central Bancompany research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Central Bancompany research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Central Bancompany's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CBCY

Central Bancompany

Operates as the bank holding company for The Central Trust Bank that provides consumer, commercial and wealth management products and services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives