- United States

- /

- Banks

- /

- OTCPK:CBCY

A Closer Look at Central Bancompany (OTCPK:CBCY) Valuation Following Strong Earnings Growth

Reviewed by Simply Wall St

Central Bancompany (OTCPK:CBCY) just posted its earnings for the nine months ending September 2025. The company reported higher net interest income and net income compared to last year. Earnings per share also rose, reflecting ongoing operational improvements.

See our latest analysis for Central Bancompany.

Central Bancompany’s latest financial update arrives amid a breakout period for its stock. The share price has surged 15% in the past month and is now up nearly 71% year-to-date, with a remarkable 1-year total shareholder return of 82%. This signals strong momentum and renewed investor confidence in its outlook.

If Central Bancompany’s recent run grabbed your attention, it might be time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares climbing so dramatically, investors now face a key question: Is Central Bancompany still undervalued, or is the market already factoring in the company’s future growth prospects, leaving little room for upside?

Price-to-Earnings of 14.7x: Is it justified?

Central Bancompany currently trades at a price-to-earnings (P/E) multiple of 14.7x, making it notably more expensive than both its industry peers and the broader banking sector average.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of current earnings. It provides key insight into perceived future growth and profitability for banks.

This P/E multiple suggests the market is pricing in stronger expectations for Central Bancompany’s future performance. However, the company’s earnings growth over the past year (15.8%) actually trailed the Banks industry average (18.2%), which raises questions about whether the premium can be justified by fundamentals alone.

Compared to the US Banks industry average of 11.2x and the peer group’s 11.8x, Central Bancompany stands out as more highly valued on this basis. While investor optimism may be high, the premium leaves less room for error compared to sector benchmarks.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.7x (OVERVALUED)

However, any signs of slowing earnings growth or a reversal in investor sentiment could challenge Central Bancompany’s current premium valuation.

Find out about the key risks to this Central Bancompany narrative.

Another View: What Does Our DCF Model Say?

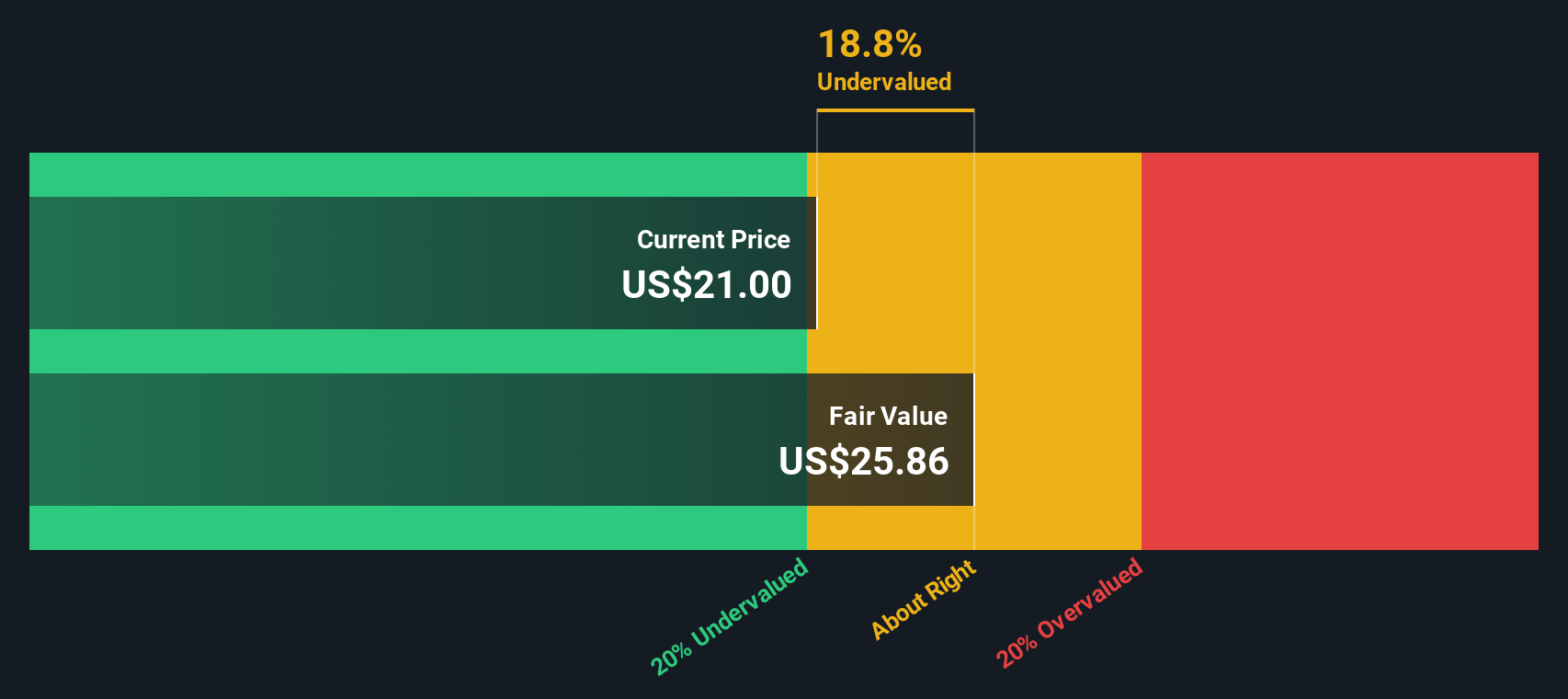

Looking at Central Bancompany from a different angle, our DCF model suggests the stock is trading about 11.5% below its estimated fair value of $25.86. While the market is pricing in optimism based on earnings multiples, the DCF points to undervaluation. Could the upside be greater than most expect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Central Bancompany for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Central Bancompany Narrative

If you think this perspective misses something, or want to dig into the details yourself, you can easily build your own view in minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Central Bancompany.

Looking for more investment ideas?

Kickstart your next smart move by checking out market-tested investment opportunities tailored to different trends and sectors with our powerful screener tools.

- Accelerate your search for tomorrow’s leaders with these 27 AI penny stocks and catch those innovating with artificial intelligence before the crowd.

- Step up your income game by reviewing high-yield options through these 15 dividend stocks with yields > 3%, helping you secure attractive returns from companies with robust dividends.

- Get ahead of the curve by targeting potential winners in emerging technologies. Start with these 27 quantum computing stocks and stay on the cutting edge of investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CBCY

Central Bancompany

Operates as the bank holding company for The Central Trust Bank that provides consumer, commercial and wealth management products and services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives