- United States

- /

- Banks

- /

- NYSEAM:PRK

Assessing Park National’s (PRK) Valuation Following Recent Market Movement

Reviewed by Simply Wall St

See our latest analysis for Park National.

This week’s mild bounce comes after a tough run for banks, and Park National’s share price is still well below its highs with a year-to-date return of -8.73%. That said, long-term investors have enjoyed a total shareholder return of nearly 77% over five years, which shows its resilience even in a shifting market environment.

If you’re weighing up what’s next in the sector, now is the perfect time to broaden your view and discover fast growing stocks with high insider ownership

With shares still trading below their price target and a strong history of long-term returns, the question is whether recent weakness points to a bargain or if the current price already reflects all expected growth.

Price-to-Earnings of 14.2x: Is it justified?

Park National currently trades at a price-to-earnings ratio of 14.2x, which places it above its US bank peers and the broader industry, even as the share price sits well below its highs.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of company earnings. For banks like Park National, it is a widely used metric to judge whether the stock price is justified by underlying profitability.

Compared to its immediate peer group, which averages 12.5x, and the broader US Banks industry average of 11.2x, Park National appears expensive. The market is pricing in more optimism for Park National than for other banks of similar size and growth, even though its fair P/E ratio is estimated at just 10.7x. The market could revert to this level if sentiment shifts or growth underwhelms.

Explore the SWS fair ratio for Park National

Result: Price-to-Earnings of 14.2x (OVERVALUED)

However, sluggish revenue growth and recent underperformance could weigh on Park National shares if market sentiment turns cautious or if economic conditions deteriorate.

Find out about the key risks to this Park National narrative.

Another View: Discounted Cash Flow

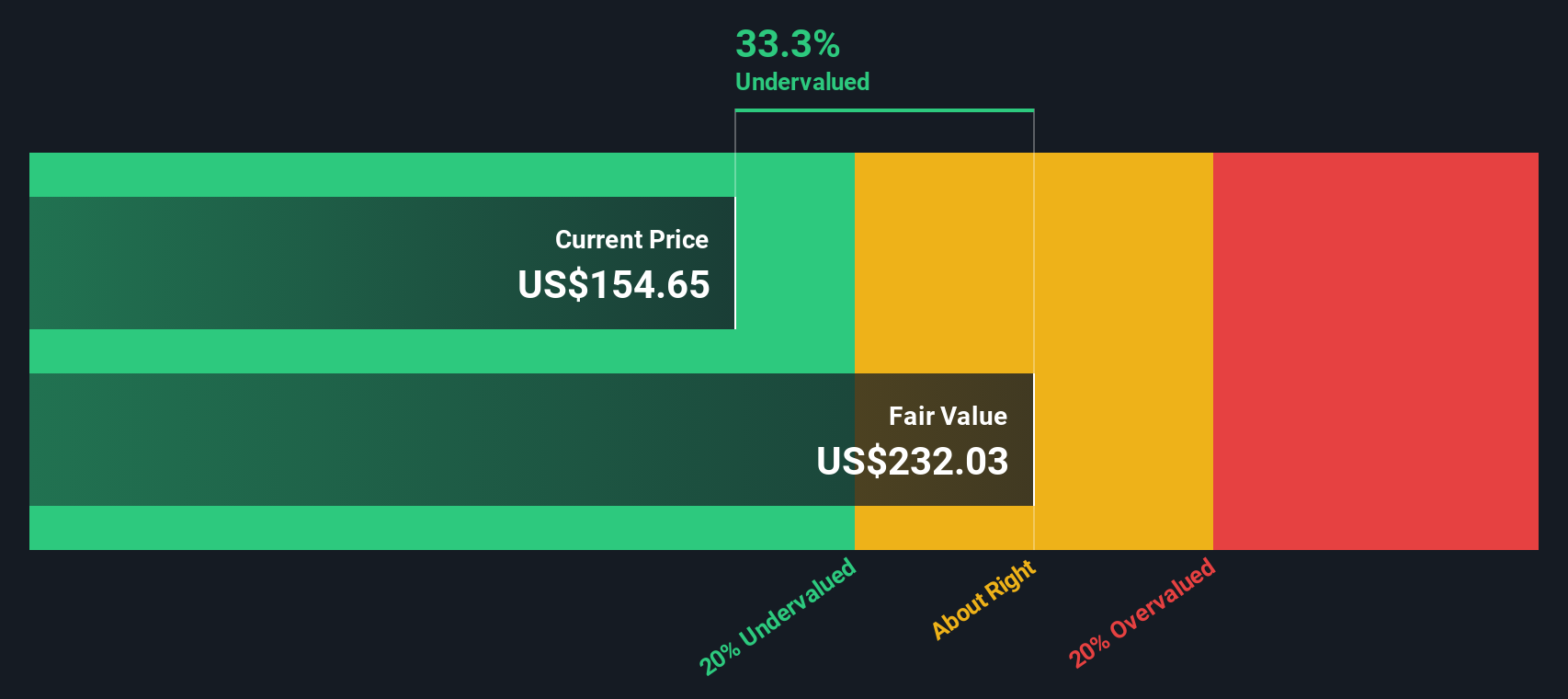

While the price-to-earnings ratio hints that Park National looks expensive compared to peers, our SWS DCF model offers a different perspective. In this approach, Park National trades at a 31.5% discount to its fair value, suggesting the stock could be undervalued in the market right now. Does this signal an opportunity or a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Park National for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Park National Narrative

If you have your own take or want to analyze the numbers for yourself, you can build your personal view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Park National.

Looking for more investment ideas?

Level up your portfolio by using the Simply Wall Street Screener to spot unique opportunities you might otherwise miss. Don’t let potential winners slip past you.

- Seize high potential in emerging technology markets by unleashing your search through these 27 AI penny stocks, which power tomorrow’s breakthroughs.

- Tap into reliable income streams with stability and attractive yields by reviewing these 14 dividend stocks with yields > 3%, now trending among smart investors.

- Gain an edge in an evolving digital landscape as you access these 82 cryptocurrency and blockchain stocks, driving innovation in blockchain and crypto sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:PRK

Park National

Operates as the bank holding company for Park National Bank that provides commercial banking and trust services in small and medium population areas in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives