- United States

- /

- Banks

- /

- NYSEAM:BHB

Bar Harbor Bankshares (BHB): Margin Decline Reinforces Concerns About Profit Durability

Reviewed by Simply Wall St

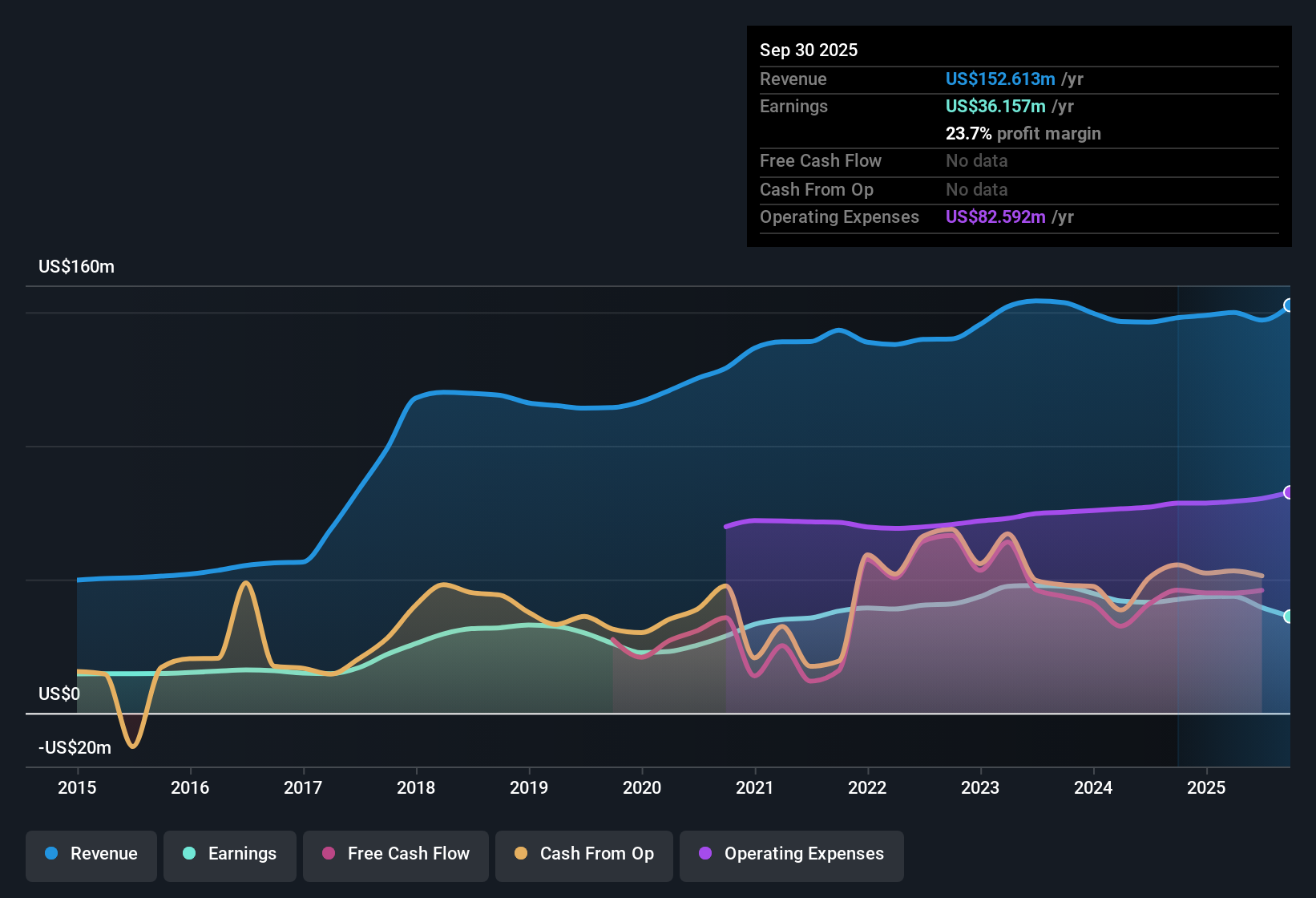

Bar Harbor Bankshares (BHB) reported current net profit margins of 26.9%, down from 28.3% a year ago, signaling a decline in profitability year over year. Over the past five years, earnings have grown at 5.6% annually, with revenue projected to rise 7.3% per year going forward. This is slower than the broader US market. However, forecast earnings growth of 19.7% per year outpaces national averages, even after a dip in earnings over the last twelve months. Investors are weighing the company’s attractive dividend, profit growth, and valuation metrics against the backdrop of ongoing margin compression and slower revenue expansion compared to peers.

See our full analysis for Bar Harbor Bankshares.Now, let’s see how these latest figures stack up against the community narrative. Where expectations and the real numbers meet, some views might get reinforced and others will be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Nearly Double Current Share Price

- Bar Harbor Bankshares is trading at $30.29 per share, while its DCF fair value estimate is $59.01. This shows a wide 49% discount to its calculated intrinsic value.

- What’s surprising is that, even with a higher-than-industry Price-to-Earnings ratio of 12.8x (compared to 11.2x for US Banks), the current price remains well below DCF fair value. This strongly supports the investment case that the market may be under-appreciating the company's ability to generate high-quality earnings.

- This valuation gap suggests the market could be assigning a premium for quality, but it is not fully pricing in future earnings growth, which is forecast at 19.7% per year and is faster than the US average.

- Despite a slower revenue growth outlook compared to the overall market, the deep discount to fair value provides meaningful upside for long-term investors willing to look past short-term margin pressure.

Margins Slip as Profit Quality Remains High

- Net profit margins stand at 26.9%, down from 28.3% last year. This represents a decrease of 1.4 percentage points, but the company is still recognized for high-quality earnings.

- The data highlights a key tension: while profit margins are tightening, the company’s blend of ongoing profitability and above-average earnings growth contrasts with the cautious narrative that shrinking margins should threaten bottom line durability.

- With earnings per year projected to rise 19.7%, management is still delivering substantial profit, which strongly supports the case that Bar Harbor’s profitability is more defensible than typical regional banks.

- In the absence of major risk statements, the sustained quality of earnings stands out as a reason bullish investors remain patient despite margin compression.

Trading Rich to Peers but Still Labeled “Good Value”

- The company’s Price-To-Earnings ratio of 12.8x places it above both its peer average of 12.5x and the broader US Banks industry at 11.2x, underscoring its premium valuation.

- Prevailing analysis notes that, even though the premium to peers might signal an expensive stock to some, Bar Harbor Bankshares is still described as a “good value” based on its attractive dividend, strong forecast profit growth, and high-quality earnings metrics.

- This unusual combination of trading rich to peers but discounted versus intrinsic value creates a complex narrative where both value and quality investors find reasons for optimism.

- Positively, there are no flagged risks weighing down the investment case, which helps support a constructive view even at a relatively high multiple.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Bar Harbor Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Bar Harbor Bankshares faces pressure from narrowing profit margins and slower revenue growth, which weakens its appeal for investors seeking steady, dependable performance.

If consistent results matter to you, check out stable growth stocks screener (2095 results) for a list of companies delivering more reliable and sustained expansion than what we’ve seen here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bar Harbor Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BHB

Bar Harbor Bankshares

Operates as the holding company for Bar Harbor Bank & Trust that provides banking and nonbanking products and services primarily to consumers and businesses.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives