- United States

- /

- Banks

- /

- NYSE:WFC

What Wells Fargo (WFC)'s Asset Cap Lift and US$40 Billion Buyback Plan Means For Shareholders

Reviewed by Sasha Jovanovic

- Wells Fargo recently ramped up its funding plans and leadership reshuffle, completing several million‑dollar senior and subordinated note offerings in late November 2025 and announcing multiple new callable senior unsecured note issuances in early December alongside key appointments in AI and wealth management product leadership.

- Together with the lifting of its US$1.95 billion Federal Reserve asset cap and a new US$40.00 billion share repurchase authorization, these moves point to a bank refocusing on balance sheet growth, technology‑driven efficiency and ongoing capital returns while continuing to resolve legacy regulatory and legal issues.

- We’ll now examine how the lifted asset cap, paired with this large buyback plan, reshapes Wells Fargo’s existing investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Wells Fargo Investment Narrative Recap

To own Wells Fargo today, you need to believe it can convert its post asset cap freedom into steady balance sheet growth while keeping regulatory, technology and competition risks under control. The latest bond offerings and leadership reshuffle do not materially change that near term; the key catalyst remains how effectively Wells Fargo uses its larger buyback capacity and balance sheet flexibility, while the biggest risk is still execution on ongoing compliance and digital transformation.

Among recent developments, the new US$40.00 billion share repurchase authorization stands out alongside the lifting of the US$1.95 trillion Federal Reserve asset cap, because it directly connects capital return with renewed room to grow. For investors, this pairing puts more attention on how Wells Fargo balances buybacks, debt issuance and technology investment, especially AI initiatives, to support earnings without re introducing regulatory or operational strain.

But investors should also be aware that ongoing consent orders and compliance demands could still...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's narrative projects $90.6 billion in revenue and $22.1 billion in earnings by 2028.

Uncover how Wells Fargo's forecasts yield a $93.71 fair value, a 5% upside to its current price.

Exploring Other Perspectives

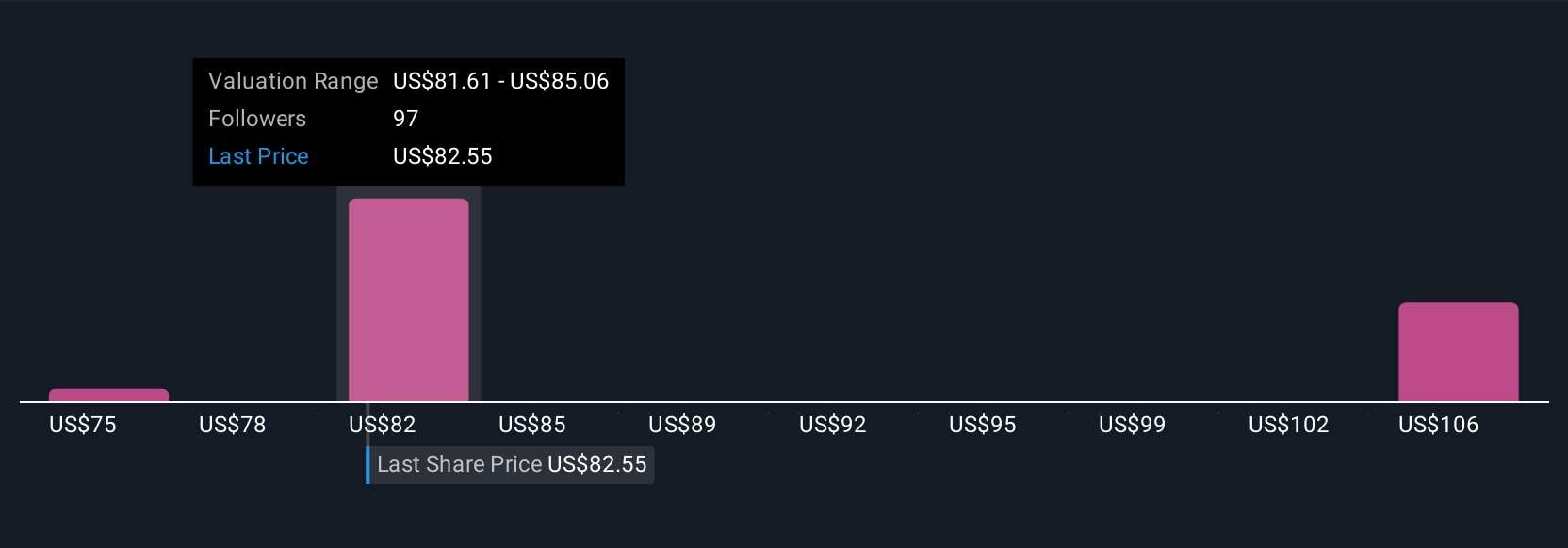

Six fair value estimates from the Simply Wall St Community span roughly US$74.70 to US$110.37, reflecting a wide range of expectations. When you set these beside Wells Fargo's dependence on successful AI and digital execution, it becomes clear why exploring several viewpoints on the bank's future performance matters.

Explore 6 other fair value estimates on Wells Fargo - why the stock might be worth 16% less than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026