- United States

- /

- Banks

- /

- NYSE:WAL

How Fraud Lawsuit and Rising Loan Charge-Offs Could Impact Western Alliance Bancorporation (WAL) Investors

Reviewed by Sasha Jovanovic

- In October 2025, Western Alliance Bancorporation disclosed that it had initiated a lawsuit against Cantor Group V LLC for alleged fraud involving collateral loans, and also reported third-quarter net loan charge-offs of US$31.1 million, up from US$26.6 million the prior year.

- These developments led to increased scrutiny, with the Rosen Law Firm launching an investigation into potential securities claims regarding the company’s disclosures and risk management practices.

- We'll consider how concerns around borrower fraud allegations and legal scrutiny could affect Western Alliance Bancorporation's investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Western Alliance Bancorporation Investment Narrative Recap

For shareholders in Western Alliance Bancorporation, belief in the company’s ability to deliver loan and deposit growth while maintaining earnings quality is central. The recent lawsuit against Cantor Group V LLC for alleged collateral loan fraud and an uptick in third-quarter net loan charge-offs, now at US$31.1 million, have drawn regulatory and legal attention. While these issues have heightened short-term uncertainty and could put credit discipline at the forefront, the most important catalyst remains the expansion in key Western and Sun Belt markets, with the biggest current risk centered around credit quality in commercial real estate exposure.

Among recent announcements, the rise in quarterly loan charge-offs stands out as most relevant to current investor concerns. This increase, alongside the legal dispute, brings sharper focus on credit practices and potential impacts to asset quality, factors closely watched given the bank’s significant exposure to specialized lending verticals and commercial real estate.

By contrast, ongoing momentum in Western Alliance’s traditional markets is set against the backdrop of regulatory investigations that investors should not overlook...

Read the full narrative on Western Alliance Bancorporation (it's free!)

Western Alliance Bancorporation is projected to reach $4.4 billion in revenue and $1.4 billion in earnings by 2028. This would require an annual revenue growth rate of 11.9% and an earnings increase of about $566 million from current earnings of $833.4 million.

Uncover how Western Alliance Bancorporation's forecasts yield a $102.06 fair value, a 32% upside to its current price.

Exploring Other Perspectives

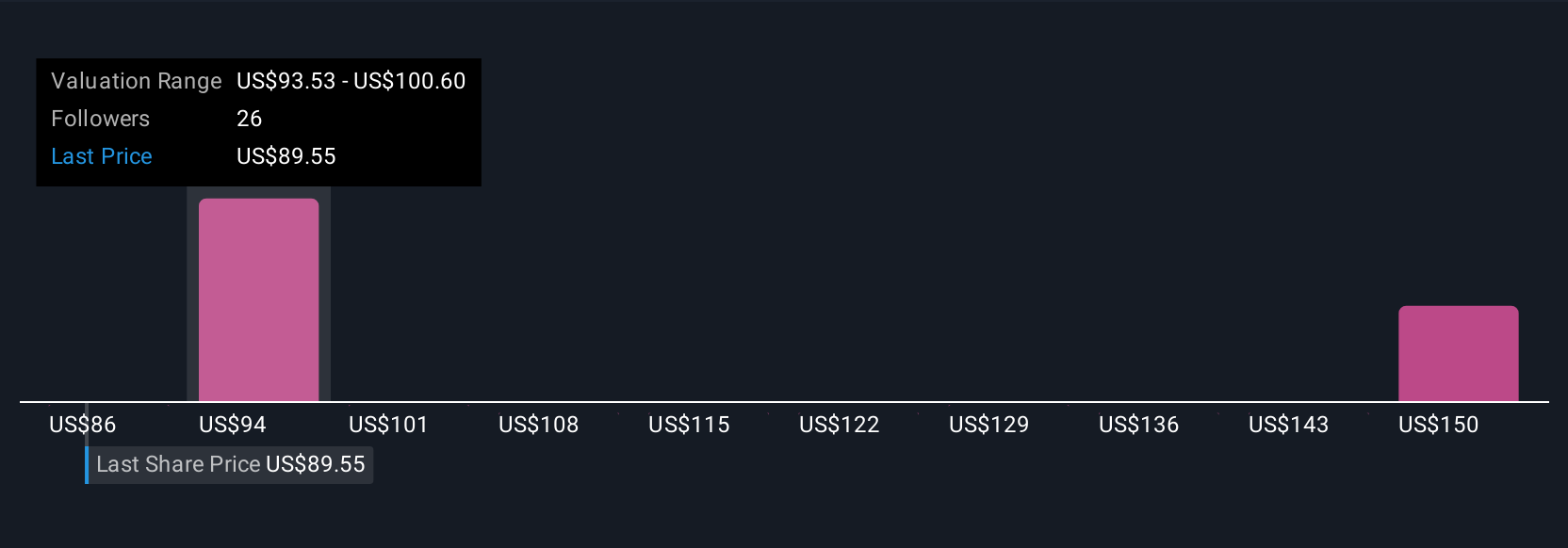

Six members of the Simply Wall St Community estimate Western Alliance’s fair value at US$96.06 to US$166.26 per share. With commercial real estate loan quality an active concern, these differing outlooks remind you that perspectives on the bank’s future profitability can vary widely among market participants.

Explore 6 other fair value estimates on Western Alliance Bancorporation - why the stock might be worth over 2x more than the current price!

Build Your Own Western Alliance Bancorporation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Alliance Bancorporation research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Western Alliance Bancorporation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Alliance Bancorporation's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives