- United States

- /

- Banks

- /

- NYSE:USB

Is There Opportunity in US Bancorp After This Week's 5.6% Price Jump?

Reviewed by Bailey Pemberton

Thinking about whether to hold, buy, or sell U.S. Bancorp stock? You’re not alone. Plenty of investors are watching this storied regional banking name, especially after a recent uptick in price and a slew of headlines reshaping the financial sector outlook. Over the past week, shares have climbed 5.6%, a notable reversal after a slightly negative month, and are holding modestly higher for the year. That is a big deal for folks looking for steady growth in the banking space, especially compared to the rollercoaster most financials have ridden the last couple of years.

Much of this movement has been influenced by broader optimism about interest rate stability and improving economic forecasts. Investors also took note of U.S. Bancorp’s expanding footprint in digital banking, a strategic play that has been met with positive sentiment. While some regulatory headlines have created ripples, the recent climb reflects increased confidence in U.S. Bancorp’s ability to adapt and thrive.

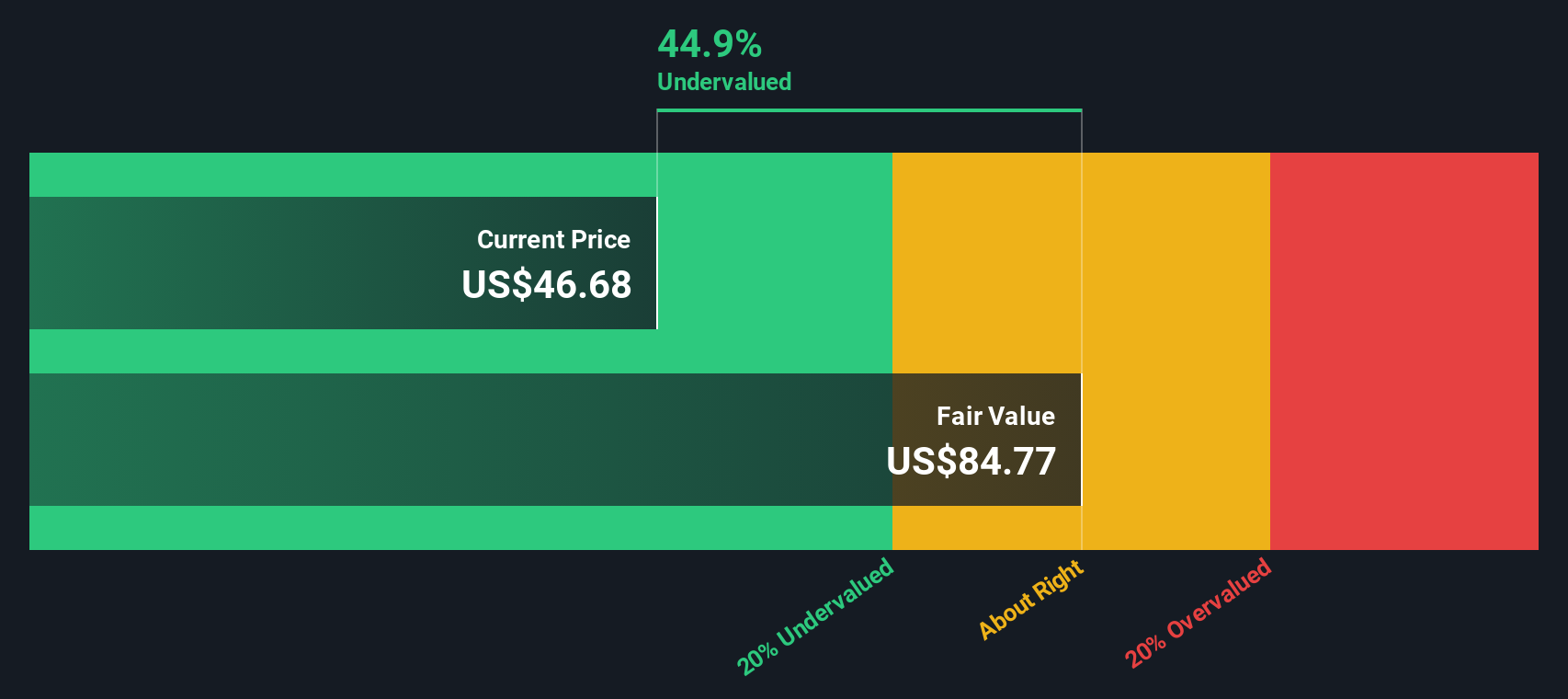

But even with these recent gains, the bigger question looms: is the stock still undervalued? According to our standard valuation checks, which cover six key financial health and value metrics, U.S. Bancorp notches an impressive score of 5 out of 6, signaling the shares remain attractively priced by most traditional models. Let us walk through those primary valuation approaches next, and stay tuned because I will share a perspective at the end that could give you an even clearer read on U.S. Bancorp’s true worth.

Why U.S. Bancorp is lagging behind its peers

Approach 1: U.S. Bancorp Excess Returns Analysis

The Excess Returns valuation model is designed to measure how a company’s return on invested capital compares to its cost of equity, essentially highlighting whether each dollar invested is delivering value above what investors require. For U.S. Bancorp, this approach reveals meaningful insights into the stock’s fundamental value and efficiency in generating shareholder returns.

Looking at the numbers, U.S. Bancorp’s Book Value currently stands at $36.33 per share, while its stable Earnings Per Share (EPS) is estimated at $5.11. These estimates are sourced from weighted future Return on Equity projections from 15 analysts and indicate solid underlying profitability. With a Cost of Equity of $3.06 per share, the company’s Excess Return is $2.05 per share, reflecting an average Return on Equity of 12.85 percent, a strong margin above the required rate. Projections also put the stable Book Value at $39.81 per share, based on input from 13 analysts.

According to this Excess Returns analysis, U.S. Bancorp’s intrinsic value is $84.38 per share. Compared to its current market price, this suggests the stock is trading at a 42.8 percent discount, making it significantly undervalued from this model’s perspective.

Result: UNDERVALUED

Our Excess Returns analysis suggests U.S. Bancorp is undervalued by 42.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: U.S. Bancorp Price vs Earnings

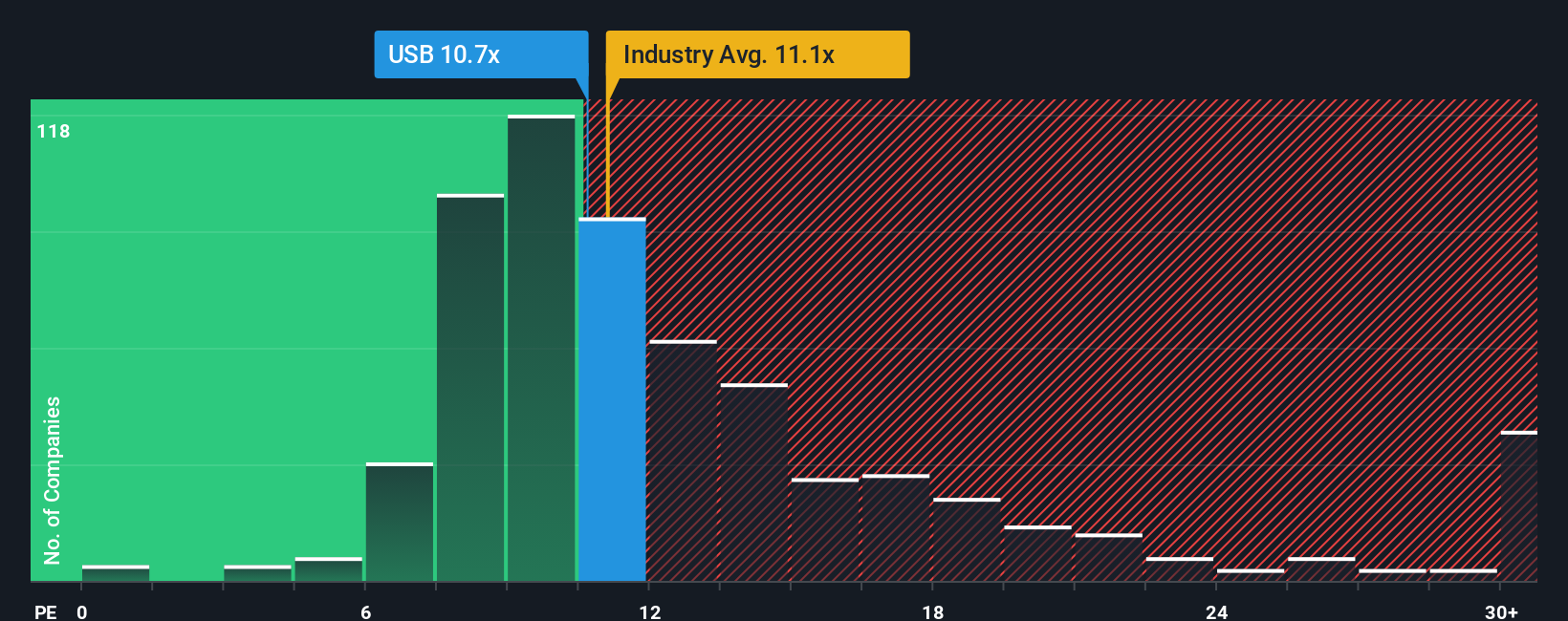

For companies that are consistently profitable like U.S. Bancorp, the Price-to-Earnings (PE) ratio is one of the most widely used ways to assess valuation. The PE ratio compares a company’s share price with its earnings per share, making it straightforward to see how much investors are willing to pay for each dollar of profit. Typically, higher growth prospects or lower risk drive the “fair” or accepted PE ratio higher, while slower growth or greater risk results in a lower fair multiple.

U.S. Bancorp currently trades at an 11.0x PE ratio, which sits just below the industry average of 11.2x and is notably lower than the average of its peers at 17.7x. That alone might suggest potential undervaluation, but these metrics often miss the full picture. This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, at 14.3x for U.S. Bancorp, is Simply Wall St’s estimate of the right multiple for this stock, calculated by factoring in growth outlook, risk profile, profit margins, market size, and industry nuances. This makes it a more precise benchmark than raw peer or sector averages.

Given that U.S. Bancorp’s current PE is 11.0x and its Fair Ratio is 14.3x, the stock looks attractively priced, offering a discount relative to what the fundamentals suggest is fair.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your U.S. Bancorp Narrative

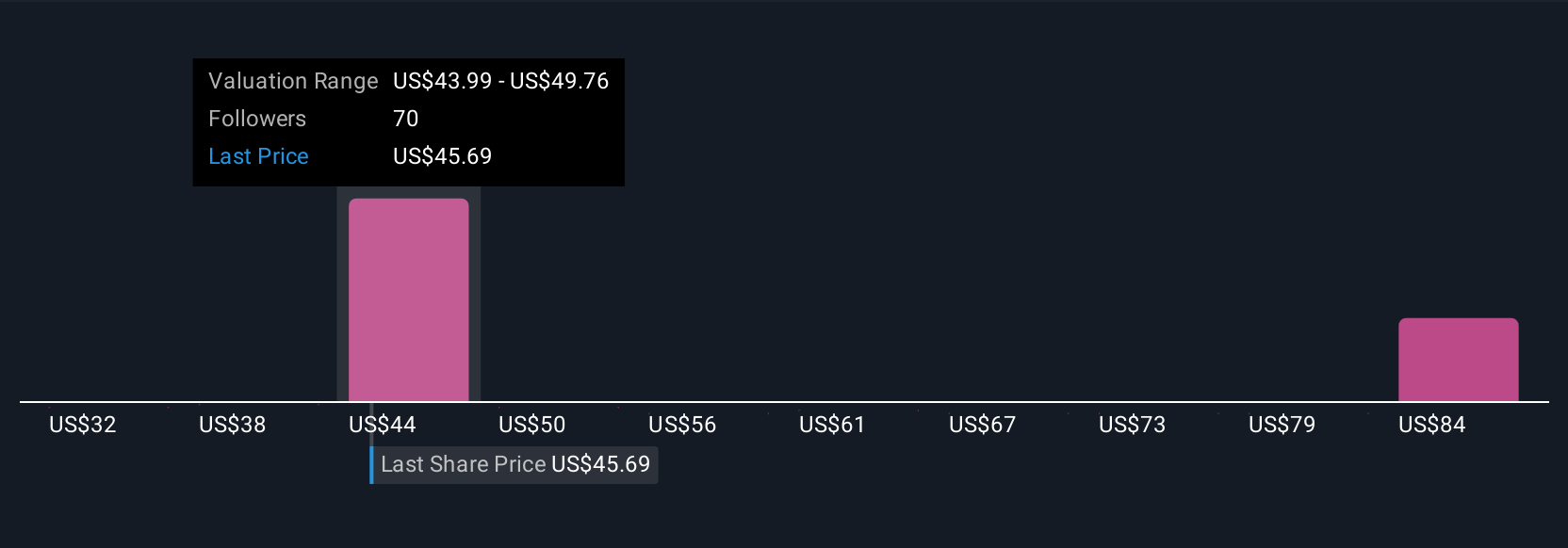

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative gives you the chance to tell your unique story about a company, linking what you believe about U.S. Bancorp’s business future to actual financial forecasts and, ultimately, to a fair value for its shares. Narratives are simple yet powerful because they connect your thesis about where the company is headed with your assumptions for future revenue, earnings, and margins. This impacts whether the stock appears undervalued or overvalued for you specifically.

Available on Simply Wall St’s Community page and used by millions of investors, Narratives take you beyond static numbers and ratios, allowing you to compare your estimated Fair Value against the market price to decide when to buy or sell. As new information comes in, such as earnings, news, or industry developments, your Narrative updates automatically, keeping your view responsive and relevant.

For U.S. Bancorp, some investors may see accelerating digital growth and efficiency gains, building a Narrative with a bullish fair value as high as $67.0. Others may emphasize competitive threats or regional challenges, leading to a more cautious perspective and a fair value closer to $47.0. Narratives show how the story you believe drives the price you are willing to pay, giving you more confidence in your decisions.

Do you think there's more to the story for U.S. Bancorp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives