- United States

- /

- Banks

- /

- NYSE:UCB

Is United Community Banks’ Florida Loan Growth and ANB Acquisition Reshaping Its Story for UCB Investors?

Reviewed by Sasha Jovanovic

- In its latest quarterly Form 10-Q released earlier this week, United Community Banks Inc. reported significant increases in revenue, net income, and earnings per share, alongside updates on its acquisition of Florida-based ANB.

- One interesting insight is that this expansion comes even as United Community Banks' recent annual revenue and tangible book value growth have lagged behind those of its banking peers.

- We'll explore how United Community Banks' continued commercial loan growth in Florida may shift its investment outlook going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

United Community Banks Investment Narrative Recap

To invest in United Community Banks, you need to believe in the company’s ability to grow its earnings and commercial loan book despite lagging revenue and tangible book value growth compared to peers. The Q3 report’s strong revenue and profit improvement did not meaningfully change the biggest near-term catalyst, continued loan expansion in Florida, nor address the ongoing risk from rising competition and potential margin compression. Among recent announcements, the acquisition of ANB in Florida is especially relevant. This move directly supports the company’s short-term growth engine by broadening its commercial lending reach in a key, faster-growing market, even as integration and local competition could shape how much benefit is ultimately realized. Yet, investors should remember an important contrast: While much attention is on Florida’s loan growth, the risk of margin compression from intense competition and higher deposit costs remains a factor worth…

Read the full narrative on United Community Banks (it's free!)

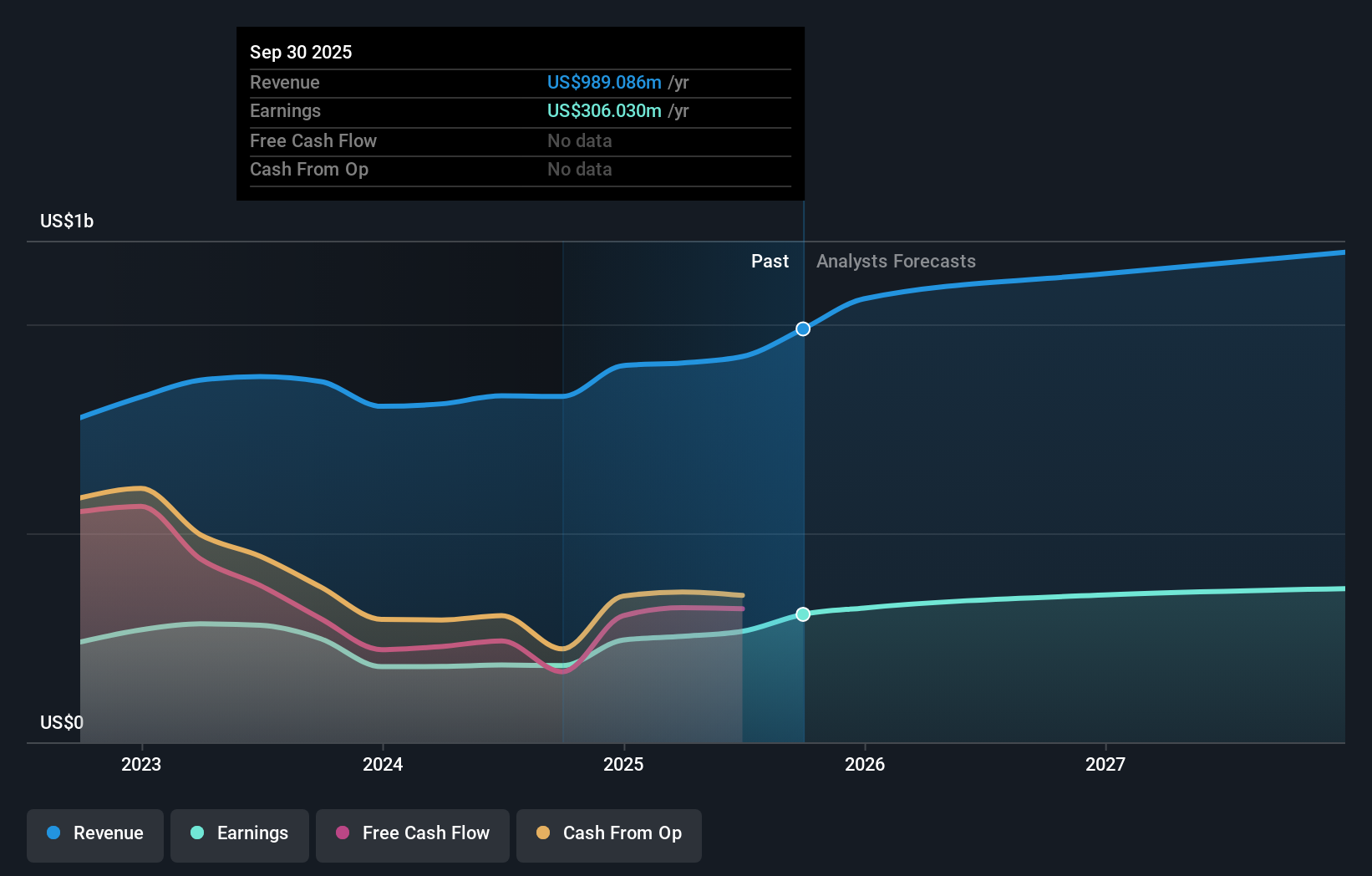

United Community Banks' outlook anticipates $1.3 billion in revenue and $442.5 million in earnings by 2028. This is based on a projected 13.4% annual revenue growth rate and an earnings increase of $177 million from the current $265.4 million level.

Uncover how United Community Banks' forecasts yield a $34.92 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members suggest fair values between US$34.92 and US$51.86 based on two analyses. While opinions range widely, competition-driven margin pressures could still weigh on future returns, explore the different perspectives for a fuller view.

Explore 2 other fair value estimates on United Community Banks - why the stock might be worth just $34.92!

Build Your Own United Community Banks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Community Banks research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free United Community Banks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Community Banks' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives