- United States

- /

- Banks

- /

- NYSE:UCB

A Look at United Community Banks’s Valuation Following Strong 10-Q and Florida Expansion

Reviewed by Simply Wall St

United Community Banks (UCB) just published its latest quarterly report, revealing year-over-year increases in revenue, net income, and earnings per share. The company’s acquisition of ANB also expands its footprint in Florida and aligns with broader growth plans.

See our latest analysis for United Community Banks.

UCB’s latest rally has sparked renewed optimism, yet the stock’s 1-year total shareholder return of -4.3% reflects lingering caution from the market, particularly after the company’s expansion into Florida and steady loan portfolio growth. Momentum appears to be stabilizing as investors weigh recent gains against long-term prospects.

If you’re curious where the next breakout might come from, now’s a good time to broaden your investing lens and discover fast growing stocks with high insider ownership

Given this backdrop of strong earnings and expansion, investors now face a key question: Is United Community Banks actually undervalued, or is future growth already reflected in the current share price?

Most Popular Narrative: 13.8% Undervalued

United Community Banks closed at $30.09, while the most followed narrative suggests a fair value of $34.92. That gap surfaces as investors wonder if the latest acquisition and earnings momentum are fully captured by the market or if future upside remains underappreciated.

Strong capital ratios, disciplined expense management, and system integration following recent acquisitions enable UCBI to be opportunistic in future M&A activity, accelerating geographic expansion and capturing cost synergies, which could improve long-term net margins and earnings power.

Want to see the financial engine driving this price target? The narrative is powered by bold profit margin expansion and rapid revenue growth assumptions, pushing the limits of what regional banks can typically achieve. The valuation hinges on a set of projections that may surprise even seasoned investors. Curious how those numbers stack up?

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition from larger banks and overreliance on acquisitions could limit growth, adding uncertainty to United Community Banks’ bullish outlook.

Find out about the key risks to this United Community Banks narrative.

Another View: Peer and Industry Ratios Tell a Different Story

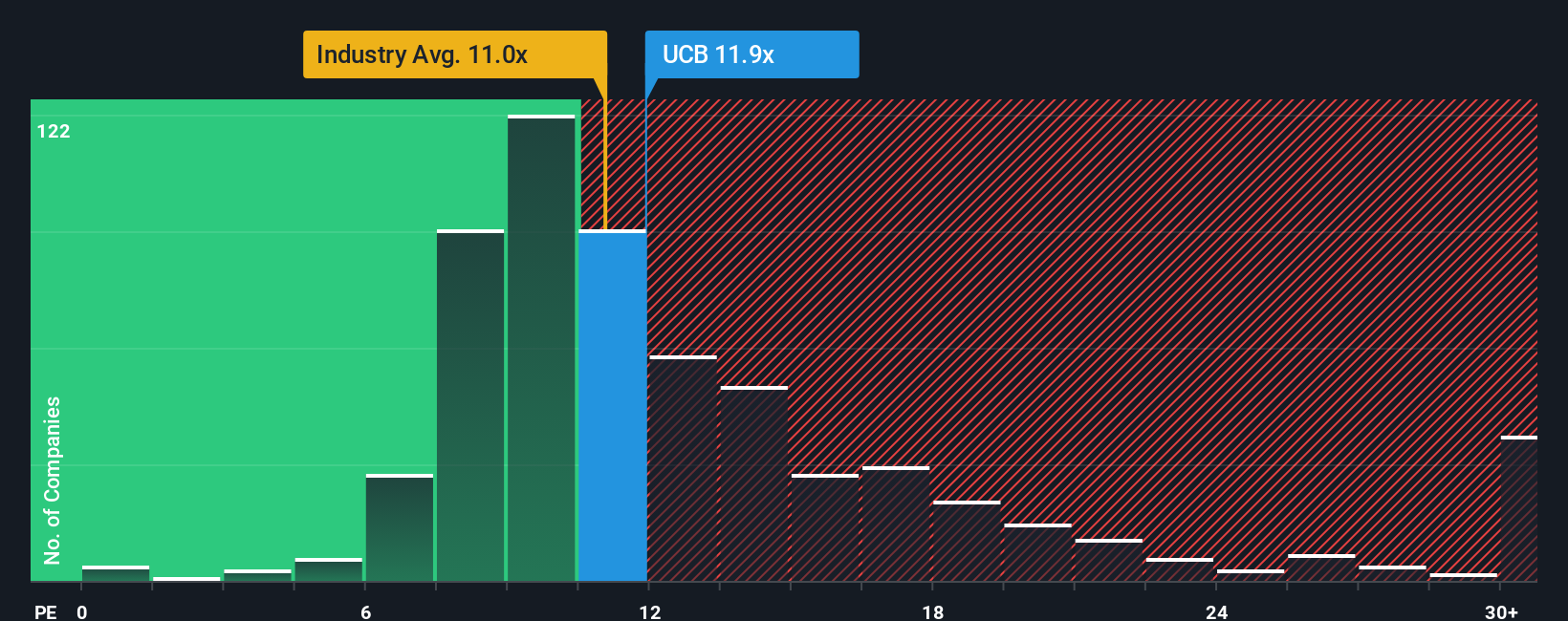

Looking at how United Community Banks is valued compared to other banks reveals an interesting twist. Its price-to-earnings ratio of 12x is higher than the industry average of 11.1x and above its fair ratio of 11.5x, yet it remains much lower than peers at 27.8x. This suggests the market could be expecting either slower growth or viewing risk differently. Could this signal untapped potential, or should investors be cautious about overpaying for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

If you’d rather explore the numbers first-hand or want to shape your own take on United Community Banks, you can create a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Looking for More Investment Ideas?

Smart investors know that staying ahead means always seeking fresh opportunities, not settling for yesterday’s winners. Here are three exciting ways to expand your portfolio. Don’t let these trends pass you by.

- Unlock growth potential by targeting underpriced gems through these 865 undervalued stocks based on cash flows, offering unique ideas rooted in strong fundamentals and future cash flows.

- Boost your passive income stream with solid companies paying attractive returns. Start your search with these 16 dividend stocks with yields > 3% yielding over 3% annually.

- Capitalize on tomorrow’s tech by tapping into the rapidly evolving world of artificial intelligence and robotics, all within these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives