- United States

- /

- Banks

- /

- NYSE:TFIN

Does Triumph Financial’s 11.8% Weekly Surge Signal a Shift in Market Expectations for 2025?

Reviewed by Bailey Pemberton

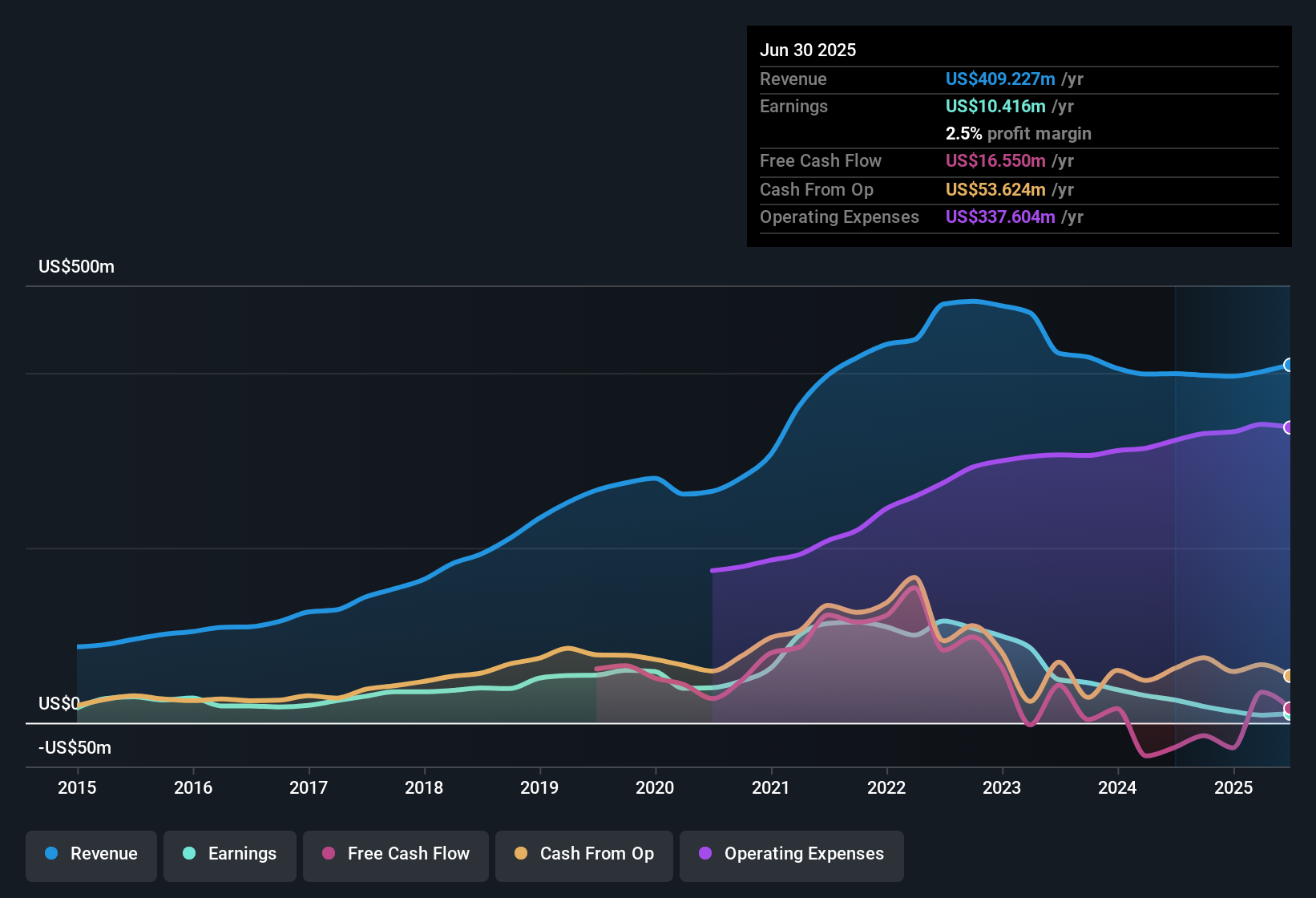

If you’re staring at Triumph Financial and debating whether it’s time to buy, hold, or move on, you’re not alone. Over the last week, shares have surged an impressive 11.8%, shaking off a longer-term downward trend that has left the stock down 35.4% year-to-date. These sharp moves are more than just numbers on a screen. They reflect shifts in how investors perceive Triumph’s risk and growth prospects, especially after a stretch of turbulent financial sector headlines and changes in regulatory sentiment.

Looking further back, the picture offers a mixed bag. While the last year brought a tough 36.0% decline, the three-year and five-year snapshots show the company eking out gains of 14.9% and 36.0%, respectively. That speaks to both resilience and volatility, qualities that grab attention when news stories highlight changes in lending landscapes, digital banking initiatives, or strategic updates from Triumph.

When it comes to valuation, though, numbers speak louder than headlines. Based on six key underscoring checks, Triumph Financial does not currently look undervalued on any front, giving it a value score of 0. That sets up a deeper dive into how professionals approach valuation, and why sometimes, traditional metrics alone might not tell the whole story. So, let’s explore the methods investors use to assess valuation, and then consider a fresh perspective that could reveal more about Triumph’s true worth.

Triumph Financial scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Triumph Financial Excess Returns Analysis

The Excess Returns valuation focuses on how much value a company can generate over and above the basic cost of its shareholders’ capital. This approach highlights Triumph Financial’s ability to earn attractive returns on invested equity, not just whether it can grow in size or sales. The key numbers tell the story: Triumph currently posts an average return on equity of 4.39%, delivered through stable, forward-looking estimates from four analysts.

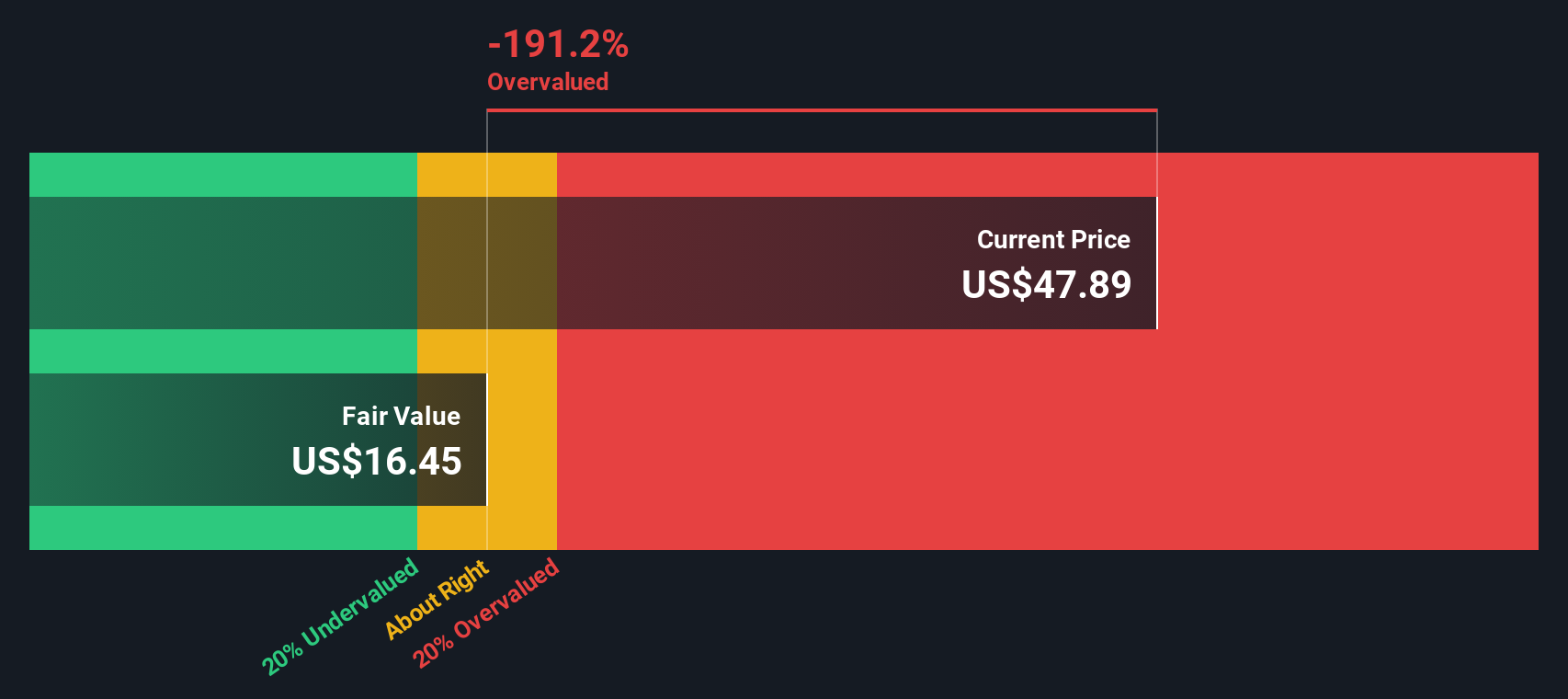

With a book value per share at $36.79 and a stable projected book value of $38.66, Triumph’s expected earnings per share settle at $1.70. After accounting for the $2.62 cost of equity, the company is actually losing value for shareholders, showing a negative excess return of $-0.92 per share. This suggests that Triumph’s profits are not currently covering the risk and capital injections its investors provide, according to the latest forecasts.

Based on this analysis, the Excess Returns model estimates Triumph Financial’s fair value at just $13.71 per share, while the stock trades substantially higher. This suggests Triumph is considered 318.1% overvalued on this basis, indicating a significant mismatch between market optimism and underlying returns.

Result: OVERVALUED

Our Excess Returns analysis suggests Triumph Financial may be overvalued by 318.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Triumph Financial Price vs Book

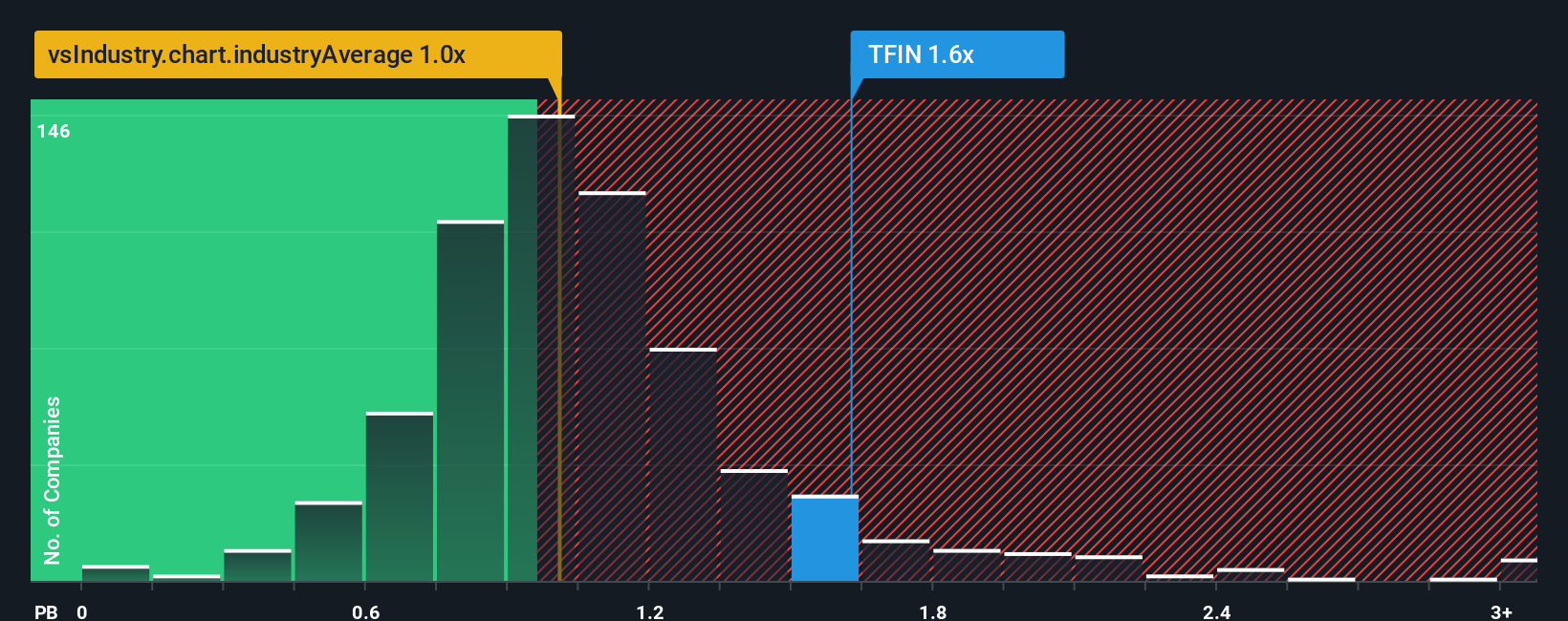

The price-to-book (PB) ratio is often the go-to valuation tool for financial companies like Triumph Financial, particularly banks. Book value represents a bank’s net asset base and tends to be far more stable than earnings, especially in an industry known for fluctuating profits and credit cycles. For investors, the PB ratio can give a clear snapshot of how the market values a company’s assets, which is an especially relevant metric if the company is not consistently profitable or when earnings are hard to predict.

A “normal” or “fair” PB ratio will reflect not just the firm’s size but its growth prospects, risk profile, and how effectively it converts assets into returns for shareholders. Generally, higher expected growth or greater profitability will justify a higher PB multiple, while heightened risks or slower growth can pull the ratio down.

Triumph Financial currently trades at a PB ratio of 1.56x. That is notably higher than both its industry average of 1.01x and a peer average of 0.92x, implying the market is pricing Triumph as a premium bank relative to these benchmarks. However, industry and peer averages do not capture everything that makes a business unique.

This is where Simply Wall St’s proprietary Fair Ratio comes in. Rather than a one-size-fits-all number, the Fair Ratio blends together factors like Triumph’s earnings growth trajectory, profit margins, risk profile and even its market capitalization, creating a custom benchmark for fair valuation. This makes it a more holistic tool than straight peer or industry comparisons and helps investors see how market expectations align with the business’s unique attributes.

Comparing Triumph’s actual PB of 1.56x to its custom Fair Ratio reveals a steep premium, suggesting that investors are paying well above what would be considered reasonable, even after accounting for Triumph’s specific risks and growth outlook.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Triumph Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story you build around a company’s future, based on your own expectations about where Triumph Financial is heading. These expectations are shaped by numbers like revenue, profits, margins, and fair value, and are connected to the real-world developments and trends that truly drive results.

With Narratives, you combine this story with a concrete financial outlook. This approach translates your perspective into an estimated fair value that you can directly compare against today’s share price, making it easier to decide when to buy, hold, or sell. Available right on Simply Wall St’s Community page, Narratives are designed for any investor to use and update automatically as news breaks or new earnings arrive, ensuring your view stays fresh and informed.

Different investors can and do hold very different Narratives about Triumph Financial. For example, one investor may forecast continued digital innovation and strong loan growth, supporting a fair value far above $60 per share. Another may see risks around freight market volatility and regulatory costs, arriving at a fair value closer to $13. By using Narratives, you can clearly see how your own expectations compare with the broader Community’s evolving views on Triumph Financial.

Do you think there's more to the story for Triumph Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives