- United States

- /

- Banks

- /

- NYSE:TFC

How Investors Are Reacting To Truist Financial (TFC) Hiring Microsoft Veteran as Chief AI and Data Officer

Reviewed by Sasha Jovanovic

- Truist Financial Corporation recently appointed Pascal Belaud, a longtime Microsoft executive, as chief AI & data officer to lead its AI, data, and automation initiatives across the enterprise starting November 24, 2025.

- This significant hire reflects Truist’s growing commitment to digital transformation, signaling a push to leverage artificial intelligence and automation for company-wide innovation.

- We’ll now explore how Belaud’s appointment as chief AI & data officer could influence Truist Financial’s investment outlook and growth trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Truist Financial Investment Narrative Recap

At its core, Truist Financial appeals to investors who believe that digital transformation and innovation can drive more efficient, profitable growth in a traditional banking model. The recent appointment of Pascal Belaud as chief AI & data officer is a step aligned with this vision but is not likely to shift the most immediate catalyst, continued digital adoption, or meaningfully reduce the near-term risk tied to the company’s sizable exposure to commercial real estate.

Of the recent announcements, Truist’s launch of Truist One View Connect stands out in relation to Belaud’s hiring, as it reflects ongoing efforts to enhance digital product offerings and streamline operations, an important short-term driver as technology ramps up to lower costs and improve client experience. Yet, even the most robust digital initiatives are not likely to offset the immediate credit risk associated with changing dynamics in commercial real estate.

In contrast, investors should also be aware of how sustained pressure in commercial real estate credit quality may...

Read the full narrative on Truist Financial (it's free!)

Truist Financial's narrative projects $22.5 billion revenue and $6.3 billion earnings by 2028. This requires 7.5% yearly revenue growth and a $1.4 billion earnings increase from $4.9 billion currently.

Uncover how Truist Financial's forecasts yield a $50.55 fair value, a 11% upside to its current price.

Exploring Other Perspectives

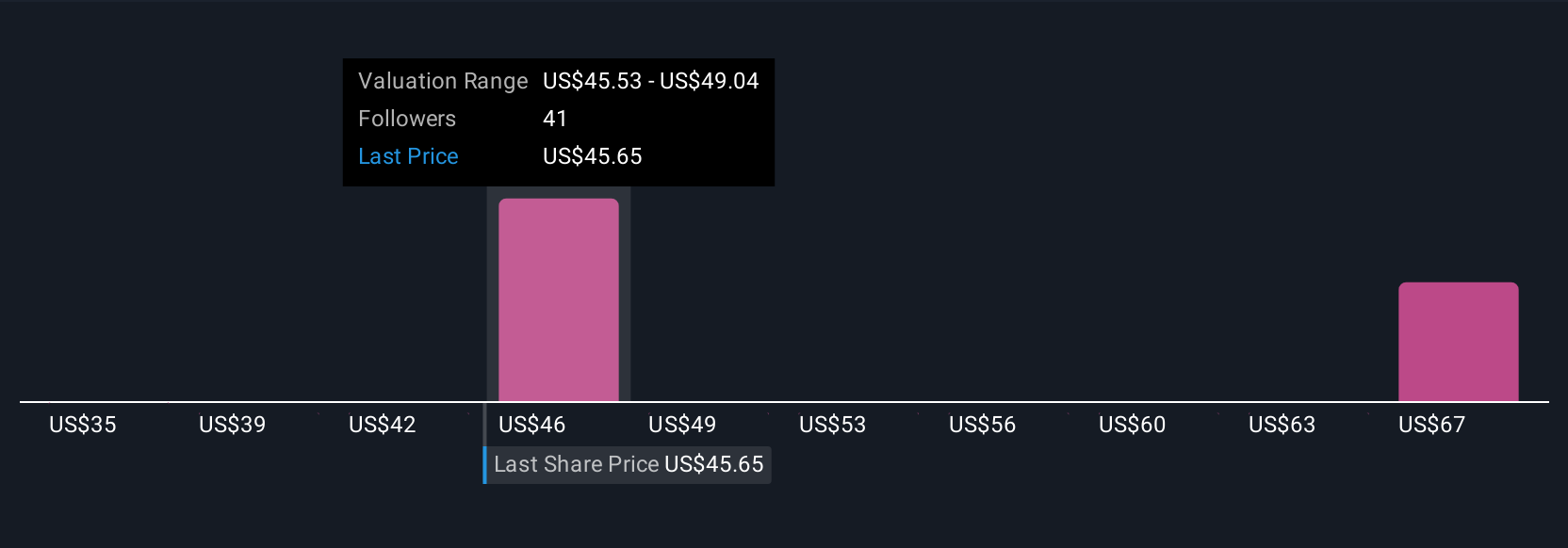

The Simply Wall St Community posted four fair value estimates for Truist Financial ranging from US$35.00 to US$59.00. While perspectives are varied, many are weighing the impact of rapid digital adoption against structural risks in commercial real estate and operational efficiency.

Explore 4 other fair value estimates on Truist Financial - why the stock might be worth as much as 30% more than the current price!

Build Your Own Truist Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truist Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truist Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truist Financial's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives