- United States

- /

- Banks

- /

- NYSE:STEL

A Fresh Look at Stellar Bancorp (STEL) Valuation Following Third Quarter Results and Deposit Growth

Reviewed by Simply Wall St

Stellar Bancorp (STEL) released its third quarter earnings, showing results that largely matched what analysts were expecting. A steady net interest margin and strong deposit growth helped reinforce the company’s balance sheet, despite some lingering headwinds.

See our latest analysis for Stellar Bancorp.

Stellar Bancorp’s balance sheet momentum in the third quarter is showing up in the stock’s performance as well. While the 1-year total shareholder return sits at 9.5%, the share price has gained 7.5% year-to-date, reflecting steady investor confidence even as the bank managed larger charge-offs and non-recurring expense bumps. With its strategic refocus and solid deposit growth, momentum appears well-supported for the long term.

If you’re interested in discovering what else is building momentum across the market, broaden your search and uncover fast growing stocks with high insider ownership

With shares trading just below analysts’ price targets and the latest results already factored in, investors may wonder whether Stellar Bancorp’s current valuation still leaves room for upside or if the market is already pricing in future growth.

Most Popular Narrative: 5.5% Undervalued

With Stellar Bancorp closing at $29.87 and the current fair value narrative set at $31.60, market sentiment appears to leave a modest gap between price and perceived worth. That gap is where the most influential narrative steps in: strong on Texas growth but alert to the headwinds of digital disruption and cost escalation.

Share price appears to reflect high expectations that Stellar Bancorp can effectively defend and grow margins through core deposit growth and disciplined relationship banking, despite intensifying competition from digital-first banks and fintechs. This poses risk to long-term revenue and net margin stability if digital disruption accelerates.

Beneath this price target lie bold projections. Revenue growth, shrinking margins, and a valuation multiple that could make even the biggest sector bulls pause. Wondering what assumptions must hold for analysts to back this premium? The full narrative has the answers and some surprises.

Result: Fair Value of $31.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong demographic growth in Texas and successful expense management could fuel ongoing earnings and potentially challenge the current cautious narrative.

Find out about the key risks to this Stellar Bancorp narrative.

Another View: Is the Market Overpaying?

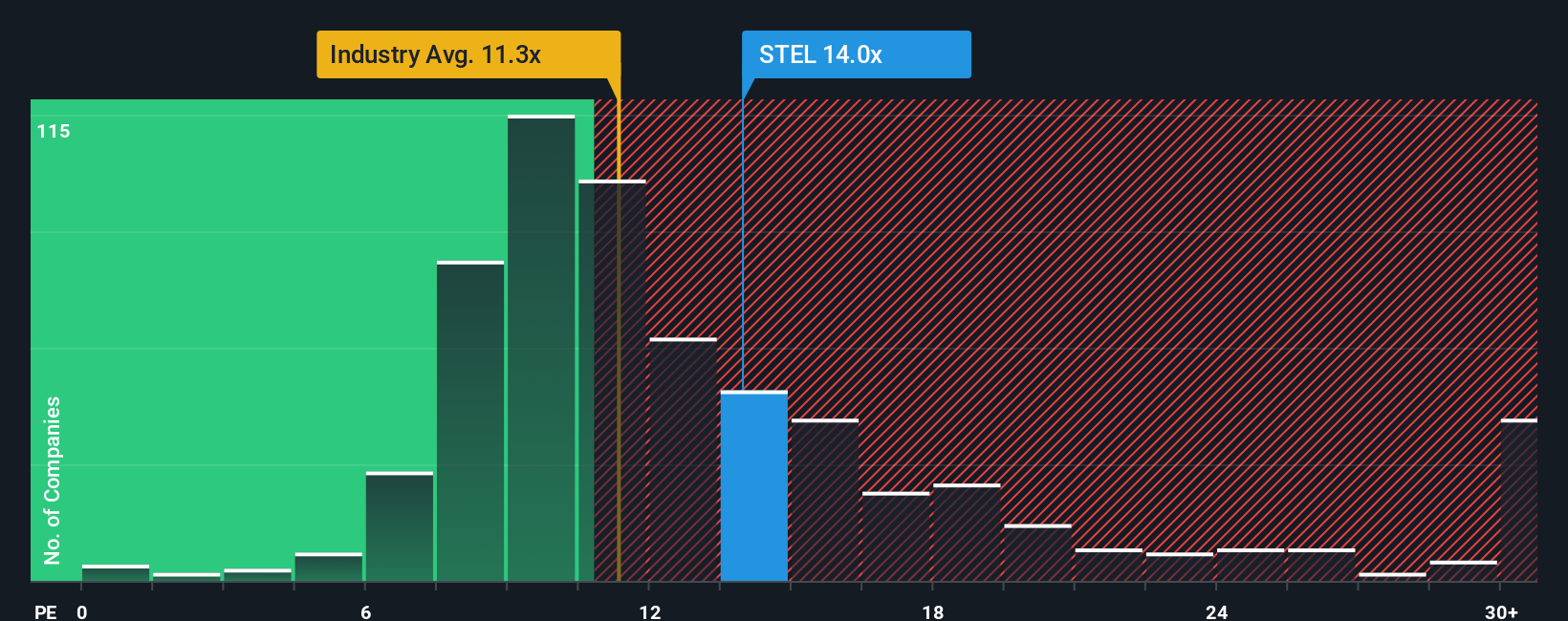

While analysts see fair value around $31.60, the market’s price-to-earnings ratio for Stellar Bancorp sits at 15x, noticeably higher than the US Banks industry average of 11.2x and above the fair ratio of 10.8x. This premium could mean investors are paying up for growth. Is that justified, or is the risk being underestimated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stellar Bancorp Narrative

If you see the numbers differently or trust your own research process, it's quick and easy to build your personal perspective in just a few minutes. Do it your way

A great starting point for your Stellar Bancorp research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by finding companies with hidden potential, breakthrough technology, or steady rewards. New opportunities are just a step away—do not let the market pass you by.

- Boost your income stream with reliable picks by starting with these 19 dividend stocks with yields > 3% yielding over 3%.

- Capture early movers in emerging trends by launching your search with these 27 AI penny stocks at the forefront of artificial intelligence innovation.

- Get ahead of the herd by targeting value with these 876 undervalued stocks based on cash flows that may fly under most investors’ radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STEL

Stellar Bancorp

Operates as the bank holding company that provides a range of commercial banking products and services primarily to small and medium-sized businesses, professionals, and individual customers.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives