- United States

- /

- Banks

- /

- NYSE:SFBS

How Surging Credit Losses At ServisFirst Bancshares (SFBS) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- ServisFirst Bancshares reported net charge-offs of US$9,063,000 for the third quarter ended September 30, 2025, compared to US$2,772,000 in the same period last year.

- This sharp increase in credit losses may raise concerns about loan performance and asset quality trends among investors and stakeholders.

- We'll explore how the recent surge in net charge-offs could influence ServisFirst Bancshares' outlook and future earnings expectations.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ServisFirst Bancshares Investment Narrative Recap

To be a shareholder in ServisFirst Bancshares, you need confidence in its ability to produce above-average loan and earnings growth by capitalizing on business expansion in Southeastern markets and disciplined lending. The recent surge in net charge-offs, now at US$9,063,000, places renewed attention on asset quality; if credit quality fails to stabilize, this could be the single biggest short-term risk, potentially outweighing new commercial lending initiatives as a growth driver.

Most relevant to the charge-off increase is the board’s recent decision to appoint a new Chief Credit Officer this year, an announcement that signaled heightened attention on credit risk long before the third-quarter numbers surfaced. Continuing efforts to fortify risk controls will be key as the bank looks to maintain a balance between growth and rising credit costs.

By contrast, persistent headwinds in the commercial real estate loan segment remain a risk investors should watch for as they…

Read the full narrative on ServisFirst Bancshares (it's free!)

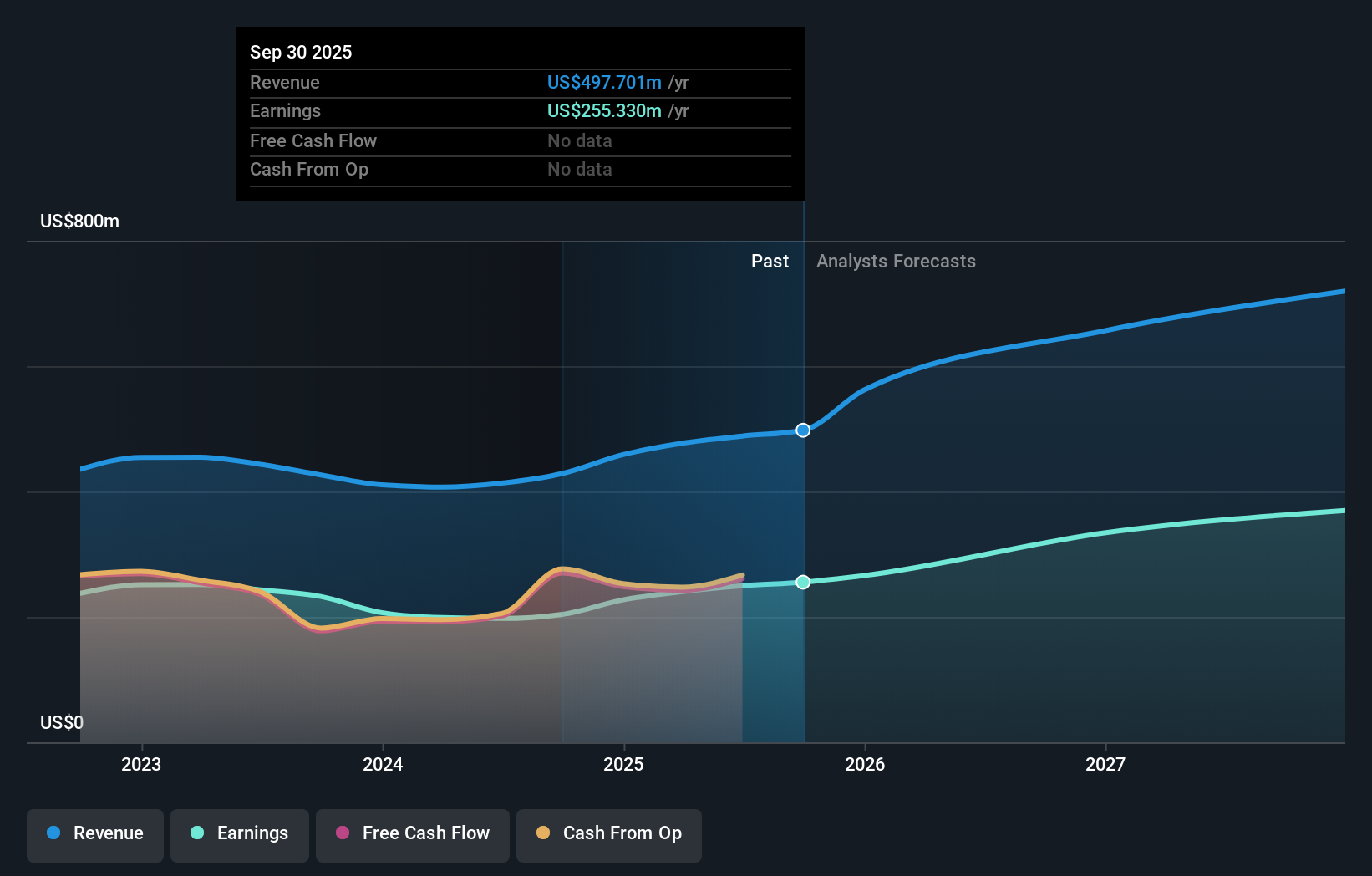

ServisFirst Bancshares is projected to reach $868.4 million in revenue and $443.0 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 21.1% and an increase in earnings of about $193 million from the current $249.7 million.

Uncover how ServisFirst Bancshares' forecasts yield a $86.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members span from US$86.67 to US$133.05 per share, showing wide variation in how individual investors interpret ServisFirst’s future. As the recent rise in net charge-offs fuels debate about credit quality, you can see that opinions on the company’s outlook vary considerably, offering plenty to explore in the full range of community viewpoints.

Explore 2 other fair value estimates on ServisFirst Bancshares - why the stock might be worth as much as 89% more than the current price!

Build Your Own ServisFirst Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServisFirst Bancshares research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ServisFirst Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServisFirst Bancshares' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFBS

ServisFirst Bancshares

Operates as the bank holding company for ServisFirst Bank that provides various banking services to individual and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives