- United States

- /

- Banks

- /

- NYSE:RNST

Renasant (RNST): Evaluating Undervaluation and Growth Prospects After Recent Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for Renasant.

Momentum has started to turn for Renasant, with the share price recently bouncing 6.57% over the past week after a tough few months. While the one-year total shareholder return stands at -4.2%, those who have held the stock for five years have enjoyed a more robust 28% gain. This may hint that confidence in longer-term prospects is still intact as the broader sector resets.

If you're curious to see what else is moving with strong fundamentals and insider conviction, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Renasant now trading nearly 28% below its estimated intrinsic value and analysts projecting further upside, the question is whether this marks a compelling entry point or if the market has already accounted for future growth prospects.

Most Popular Narrative: 14.7% Undervalued

Comparing Renasant's fair value narrative to the latest closing price, there is a noticeable gap that positions the stock below what analysts believe it should be worth, suggesting a disconnect that may attract investor attention ahead of key growth milestones.

The merger with The First Bancshares increases scale and provides a larger footprint in regions experiencing strong small business formation, enabling Renasant to capitalize on rising entrepreneurial activity. This should enhance lending opportunities and fee income over time.

Curious about the calculations fueling this upside? There is one bold assumption about future earnings that could transform the stock’s outlook. The narrative is betting on rapid growth and margin expansion. What figures are driving that confidence? Only a deep dive will reveal the numbers that justify such a premium in today’s market.

Result: Fair Value of $41.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regional economic shocks or delays in integrating recent mergers could quickly challenge the optimism around Renasant’s projected growth path and valuation.

Find out about the key risks to this Renasant narrative.

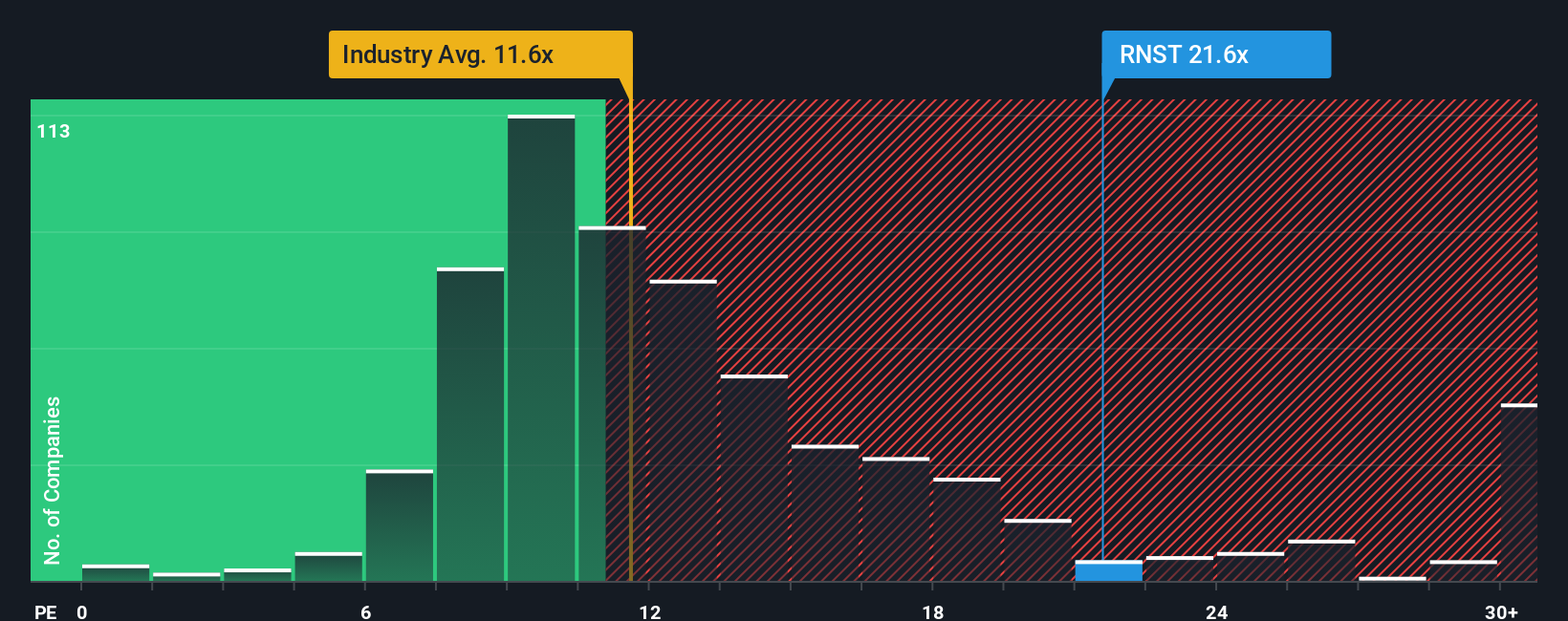

Another View: P/E Ratio Raises Questions

Looking at Renasant’s price-to-earnings ratio, the stock trades at 23.1x earnings, which is much higher than the US Banks industry average of 11.2x and above its own fair ratio of 18.6x. This premium suggests investors expect significant growth, but it could also increase valuation risk if targets are not met. Is the optimism justified, or does it signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Renasant Narrative

If you have different insights or want to test your own ideas, it only takes a few minutes to put together your own perspective. So why not Do it your way

A great starting point for your Renasant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t miss a chance to strengthen your portfolio. There are outstanding stocks thriving right now in places most investors overlook. Use the screener below to get ahead with ideas that could shape your next big move.

- Tap into tomorrow’s financial leaders by tracking these 3581 penny stocks with strong financials with resilient growth and innovative potential.

- Catch the wave of medical disruption as you check out these 30 healthcare AI stocks transforming patient care and diagnostics with artificial intelligence.

- Boost your income with steady performers. Choose these 14 dividend stocks with yields > 3% delivering attractive yields above 3% so your cash works harder.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success