- United States

- /

- Banks

- /

- NYSE:RF

How Investors May Respond To Regions Financial (RF) Enhanced Transparency and Improved Financial Metrics

Reviewed by Sasha Jovanovic

- Regions Financial Corporation recently held a presentation at the BancAnalysts Association of Boston Conference and released updated materials outlining its operations and performance to institutional investors throughout November and December 2025.

- The company has highlighted an emphasis on transparency, strategic capital and risk management, and is experiencing improvements in key financial metrics such as net income and earnings per share.

- We’ll now explore how Regions Financial’s recent positive quarterly results and management’s forward-looking guidance shape its overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Regions Financial Investment Narrative Recap

To own Regions Financial, an investor needs to believe in the company’s ability to grow earnings and preserve margins through solid regional market share and reliable credit management. Recent updates from the company’s presentation and financial disclosures reinforce improvements in net income and earnings, supporting the current investment case, though the biggest short-term catalyst remains the ongoing retention and growth of noninterest-bearing deposits. Management’s transparency and positive updates do little to address the persistent risk stemming from aggressive competition in core markets, which remains the primary threat for now.

The most relevant announcement tied to the company’s latest presentation is the third-quarter 2025 earnings release, showing a year-on-year increase in net interest income to US$1,257 million and net income to US$569 million. These results, along with management highlighting robust credit risk management and ongoing capital returns, reinforce investor focus on margin stability and balance sheet quality as key drivers for the next phase of the stock’s story. But before you get comfortable with the outlook, it’s critical to understand why ongoing changes in Southeastern market competition could still...

Read the full narrative on Regions Financial (it's free!)

Regions Financial's outlook projects $8.6 billion in revenue and $2.2 billion in earnings by 2028. This forecast assumes an annual revenue growth rate of 8.2% and an increase in earnings of $0.2 billion from the current $2.0 billion.

Uncover how Regions Financial's forecasts yield a $28.45 fair value, a 17% upside to its current price.

Exploring Other Perspectives

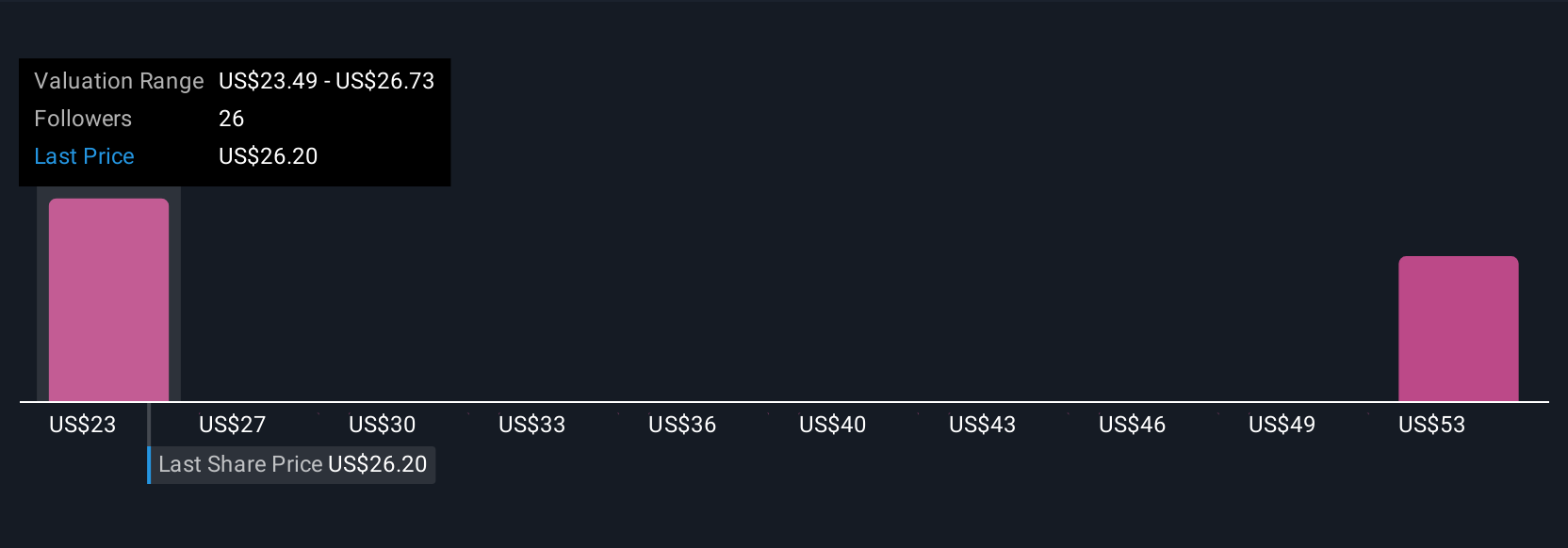

Three fair value estimates from the Simply Wall St Community span US$28.45 to US$53.47, highlighting wide disagreement among retail investors about Regions Financial’s long-term potential. While some see room for higher growth, the ongoing pressures from established and emerging competitors in key markets continue to influence performance and outlook, so explore the range of perspectives before making a decision.

Explore 3 other fair value estimates on Regions Financial - why the stock might be worth just $28.45!

Build Your Own Regions Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regions Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Regions Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regions Financial's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives