- United States

- /

- Banks

- /

- NYSE:PNC

How Investors May Respond To PNC (PNC) Earnings Beat and New Antitrust Lawsuit

Reviewed by Sasha Jovanovic

- In October 2025, PNC Financial Services Group announced strong third-quarter results, reporting net income of US$1.81 billion and lower net loan charge-offs, while also providing positive guidance for net interest income in the upcoming quarter.

- A multisided antitrust class action lawsuit was also filed against PNC and several major banks, alleging conspiracy to fix prime rates, potentially raising regulatory and legal considerations for the sector.

- We'll examine how PNC's strong earnings and improved credit performance affect its investment outlook amid new legal challenges.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PNC Financial Services Group Investment Narrative Recap

To be a PNC Financial Services Group shareholder, you need to believe in its ability to maintain positive operating leverage and deliver steady net interest income growth, even as broader capital market risks and economic uncertainties persist. Recent news around the antitrust class action lawsuit does not appear to materially affect the company’s most immediate catalyst, continued earnings growth, but could increase legal and regulatory risks for the sector in the medium term.

The antitrust lawsuit comes just days after PNC’s announcement of Q3 results showing net income of US$1.81 billion and a further decline in net loan charge-offs to US$179 million, supporting the narrative of improved credit performance. While legal actions capture headlines, the company’s core earnings results remain central to investor outlook, as this has reinforced confidence in near-term operating momentum.

By contrast, the potential for expanded legal scrutiny in banking is something investors should be aware of, especially as...

Read the full narrative on PNC Financial Services Group (it's free!)

PNC Financial Services Group's outlook anticipates $24.5 billion in revenue and $6.5 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 4.9% and a $0.7 billion increase in earnings from the current $5.8 billion.

Uncover how PNC Financial Services Group's forecasts yield a $221.74 fair value, a 22% upside to its current price.

Exploring Other Perspectives

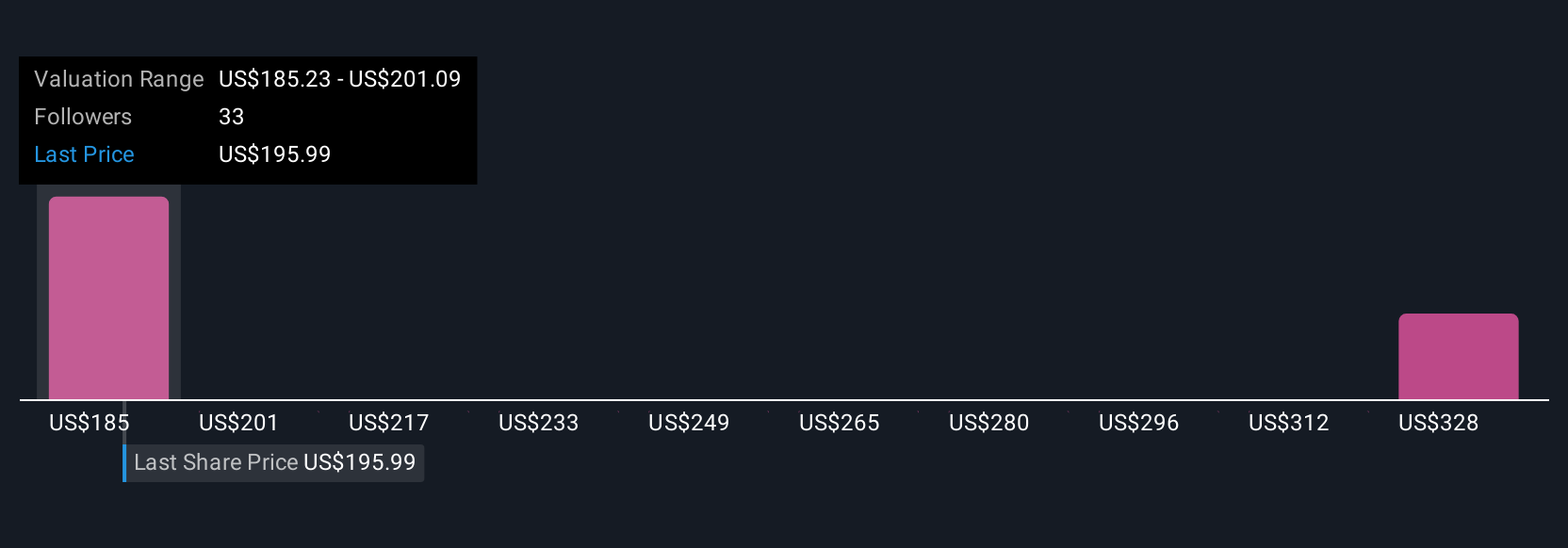

Four Simply Wall St Community members’ fair value estimates for PNC range from US$179.10 to US$311.22 per share. With legal risk in focus, this diversity shows how opinions on future performance can widely diverge, see how your view compares.

Explore 4 other fair value estimates on PNC Financial Services Group - why the stock might be worth as much as 71% more than the current price!

Build Your Own PNC Financial Services Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PNC Financial Services Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free PNC Financial Services Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PNC Financial Services Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNC

PNC Financial Services Group

Operates as a diversified financial services company in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives