- United States

- /

- Banks

- /

- NYSE:PFS

Provident Financial Services (PFS): Assessing Valuation After Surpassing Quarterly Expectations and Posting Record Revenues

Reviewed by Simply Wall St

The spotlight is on Provident Financial Services (PFS) after the company delivered quarterly results that came in ahead of expectations, featuring record revenues and a significant boost in net interest income. Management’s focus on both loan growth and keeping costs in check resulted in improved profit margins. This has caught the eye of investors seeking positive surprises in the banking sector. While an insider sale by a director recently made headlines, it is the strong underlying business performance that appears to be fueling the latest move in the stock.

This mix of upbeat financials and insider activity comes at a time when Provident Financial Services has already turned in a solid year. The stock climbed more than 13% over the past 12 months and regained momentum after a challenging stretch earlier this cycle. Notably, performance has accelerated in the past three months, with the share price up 22%. Recent additions to the management team signal a continued focus on long-term strategy, even as the company navigates industry headwinds and shifting economic conditions.

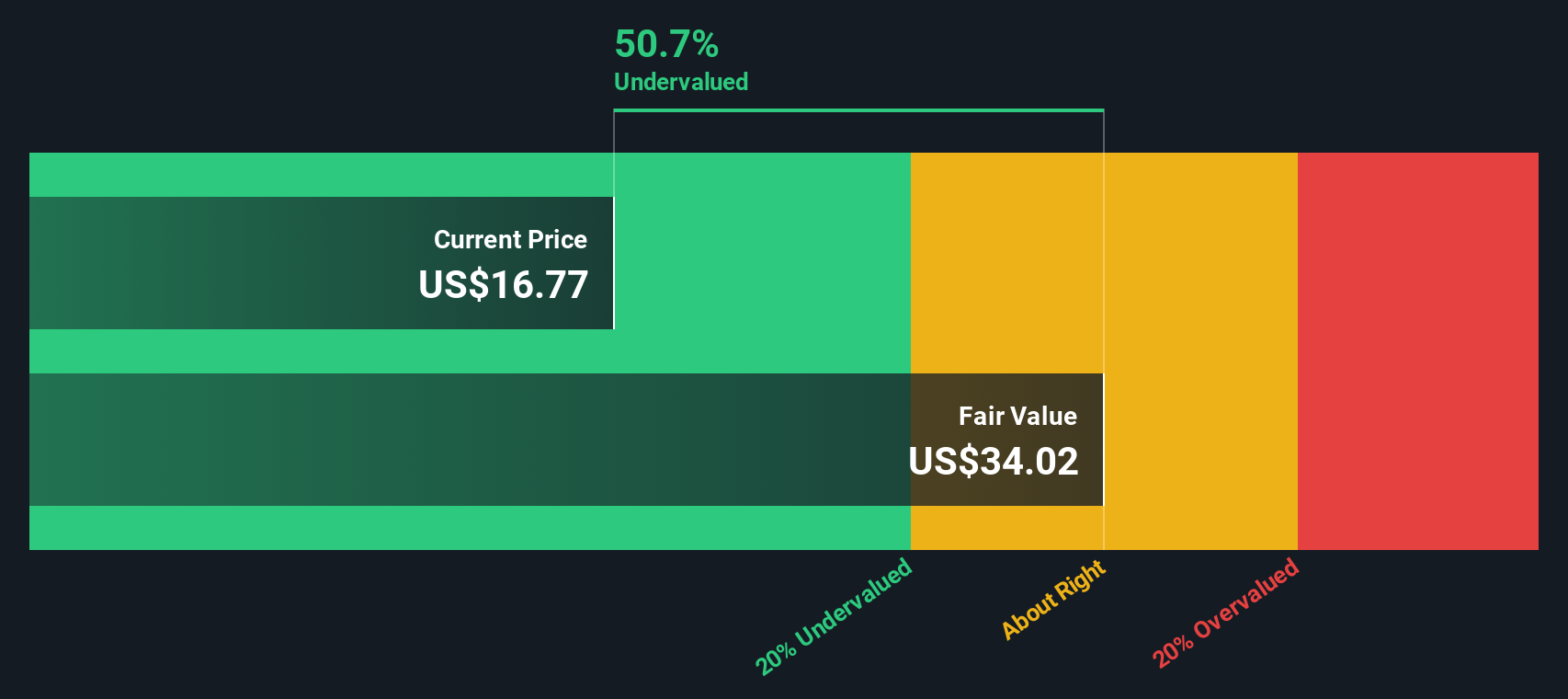

Now the key question for investors is whether Provident Financial Services is attractively valued given these results or if the market has already priced in future growth prospects.

Most Popular Narrative: 10% Undervalued

The most widely followed valuation narrative suggests Provident Financial Services is currently undervalued, projecting notable upside relative to its fair value estimate.

“Sustained commercial loan growth driven by both new originations and expansion into diverse, higher-margin verticals (e.g., healthcare lending, mortgage warehousing, SBA loans) positions Provident to benefit from the rising population and business formation in its core markets. This supports ongoing revenue expansion and improved earnings stability.”

How are analysts getting to that eye-catching target? The secret sauce involves aggressive growth assumptions and some surprising margin projections. Are you intrigued by how fee income, deposits, and digital banking investments all factor into the equation? Find out which financial levers matter most and why the narrative pegs the stock as a bargain.

Result: Fair Value of $22.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant competition for deposits and high regional concentration could create challenges for Provident Financial Services’s growth plans if economic conditions deteriorate.

Find out about the key risks to this Provident Financial Services narrative.Another View: Discounted Cash Flow Model

Looking at Provident Financial Services through the lens of our DCF model offers a different perspective and suggests the shares may be even more attractively valued than what analyst consensus implies. But does this approach reflect current risks, or does it miss something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Provident Financial Services Narrative

If you see things differently or enjoy charting your own findings, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Provident Financial Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself a head start by expanding your watchlist and checking out other top-notch companies making waves in fast-moving sectors today. Don’t miss out on opportunities your peers are already tracking.

- Grow your portfolio’s income with top picks offering impressive yields by tapping into dividend stocks with yields > 3%.

- Catalyze your investments with promising companies at the forefront of artificial intelligence advancements by heading to AI penny stocks now.

- Unlock hidden gems trading below their potential with tailored undervalued opportunities inside undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFS

Provident Financial Services

Operates as the bank holding company for Provident Bank that provides various banking products and services to individuals, families, and businesses in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives