- United States

- /

- Banks

- /

- NYSE:PB

Assessing Prosperity Bancshares (PB) Valuation Following Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

See our latest analysis for Prosperity Bancshares.

Prosperity Bancshares’ 1-year total shareholder return stands at -10.6%. Share price momentum has cooled off lately, despite today’s modest move higher. Recent declines reflect wider concerns for regional banks and also suggest shifting investor sentiment regarding the sector’s future risk and growth profile.

If recent moves in regional banks have you looking for fresh opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

But does Prosperity Bancshares’ current weakness mean the stock is undervalued compared to its growth prospects? Or has the market fully accounted for future risks and rewards, leaving limited room for upside from here?

Most Popular Narrative: 20.8% Undervalued

Prosperity Bancshares' widely followed valuation narrative sees clear upside, with its fair value estimate far above the most recent closing price of $63.17. This positions the stock as a notable outlier among regional banks facing sector confusion and raises questions about the underlying financial drivers supporting that optimism.

Expansion into high-growth Texas markets via the American Bank acquisition broadens Prosperity's footprint in rapidly growing regions such as San Antonio and Corpus Christi. This supports above-peer core loan and deposit growth while directly boosting revenue and net interest income over the coming years.

Want to know what makes this narrative stand out? The secret sauce is a bold, future-focused revenue and profit surge, supported by tight margins and expectations only top lenders achieve. What are the key assumptions that could shake up the earnings and valuation targets? See the numbers that fuel this compelling forecast.

Result: Fair Value of $79.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising nonperforming assets and ongoing declines in loans and deposits could quickly shift the optimism surrounding Prosperity Bancshares’ outlook.

Find out about the key risks to this Prosperity Bancshares narrative.

Another View: Market Ratios Tell a Different Story

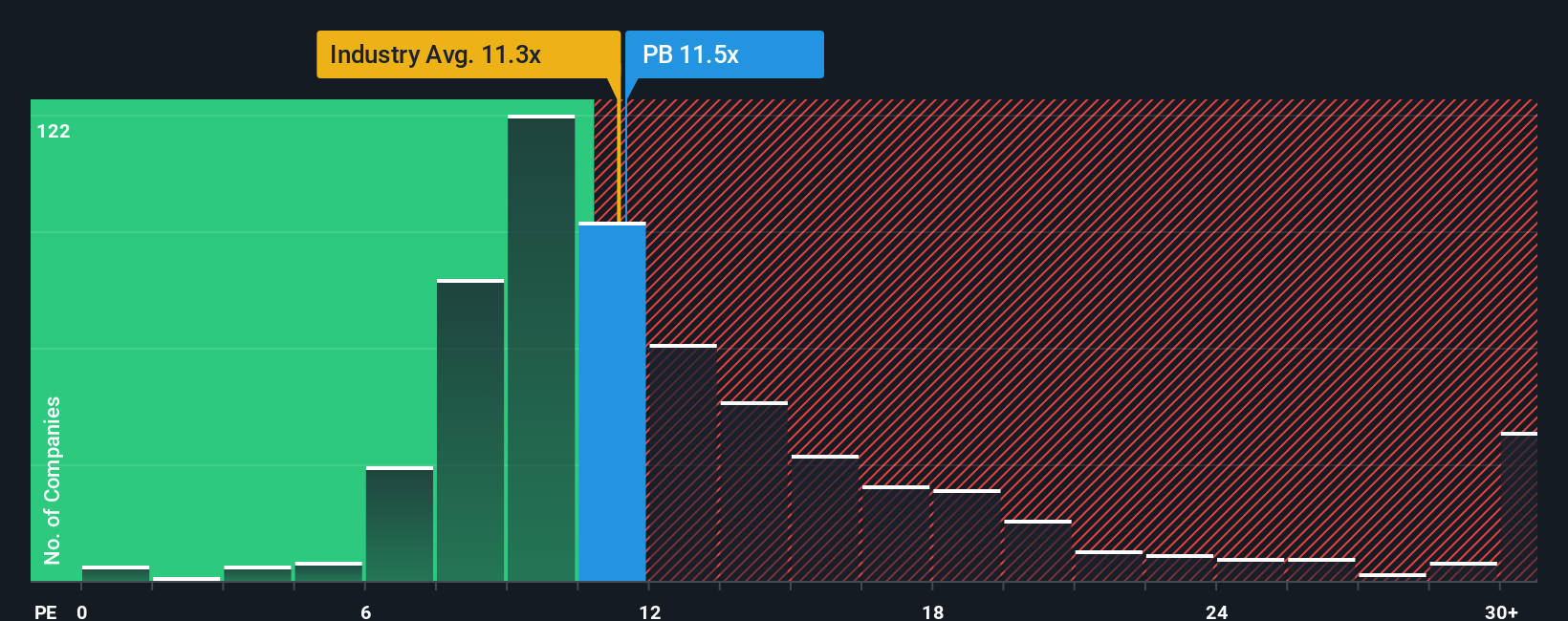

Looking through another lens, Prosperity Bancshares trades at 11.5x earnings, which is slightly above the US Banks industry average of 11.2x but below the peer average at 15.1x. Compared to its fair ratio of 13.3x, this suggests there is still some room for upside, yet not without valuation risks if industry sentiment slides. Is this margin enough to warrant confidence for value-seeking investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosperity Bancshares Narrative

If this perspective does not align with your views, or you want to dive into the figures yourself, you can craft your own analysis in just a few minutes: Do it your way

A great starting point for your Prosperity Bancshares research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Broaden your perspective and maximize your potential returns by taking action now. Unique opportunities could be just a click away, so do not let them pass you by.

- Uncover companies paying big yields by checking out these 18 dividend stocks with yields > 3% for income-focused investment options.

- Tap into the fast-growing world of digital assets with these 79 cryptocurrency and blockchain stocks and spot innovators reshaping finance and technology.

- Seize the edge with tomorrow’s technology. See which breakthrough businesses are leading AI-powered healthcare shifts via these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PB

Prosperity Bancshares

Operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives