- United States

- /

- Banks

- /

- NYSE:OFG

Should Rising Regional Bank Credit Risk Concerns Prompt Action From OFG Bancorp (OFG) Investors?

Reviewed by Sasha Jovanovic

- Earlier in October 2025, investor concerns over the regional banking sector intensified after Zions Bancorp disclosed a US$50 million charge-off on a single loan and Western Alliance Bancorp highlighted issues regarding missing collateral from a borrower.

- These incidents have added urgency to discussions about the stability and credit quality of regional lenders, prompting increased scrutiny of risk management practices across the industry.

- We'll explore how these heightened credit risk concerns in the regional banking sector may alter OFG Bancorp's underlying investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

OFG Bancorp Investment Narrative Recap

To be a shareholder in OFG Bancorp, you need confidence in the resilience of Puerto Rico’s economy, robust digital adoption, and disciplined risk management as key drivers of future earnings. While the recent charge-off headlines from peers have triggered sector-wide scrutiny, the most immediate catalyst for OFG remains its upcoming Q3 earnings release, and there is no indication that the peer events have materially impacted its short-term earnings outlook. However, the biggest near-term risk remains any deterioration in local credit quality.

A relevant development is OFG’s recent report of Q2 2025 net charge-offs at US$12.8 million, a decrease from both the previous quarter and last year. This trend suggests some credit stability ahead of the earnings report and stands out in light of the fresh concerns affecting other regional lenders, but investors watching for signs of broader contagion may still want to focus on upcoming asset quality disclosures.

By contrast, even as current data appears stable, investors should still be mindful of…

Read the full narrative on OFG Bancorp (it's free!)

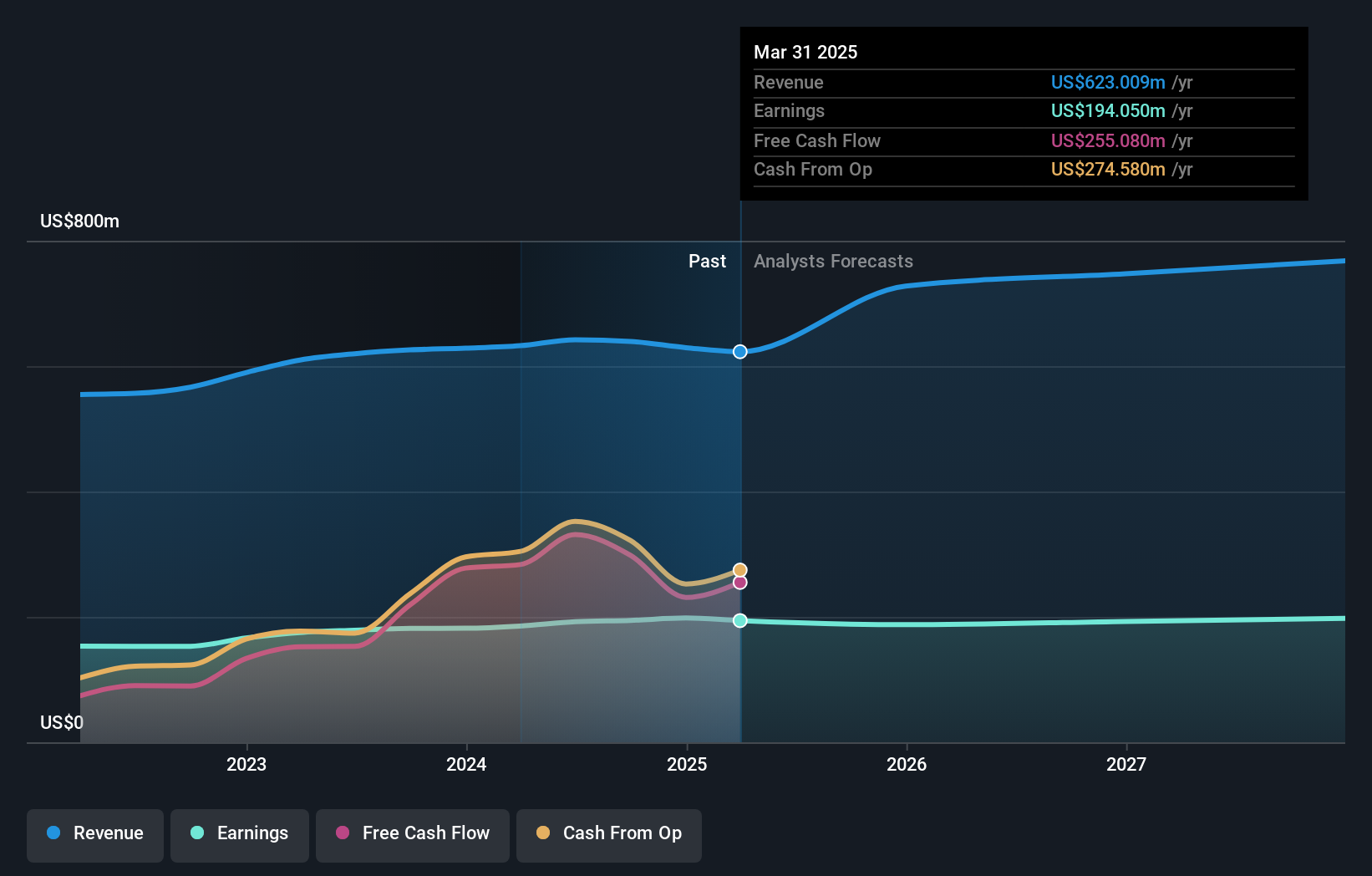

OFG Bancorp's narrative projects $828.3 million revenue and $204.3 million earnings by 2028. This requires 10.2% yearly revenue growth and a $9.6 million earnings increase from $194.7 million today.

Uncover how OFG Bancorp's forecasts yield a $50.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put OFG’s fair value estimates between US$26.70 and US$50, covering a wide spectrum with only two perspectives represented. This diversity comes as analysts highlight competition and credit quality as crucial factors influencing performance, so it’s useful to consider several viewpoints before making decisions.

Explore 2 other fair value estimates on OFG Bancorp - why the stock might be worth as much as 21% more than the current price!

Build Your Own OFG Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OFG Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OFG Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OFG Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives