- United States

- /

- Banks

- /

- NYSE:OFG

OFG Bancorp (OFG) Profit Margin Rises to 31.4%, Underscoring Ongoing Earnings Quality Debate

Reviewed by Simply Wall St

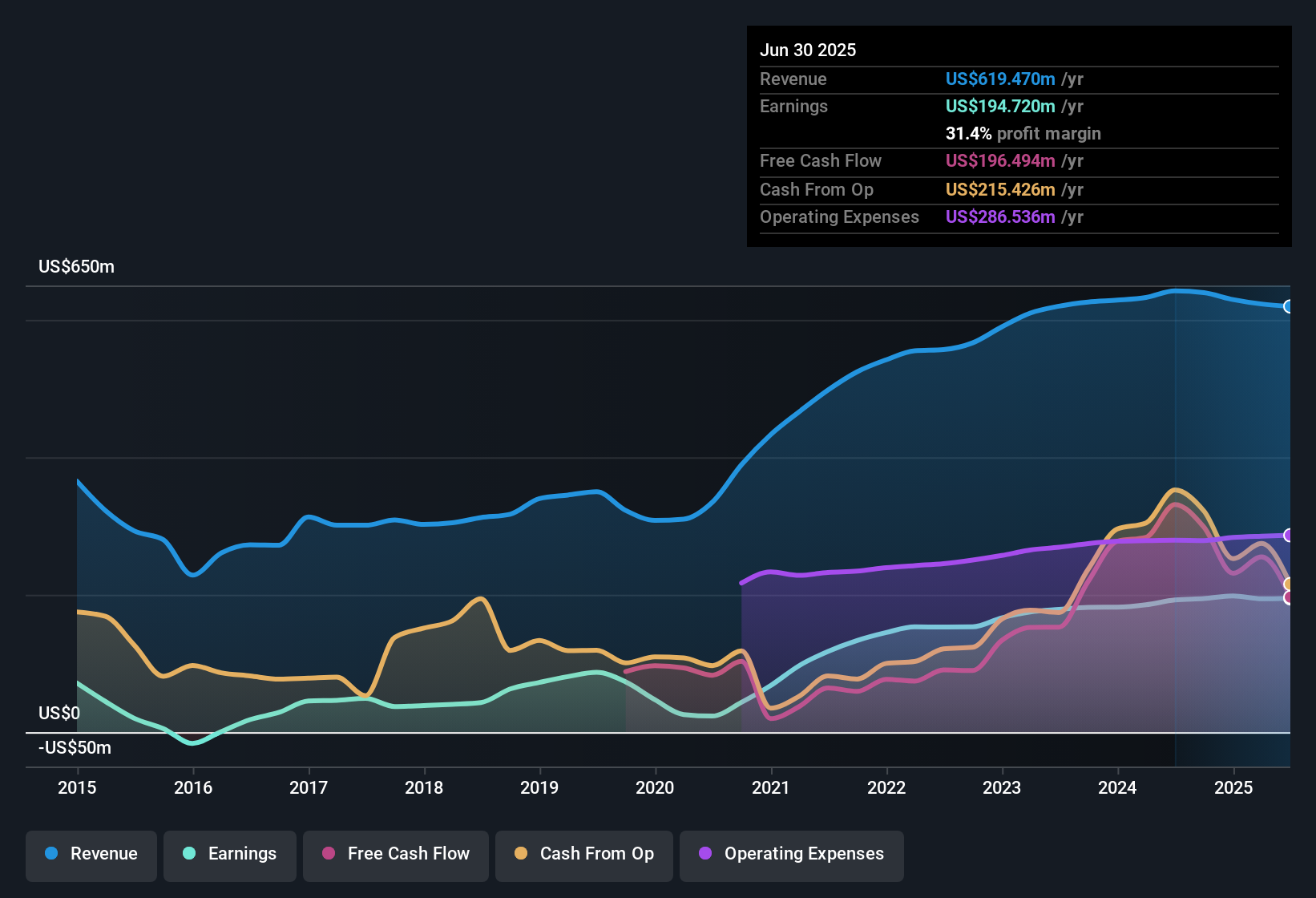

OFG Bancorp (OFG) delivered a net profit margin of 31.4%, up from 29.9% a year ago, marking a clear improvement in overall profitability. Over the past five years, earnings have grown by 17.4% per year, but this year’s EPS growth slowed to just 1.3%. Looking ahead, the company is expected to see modest gains, with revenue and earnings forecast to grow at 2.5% and 0.2% per year respectively, which is well below broader US market averages.

See our full analysis for OFG Bancorp.Next up, we will see how these results compare to the major narratives being discussed. Some storylines might get a boost, while others could be put to the test.

See what the community is saying about OFG Bancorp

Digital Banking Drives Operational Efficiency

- Analysts project OFG Bancorp's revenue to rise by 10.2% annually over the next three years, much faster than the 2.5% yearly growth rate in the latest company outlook.

- According to analysts' consensus view, ongoing digital banking expansion and process streamlining are expected to deliver double benefits:

- Operational efficiency gains should help reduce future expense growth and support higher net margins. This complements the impact of broadening digital services for customers.

- Robust loan and core deposit growth, supported by digital channels and a proactive balance sheet strategy, is seen as key to maintaining stable funding and supporting resilient earnings in the face of changing market dynamics.

- The consensus narrative notes that these efficiency improvements, together with a strengthening digital presence, position the bank for gradual but sustainable margin improvement, even as the industry contends with rising costs and heightened competition.

- Consensus narrative: For a full breakdown of how digital banking is shaping OFG's future earnings profile, check the detailed consensus take.

📊 Read the full OFG Bancorp Consensus Narrative.

Profit Margins Set to Compress

- While the profit margin stands at 31.4% today, analysts anticipate this to contract to 24.7% within three years even as revenue grows, highlighting a shift in profitability dynamics.

- Analysts' consensus view flags that supporting ongoing investments in digital transformation and absorbing rising competition will likely mean expenses eat into margins:

- Anticipated efficiency gains may take time to fully offset expense pressures from technology spending and regulatory compliance.

- Increasing deposit and lending competition is already causing pricing pressures and could slow growth in net interest income faster than previously experienced.

Discounted Valuation vs. Peers and DCF Fair Value

- OFG trades at a price-to-earnings ratio of 9.1x, below both the US Banks industry average of 11.2x and its own peer average of 17.3x, with shares at $39.60, well under the $105.60 DCF fair value and the $50.25 consensus analyst price target.

- On the analysts' consensus view, this discounted valuation looks attractive relative to industry benchmarks:

- Valuation multiples suggest the market is not yet pricing in potential upside from OFG's forecasted revenue growth and earnings resilience.

- Current price levels below DCF and target benchmarks create a cushion, but this is dependent on whether margin pressures are managed as expected in the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for OFG Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the latest results? Take a moment to shape and share your own view. Add your narrative in just minutes. Do it your way

A great starting point for your OFG Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

OFG Bancorp faces looming profit margin compression and muted earnings growth as rising expenses and heightened competition threaten its performance outlook.

If steady results matter to you, check out stable growth stocks screener (2094 results) to find companies that consistently deliver reliable earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives