- United States

- /

- Banks

- /

- NYSE:OFG

How Slowing Net Interest Income Growth and Margin Pressure Will Impact OFG Bancorp (OFG) Investors

Reviewed by Sasha Jovanovic

- Recent commentary on OFG Bancorp highlights that over the past five years its net interest income grew at a 9.2% annualized pace, but analysts now expect only a 1.4% increase over the next 12 months as its net interest margin has contracted by 69.7 basis points in two years.

- This slowdown in net interest income growth and margin compression raises fresh questions about how much earnings support OFG Bancorp’s balance sheet can provide.

- We’ll now examine how this slowing net interest income growth and margin pressure may affect OFG Bancorp’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

OFG Bancorp Investment Narrative Recap

To own OFG Bancorp, you need to believe its Puerto Rico focused franchise, digital push and lending growth can offset near term margin pressure. The latest data on slowing net interest income growth and a 69.7 basis point margin contraction directly challenges the idea that earnings can keep cushioning these pressures, making margin stabilization the key short term catalyst and intensifying the risk from rising funding costs and competition.

The recent pattern of dividend increases, including the board’s 20% hike to a US$0.30 quarterly payout in early 2025 and subsequent affirmations, is particularly relevant here because it signals management’s confidence in ongoing earnings support, even as analysts now forecast only 1.4% net interest income growth over the next year, keeping investors focused on whether profitability can sustain both the dividend and further balance sheet resilience.

But investors also need to be aware that rising competition for loans and deposits could further pressure OFG’s net interest margin and...

Read the full narrative on OFG Bancorp (it's free!)

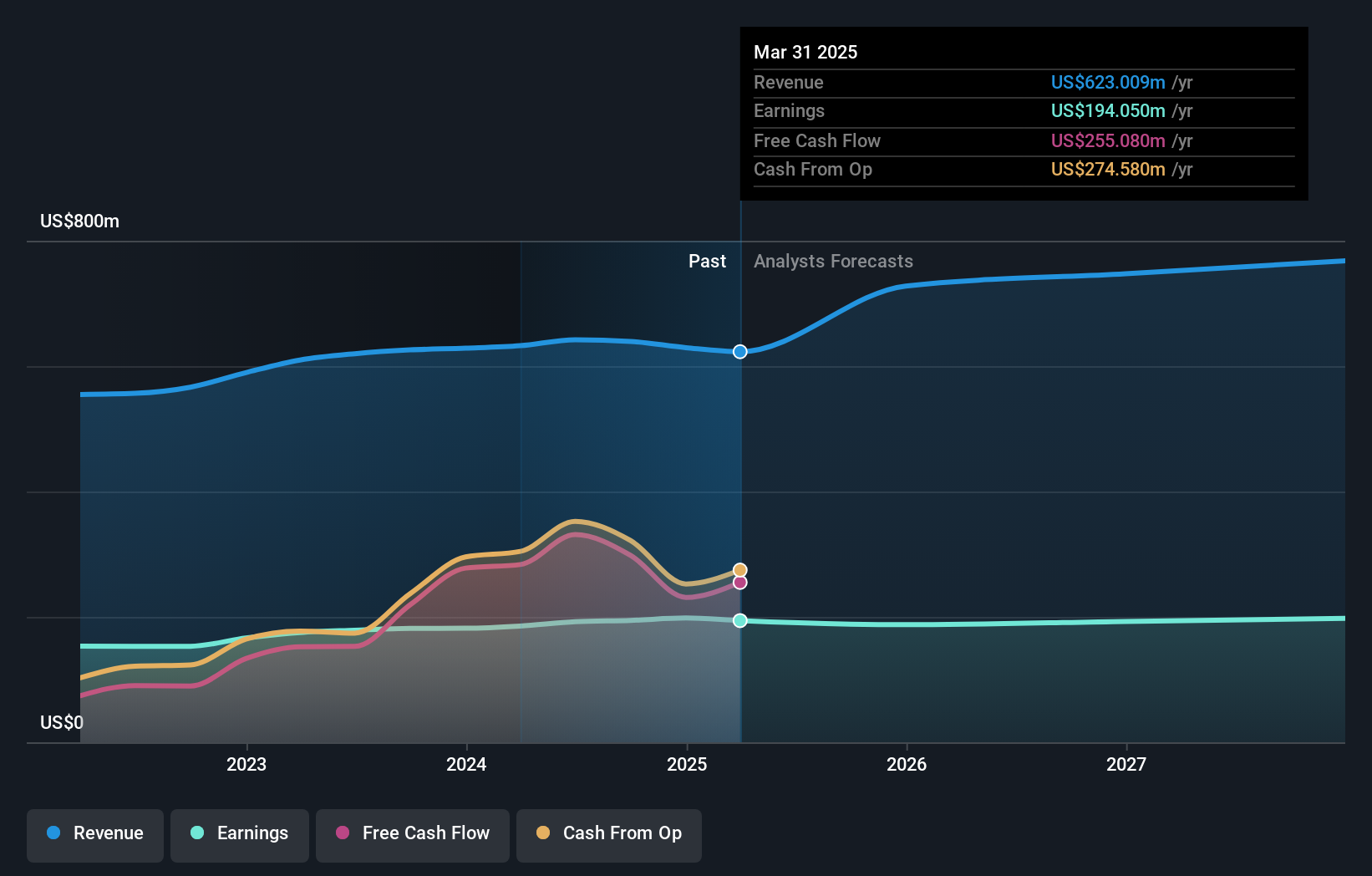

OFG Bancorp's narrative projects $828.3 million revenue and $204.3 million earnings by 2028. This requires 10.2% yearly revenue growth and about a $9.6 million earnings increase from $194.7 million today.

Uncover how OFG Bancorp's forecasts yield a $50.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community currently pegs OFG Bancorp’s fair value at US$50, highlighting how individual views can diverge from analyst models. You can weigh that against the recent slowdown in net interest income growth and margin compression, which raises broader questions about the bank’s ability to support earnings if funding costs or competition intensify further.

Explore another fair value estimate on OFG Bancorp - why the stock might be worth just $50.00!

Build Your Own OFG Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OFG Bancorp research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free OFG Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OFG Bancorp's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OFG

OFG Bancorp

A financial holding company, provides a range of banking and financial services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026