- United States

- /

- Banks

- /

- NYSE:NU

What Nu Holdings (NU)'s U.S. Bank Charter Application Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, Nu Holdings applied for a U.S. national bank charter, marking its first significant move beyond Latin America and appointing co-founder Cristina Junqueira to lead the U.S. operations.

- This expansion effort comes as the company continues to rapidly grow its customer base in Latin America, paired with increasing institutional investor support and strong performance in credit products despite macroeconomic challenges.

- We will explore how Nu Holdings’ entry into the U.S. banking market could influence the company’s long-term growth narrative and outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nu Holdings Investment Narrative Recap

Being a Nu Holdings shareholder means believing in the company's ability to sustain customer growth, monetize digital banking innovation, and diversify beyond Latin America, primarily by scaling operations efficiently. The new U.S. bank charter application is a meaningful long-term lever but does not alter the immediate catalyst, which remains ongoing user and product expansion in core Latin American markets. The main risk still centers on credit exposure to subprime segments in Brazil and Mexico, especially if economic conditions worsen.

Among recent announcements, Nu’s Q2 2025 earnings showed net interest income of US$2,098.75 million and net income of US$636.84 million, with basic EPS increasing year-over-year. This highlights the company’s operational and financial momentum heading into new markets, reinforcing the short-term importance of credit quality and growth execution.

Yet, in contrast to the optimism around expansion, exposure to mass-market credit segments brings risk that investors should be aware of if...

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' narrative projects $33.0 billion in revenue and $6.1 billion in earnings by 2028. This requires a 78.1% yearly revenue growth and a $3.8 billion increase in earnings from $2.3 billion today.

Uncover how Nu Holdings' forecasts yield a $17.29 fair value, a 9% upside to its current price.

Exploring Other Perspectives

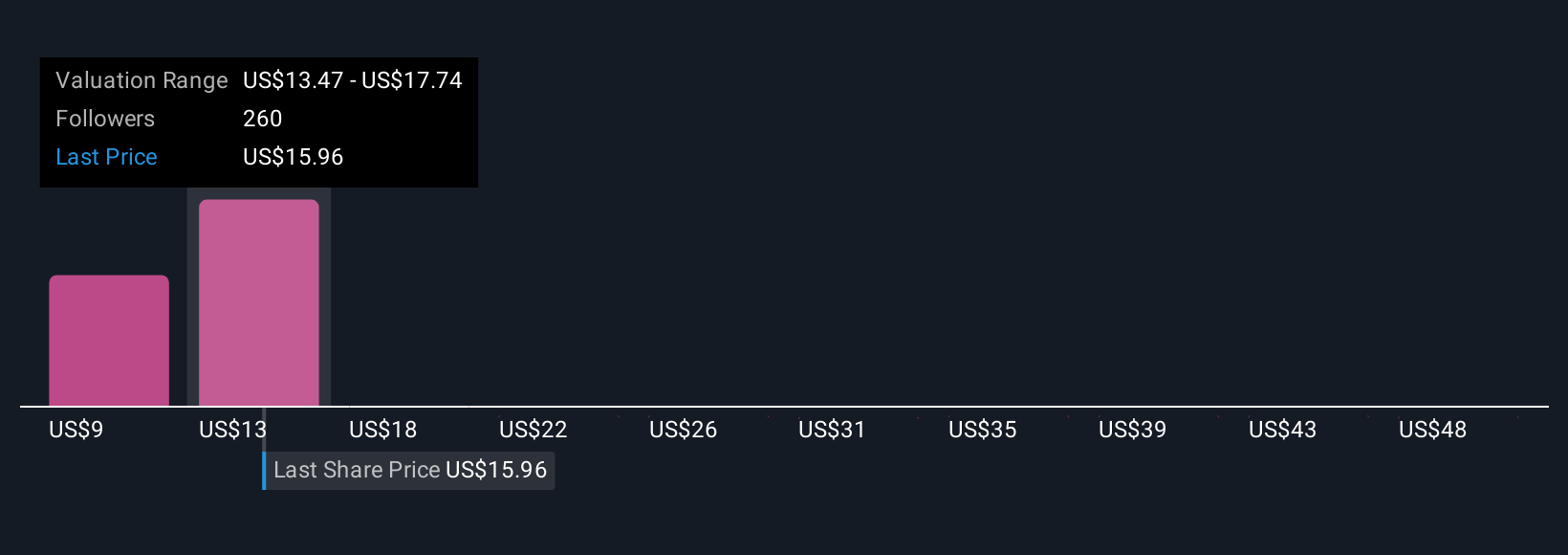

With 44 individual estimates from the Simply Wall St Community, fair values for Nu Holdings range widely from US$9.45 to US$59.35 per share. While this expansion fuels diverse opinions, the ongoing risk of rising default rates in subprime lending could shift future outcomes, see how other investors are viewing Nu’s path.

Explore 44 other fair value estimates on Nu Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives