- United States

- /

- Banks

- /

- NYSE:NU

Strong Q3 Results and US Bank Charter Application Might Change the Case for Investing in Nu Holdings (NU)

Reviewed by Sasha Jovanovic

- Nu Holdings Ltd. recently reported its third-quarter 2025 results, posting net income of US$782.47 million and diluted earnings per share of US$0.1595, both increasing versus the same period a year earlier.

- An interesting highlight was the company’s application for a U.S. national bank charter, reflecting a potential shift toward broader international expansion and diversification.

- We'll explore how the strong net income growth in the latest quarter shapes Nu Holdings' overall investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nu Holdings Investment Narrative Recap

To own shares in Nu Holdings, I would need to be confident in its ability to capitalize on the rapid adoption of digital banking across Latin America, continuing to grow its customer base and expand into new markets. This quarter’s strong net income and EPS growth are positive, but the main catalyst, sustained revenue and earnings momentum from cross-market expansion, remains balanced by the risk of rising non-performing loan ratios, which did not materially improve with this latest report.

Among recent company announcements, Nu Holdings’ application for a U.S. national bank charter stands out as highly relevant. This move signals a commitment to international expansion and regulatory sophistication, both directly connected to the catalysts of geographic diversification and enhanced compliance, but also linked to the risk of operational complexity as the business grows across multiple jurisdictions.

However, in contrast to the headline earnings figures, investors should also be aware that growing credit risk exposure in less mature loan segments means...

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' outlook anticipates $33.0 billion in revenue and $6.1 billion in earnings by 2028. This scenario requires annual revenue growth of 78.1% and an earnings increase of $3.8 billion from current earnings of $2.3 billion.

Uncover how Nu Holdings' forecasts yield a $17.46 fair value, a 12% upside to its current price.

Exploring Other Perspectives

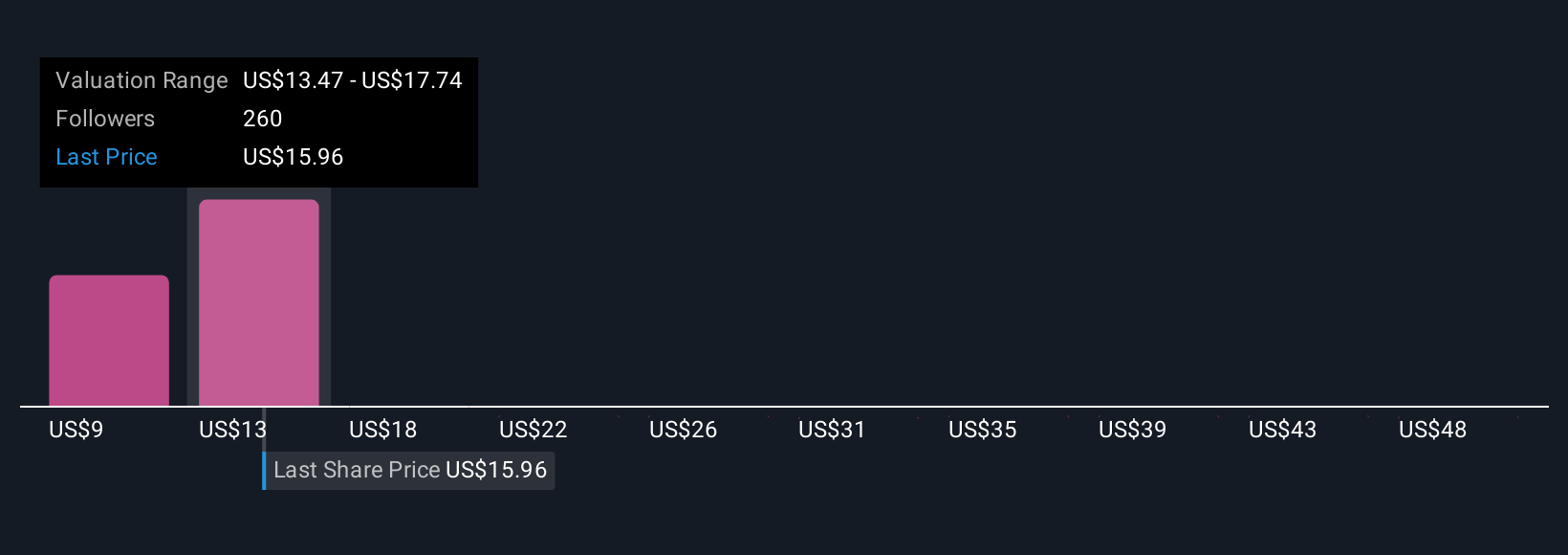

Community fair value estimates for Nu Holdings range from US$9.40 to US$26.26, based on 31 private investor perspectives from the Simply Wall St Community. This breadth of opinions stands against asset quality concerns raised in recent months, reminding you that views on risks and upside can vary widely, so consider several angles before making up your mind.

Explore 31 other fair value estimates on Nu Holdings - why the stock might be worth as much as 68% more than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives