- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU): Evaluating Valuation After Strong Earnings, Customer Growth, and Expansion Moves

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) just delivered a strong earnings report, growing net income and reaching 127 million customers. This performance is being fueled by expanding services, partnerships, and the company’s ongoing push into new markets.

See our latest analysis for Nu Holdings.

Nu Holdings’ ambitious expansion is getting real attention from investors, and it’s showing up in the numbers. The company’s share price has climbed nearly 49.5% year-to-date, reflecting building momentum and fresh optimism after its latest results. With a three-year total shareholder return of over 276%, Nu’s growth story stands out even among global fintech leaders.

If Nu’s big moves have you curious about what else is catching investor interest, now’s a great time to explore fast growing stocks with high insider ownership

With shares already surging on blockbuster growth and new partnerships, investors must now ask whether Nu Holdings’ future is fully reflected in today’s price or if a genuine buying opportunity still exists.

Most Popular Narrative: 11.6% Undervalued

Nu Holdings’ last close at $15.89 sits below the most widely followed fair value estimate. Bullish forecasts are anchoring the debate on future upside. This gap signals that expectations are building around what Nu can achieve as it accelerates its product range and expands internationally.

The rapid growth of Latin America's digitally native population, combined with expanding smartphone and internet adoption, is creating a sustained surge in demand for Nu's app-based financial services. This fuels long-term customer acquisition, higher engagement, and drives topline revenue growth. The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness. This supports robust net margin expansion as digital penetration deepens.

Want to know the secret behind this price gap? Analysts are betting on a rapid pace of growth and a notably high profit multiple. What’s powering this confidence? Click through to discover which bold financial projections set this story apart.

Result: Fair Value of $17.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growth could stall if competition intensifies or if Nu faces rising credit losses from riskier lending and slower economic conditions.

Find out about the key risks to this Nu Holdings narrative.

Another View: Multiple-Based Valuation Tells a Different Story

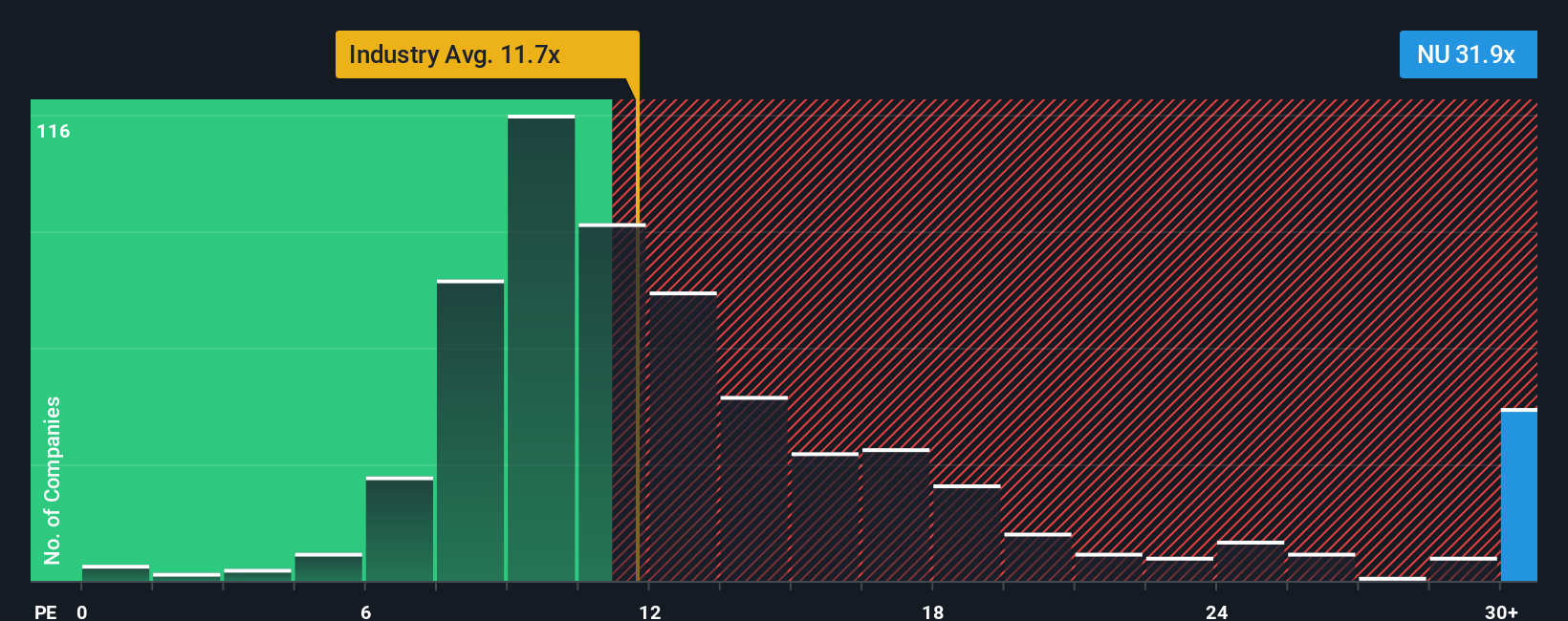

While fair value estimates suggest Nu Holdings is undervalued, its price-to-earnings ratio stands at 30.4x, much higher than both the US Banks industry average of 11.2x and the calculated fair ratio of 20.1x. Such a premium signals that a lot of future growth is already priced in, which could create extra risk if targets are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to build your own perspective on Nu Holdings. Do it your way

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why stop with Nu when you can access tailored lists of ambitious companies? Stay ahead by choosing what suits your style and never miss a market-beating idea.

- Boost your search for untapped growth with these 3597 penny stocks with strong financials, featuring companies building momentum before they hit the mainstream.

- Spark your portfolio with innovation by exploring these 26 AI penny stocks, where game-changing tech pioneers are redefining entire industries.

- Secure solid returns by checking out these 15 dividend stocks with yields > 3%, which delivers reliable income streams and resilient fundamentals for the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success