- United States

- /

- Banks

- /

- NYSE:NU

Evaluating Nu Holdings (NYSE:NU): Is Strong Growth Still Undervalued?

Reviewed by Simply Wall St

See our latest analysis for Nu Holdings.

After a notable 48.8% year-to-date share price return, Nu Holdings’ momentum has clearly caught investors’ attention, especially with its strong 18.7% gain over the past three months. Looking at a longer timeframe, the company’s 3-year total shareholder return stands at an impressive 266%. This suggests that enthusiasm for the digital banking story has held up over time as recent gains accelerate.

If the excitement around Nu’s ongoing growth has you thinking bigger, now is a perfect chance to broaden your investing horizons and discover fast growing stocks with high insider ownership

With such rapid growth and strong recent returns, the big question for investors is whether Nu Holdings’ current share price still offers value, or if the market is already factoring in all of its future potential.

Most Popular Narrative: 9.4% Undervalued

Nu Holdings’ last close of $15.82 sits below the narrative fair value of $17.46, revealing a gap driven by bold forward expectations. The crowd’s view emerges from ambitious growth projections and strong margin optimism that go beyond recent performance.

The ongoing transition from cash to digital payments and online banking in historically underserved markets continues to accelerate Nu's transaction volumes and increases opportunities for cross-sell and ecosystem stickiness. This trend supports robust net margin expansion as digital penetration deepens.

Want to unravel what powers this “undervalued” tag? It all comes down to sky-high growth rates and profit forecasts few banks dare to model. The real kicker is that the market must believe these operational leaps are just getting started. Dive in to discover which leap-of-faith assumptions underpin this valuation.

Result: Fair Value of $17.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from traditional banks and fintechs, along with increased credit exposure in newer markets, could challenge Nu Holdings’ sustained growth trajectory.

Find out about the key risks to this Nu Holdings narrative.

Another View: Reconsidering Valuation Through Earnings Ratios

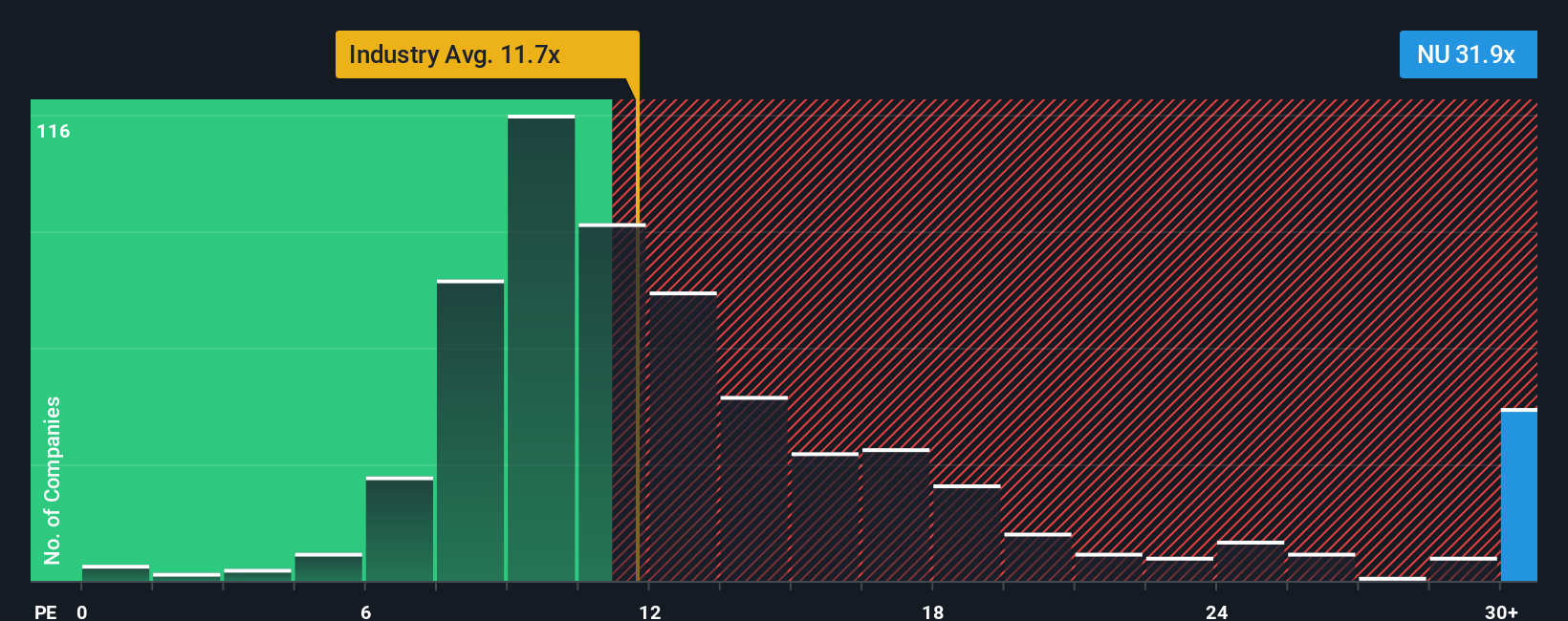

Taking a closer look at Nu Holdings using earnings multiples, the current price points to a possible overvaluation risk. Trading at around 30.3 times earnings, Nu stands much higher than the industry average of 11.2 times and even above the fair ratio of 21.5 times. This suggests the market is already expecting a lot of future growth. Such an outlook could leave little room for disappointment. If expectations fall short, could today’s price be setting investors up for a reality check?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nu Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly shape your own take on Nu’s story in under three minutes. So why not Do it your way

A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investing Move?

Go beyond Nu Holdings and give yourself an edge by tapping into other big opportunities on Simply Wall Street. The next winner could be just a click away.

- Capitalize on cutting-edge tech by checking out these 25 AI penny stocks, which have the potential to reshape tomorrow's industries and fuel the next wave of growth.

- Put your money to work in companies offering steady cash flow and income through these 16 dividend stocks with yields > 3%, ideal for those seeking reliability alongside capital appreciation.

- Catch early-stage momentum with these 3585 penny stocks with strong financials, where outsized returns and innovation may be available if you act quickly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives