- United States

- /

- Banks

- /

- NYSE:NIC

Do Insider Sales and Recent Dividend Reveal Nicolet Bankshares' (NIC) True Strategy Amid Sector Rally?

Reviewed by Sasha Jovanovic

- Nicolet Bankshares is set to announce its third-quarter 2025 earnings on October 21, following its recent quarterly dividend payout and notable insider sales by a director and an executive vice president earlier this year.

- The company was further highlighted as part of a broader rally among regional banks after several large banks exceeded quarterly expectations and the Federal Reserve suggested a possible shift in monetary policy.

- We'll look at how improved sector sentiment, driven by strong big bank earnings and potential Fed policy changes, informs Nicolet Bankshares' investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nicolet Bankshares' Investment Narrative?

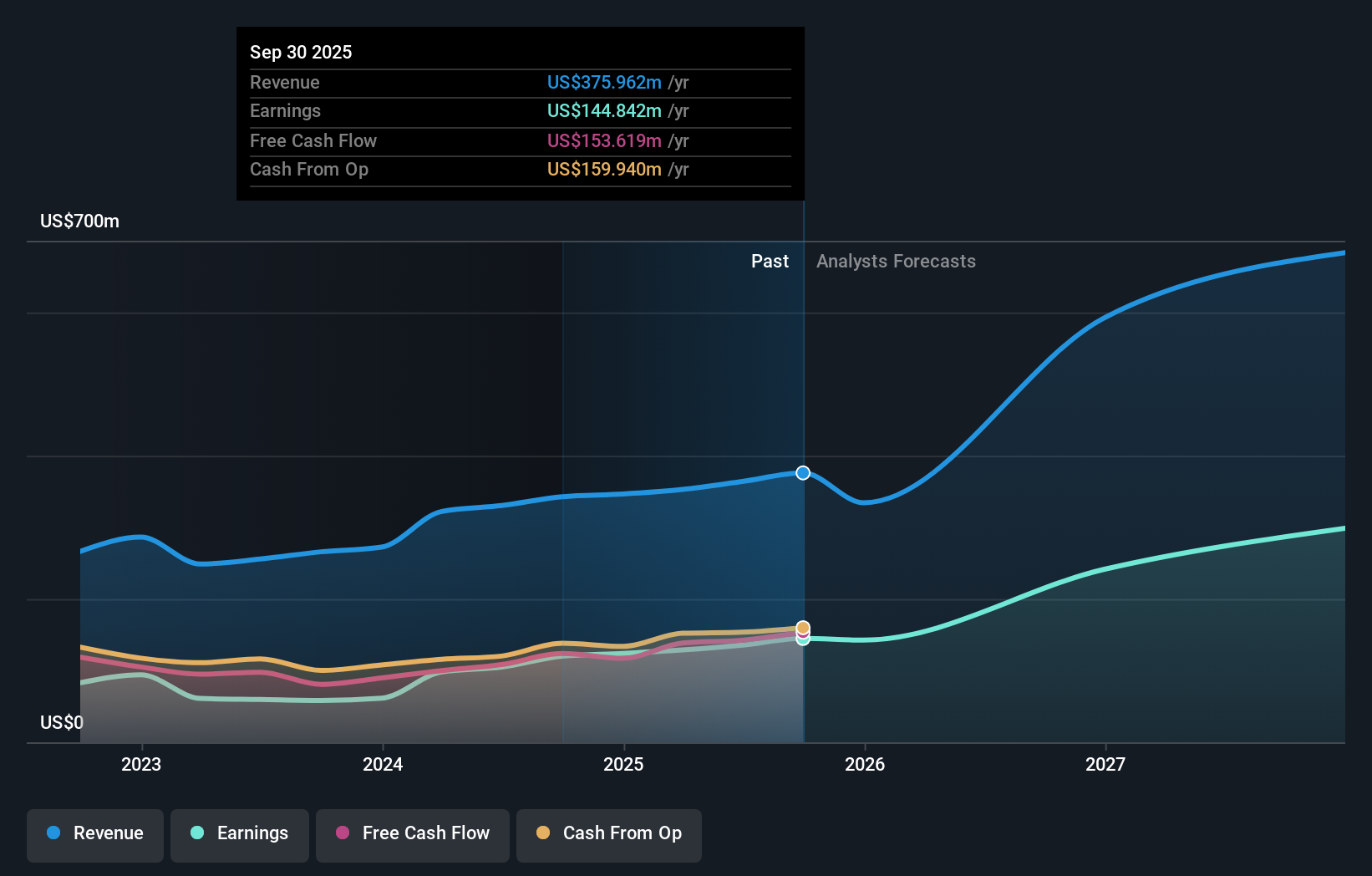

For an investor to feel comfortable as a Nicolet Bankshares shareholder, the big picture case often rests on disciplined management, consistent shareholder returns through dividends and buybacks, and the potential for sector recovery. The recent rally among regional banks, sparked by strong big bank earnings and indications of easier monetary policy from the Fed, has given the stock a lift, but it’s not immediately clear this news alters the longer-term risks or the main near-term catalysts for Nicolet. The company continues to face sector-wide challenges of declining revenue forecasts and relatively high valuation multiples versus peers, despite its strong recent profit growth. Insider selling by leadership earlier this year adds a layer of caution, but the key catalysts, such as the upcoming earnings report and any further updates on capital returns, still look most relevant for share price direction. The latest news supports improved sentiment, yet doesn’t fully resolve questions about future revenue pressure or whether recent positive momentum can persist after the near-term excitement fades. On the other hand, the insider sales earlier this year raise concerns that shouldn’t be ignored.

Despite retreating, Nicolet Bankshares' shares might still be trading 40% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Nicolet Bankshares - why the stock might be worth as much as 68% more than the current price!

Build Your Own Nicolet Bankshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nicolet Bankshares research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nicolet Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nicolet Bankshares' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nicolet Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIC

Nicolet Bankshares

Operates as the bank holding company for Nicolet National Bank that provides banking products and services for businesses and individuals in Wisconsin, Michigan, and Minnesota.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives