- United States

- /

- Banks

- /

- NYSE:LOB

How Declining Net Income Amid Rising Interest Income at Live Oak Bancshares (LOB) Has Changed Its Investment Story

Reviewed by Simply Wall St

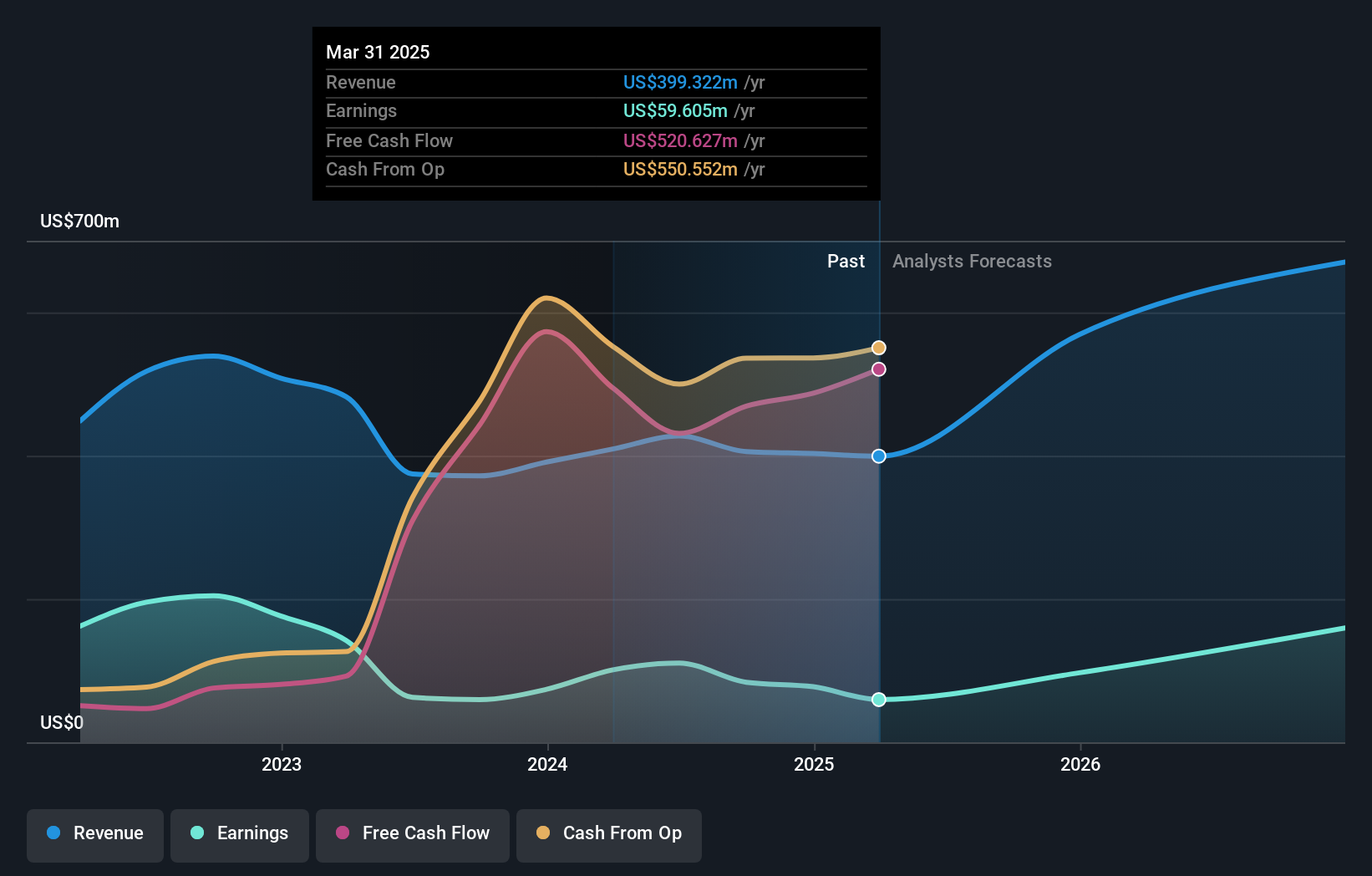

- Live Oak Bancshares recently announced its second quarter and first half 2025 results, reporting net interest income of US$109.22 million for the quarter and US$209.75 million for the half year, both up from the prior year, while net income and earnings per share declined during both periods.

- This mixed performance highlights that although the core banking business continues expanding, higher expenses or provision charges may be limiting gains in overall profitability.

- We'll now examine how the company’s net income drop amid rising net interest income reshapes Live Oak Bancshares' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Live Oak Bancshares Investment Narrative Recap

For investors considering Live Oak Bancshares, the core belief is in the bank’s ability to deliver consistent loan and deposit growth through strong SBA and technology-driven small business lending, while managing credit risks and profitability. The latest earnings update, showing net interest income rising but net income and EPS declining, suggests that near-term profitability remains exposed to elevated provision expenses, yet the news does not materially shift the main catalyst, continued lending and revenue expansion, or the biggest risk, which is credit loss volatility driven by current charge-off levels.

A relevant recent development is the Q1 2025 charge-offs report, which revealed net charge-offs of US$6.77 million, up sharply from a year ago. This uptick in credit losses provides crucial context to the Q2 earnings, highlighting how provision expenses and credit quality trends are impacting profit margins despite strong net interest income. In contrast to growing revenue, investors should be aware...

Read the full narrative on Live Oak Bancshares (it's free!)

Live Oak Bancshares’ narrative projects $970.1 million revenue and $272.6 million earnings by 2028. This requires 34.4% yearly revenue growth and a $213 million earnings increase from $59.6 million today.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Live Oak Bancshares between US$27.42 and US$69.40, reflecting wide differences in outlooks. While charge-offs and provision expenses impact short-term profitability, your view on sustainable earnings growth could shape your own assessment.

Build Your Own Live Oak Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Live Oak Bancshares research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Live Oak Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Live Oak Bancshares' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives