KeyCorp (NYSE:KEY) is about to trade ex-dividend in the next four days. You will need to purchase shares before the 30th of November to receive the dividend, which will be paid on the 15th of December.

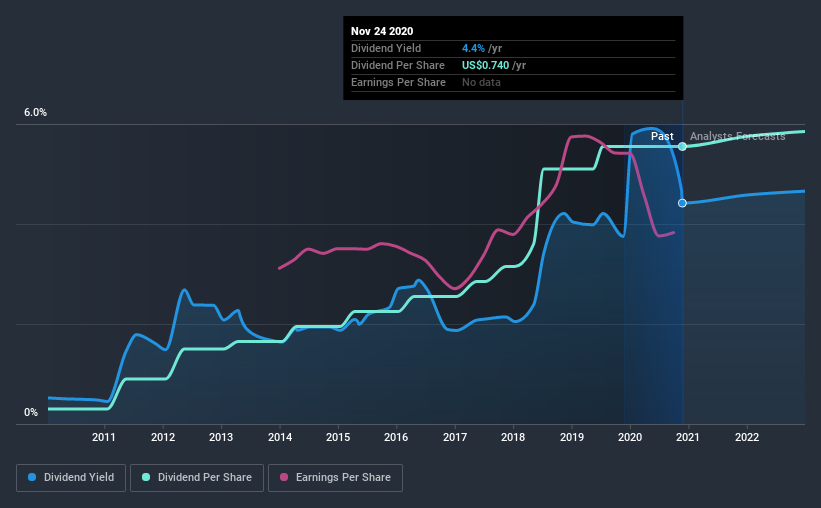

KeyCorp's next dividend payment will be US$0.18 per share, on the back of last year when the company paid a total of US$0.74 to shareholders. Based on the last year's worth of payments, KeyCorp stock has a trailing yield of around 4.4% on the current share price of $16.75. If you buy this business for its dividend, you should have an idea of whether KeyCorp's dividend is reliable and sustainable. So we need to investigate whether KeyCorp can afford its dividend, and if the dividend could grow.

See our latest analysis for KeyCorp

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. KeyCorp paid out 64% of its earnings to investors last year, a normal payout level for most businesses.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. It's not encouraging to see that KeyCorp's earnings are effectively flat over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. KeyCorp has delivered 34% dividend growth per year on average over the past 10 years.

Final Takeaway

Is KeyCorp worth buying for its dividend? KeyCorp has been struggling to generate growth while also paying out more than half of its earnings to shareholders as dividends. It doesn't appear an outstanding opportunity, but could be worth a closer look.

With that being said, if dividends aren't your biggest concern with KeyCorp, you should know about the other risks facing this business. For example - KeyCorp has 2 warning signs we think you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade KeyCorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026