- United States

- /

- Banks

- /

- NYSE:KEY

KeyCorp (KEY) Secures Naming Rights for New Event Center at Pro Football Hall of Fame

Reviewed by Simply Wall St

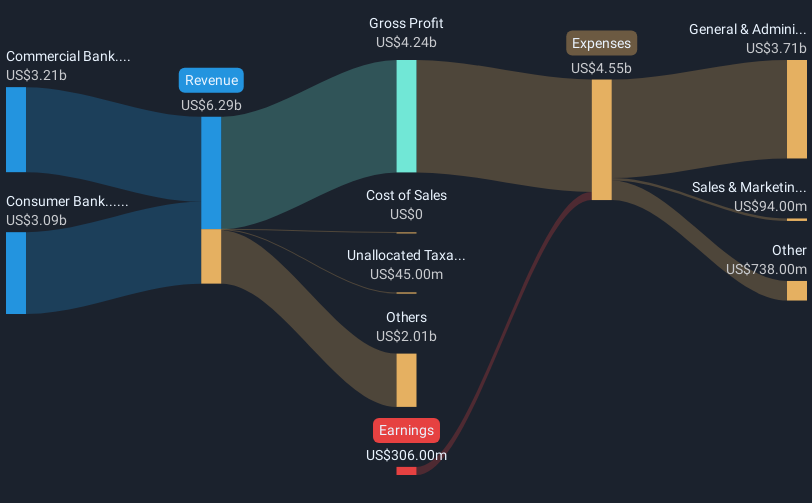

KeyBank's collaboration with the Pro Football Hall of Fame to establish the KeyBank Center, a significant investment in community engagement and financial literacy, aligns with the broader market's positive trajectory. During the last quarter, KeyCorp (KEY) witnessed a 21% price surge. This increase could be attributed to an overall favorable market environment, buoyed by strong corporate earnings across multiple sectors, including technology giants like Microsoft and Meta. Additionally, despite a challenging economic climate, KeyCorp's financial results showed resilience, with notable earnings improvements, further supporting its stock price rise.

You should learn about the 4 possible red flags we've spotted with KeyCorp.

Find companies with promising cash flow potential yet trading below their fair value.

Over the five-year period leading to July 2025, KeyCorp's total shareholder returns, including share price and dividends, amounted to 88.87%. This performance indicates significant long-term value creation, though on a one-year basis, the company's stock underperformed both the US market, which saw a 17.5% return, and the US Banks industry, which returned 21%. The recent 21% spike in KeyCorp's share price could signal market adjustment to improved financial outcomes in the face of broader economic challenges.

The company's recent collaboration with the Pro Football Hall of Fame and its robust earnings improvements may positively impact revenue and earnings forecasts. With net income reported at US$425 million for Q2 2025, up from US$274 million year-on-year, these endeavors could sustain or potentially enhance financial performance. However, despite this upward trajectory, the current share price of US$18.16 still trades below the consensus analyst price target of US$21.15, indicating that analysts consider there is room for further appreciation in value. This gap highlights investor anticipation of future growth propelled by strategic initiatives and industry positioning.

Our valuation report here indicates KeyCorp may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KeyCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEY

KeyCorp

Operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives