As banks kicked off the latest earnings season, JPMorgan Chase & Co.'s (NYSE: JPM)reported the 5th straight beat of analysts' expectations.

Yet, the report still drew criticism and even prompted a downgrade.

See our latest analysis for JPMorgan Chase

Q3 Earnings results

- GAAP EPS: US$3.74 (beat by US$0.74)

- Revenue: US$29.64b (in-line)

- Revenue Growth: +1.74% Y/Y

- FY21 Guidance: US$52.5b

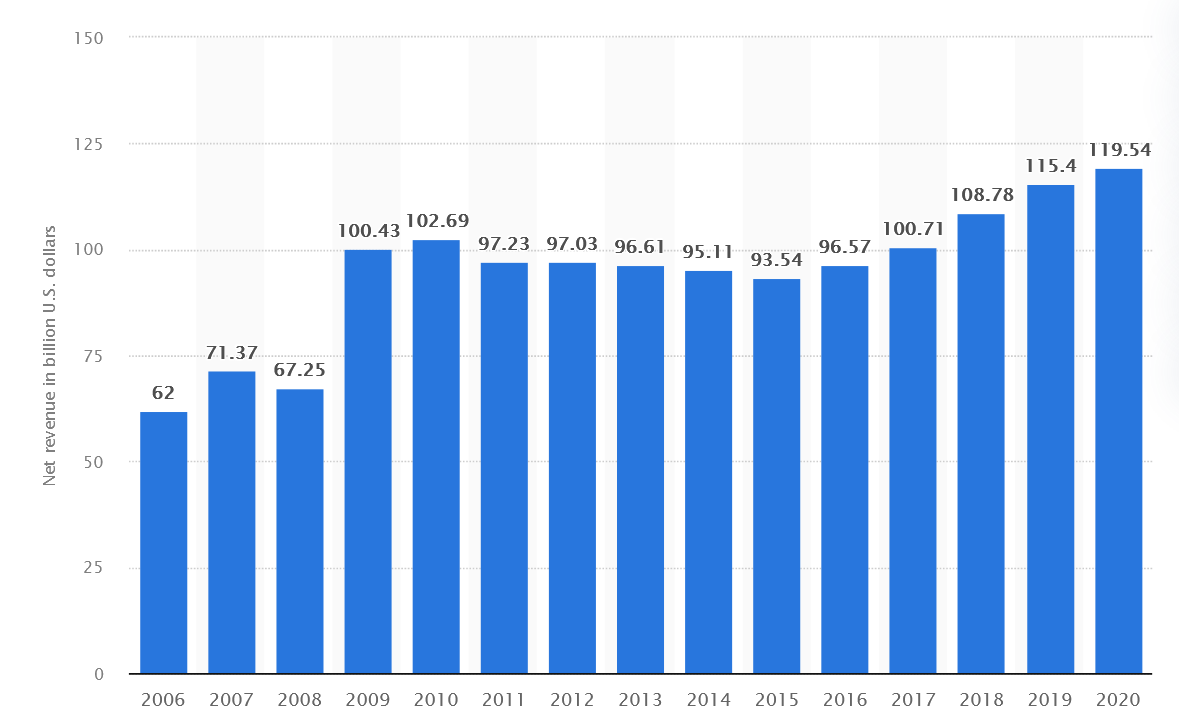

If you observe the revenue trends through the last 15 years, you can see the positive trend picking up towards the end of the previous decade.

While investment banking and trading revenues overshoot the expectations, credit card fees were underwhelming. Analysts attribute this to promotional expenses, as the revenue rate declined by 158 basis points from Q2.

Although CFO Jeremy Barnum reflected that the US$180m rewards liability adjustment was a "one-off, " he expects marketing expenses in the card business to remain elevated.

Meanwhile, CFRA analyst Kenneth Leon downgraded the stock to Hold from Buy. Mr. Leon argues that the stock is too close to his view of fair value, which now equals US$175. This rating is in line with Zacks Research that has it as a Hold, albeit highly ranked in its respective sector (3/16).

The Power Of Non-Operating Revenue

Most companies divide their revenue as either "operating revenue," which comes from normal operations, and other revenue, including government grants, for example. Frequently, non-operating revenue spikes are not repeated, so it makes sense to be cautious where non-operating revenue has substantially contributed to total profit.

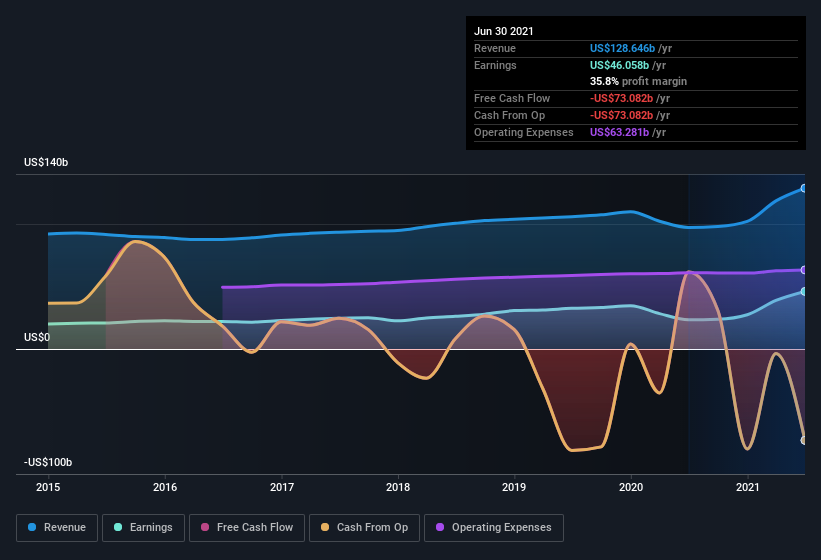

However, we note that when non-operating revenue increases suddenly, it will sometimes generate an unsustainable boost to profit. It's worth noting that JPMorgan Chase saw a significant rise in non-operating revenue over the last year. Indeed, its non-operating revenue rose from US$35.0b the previous year to US$59.6b this year. If that non-operating revenue fails to manifest in the current year, then there's a real risk the bottom line profit result will be impacted negatively.

Sometimes, you can get a better idea of the underlying earnings potential of a company by excluding unusual boosts to non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability based on their estimates.

The Impact Of Unusual Items On Profit

On top of the non-operating revenue spike, we should also consider the US$1.0b impact of unusual items in the last year, which suppressed profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later.

When we analyzed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. JPMorgan Chase took a rather substantial hit from unusual items in the year to June 2021. As a result, we can surmise that the unusual items made their statutory profit significantly weaker than they would otherwise be.

Our Take On JPMorgan Chase's Profit Performance

In its last report, JPMorgan Chase benefitted from a spike in non-operating revenue, which may have boosted its profit in a potentially unsustainable way. But, it also took a hit from unusual items, which could bode well for next year, assuming the expense was one-off.

Given the contrasting considerations, we don't have a strong view as to whether JPMorgan Chase's profits are an apt reflection of its underlying potential for profit. If you'd like to know more about JPMorgan Chase as a business, it's essential to be aware of any risks it's facing.

You'd be interested to know that we found 1 warning sign for JPMorgan Chase, and you'll want to know about it.

There are plenty of other ways to inform your opinion of a company. For example, you may wish to see this free collection of companies boasting high returns on equity or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success