- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Expands in Iowa with 25 New Branches, Boosts Dividend Amid Strong Financial Performance

Reviewed by Simply Wall St

JPMorgan Chase (NYSE:JPM) is currently navigating a period of significant financial performance and strategic growth, marked by a 20% year-on-year revenue increase and strategic expansion plans. However, the firm also faces challenges such as rising expenses and competitive pressures. In the discussion that follows, we will explore JPMorgan Chase's strengths, weaknesses, opportunities, and threats to provide a comprehensive overview of its current business situation.

Get an in-depth perspective on JPMorgan Chase's performance by reading our analysis here.

Strengths: Core Advantages Driving Sustained Success For JPMorgan Chase

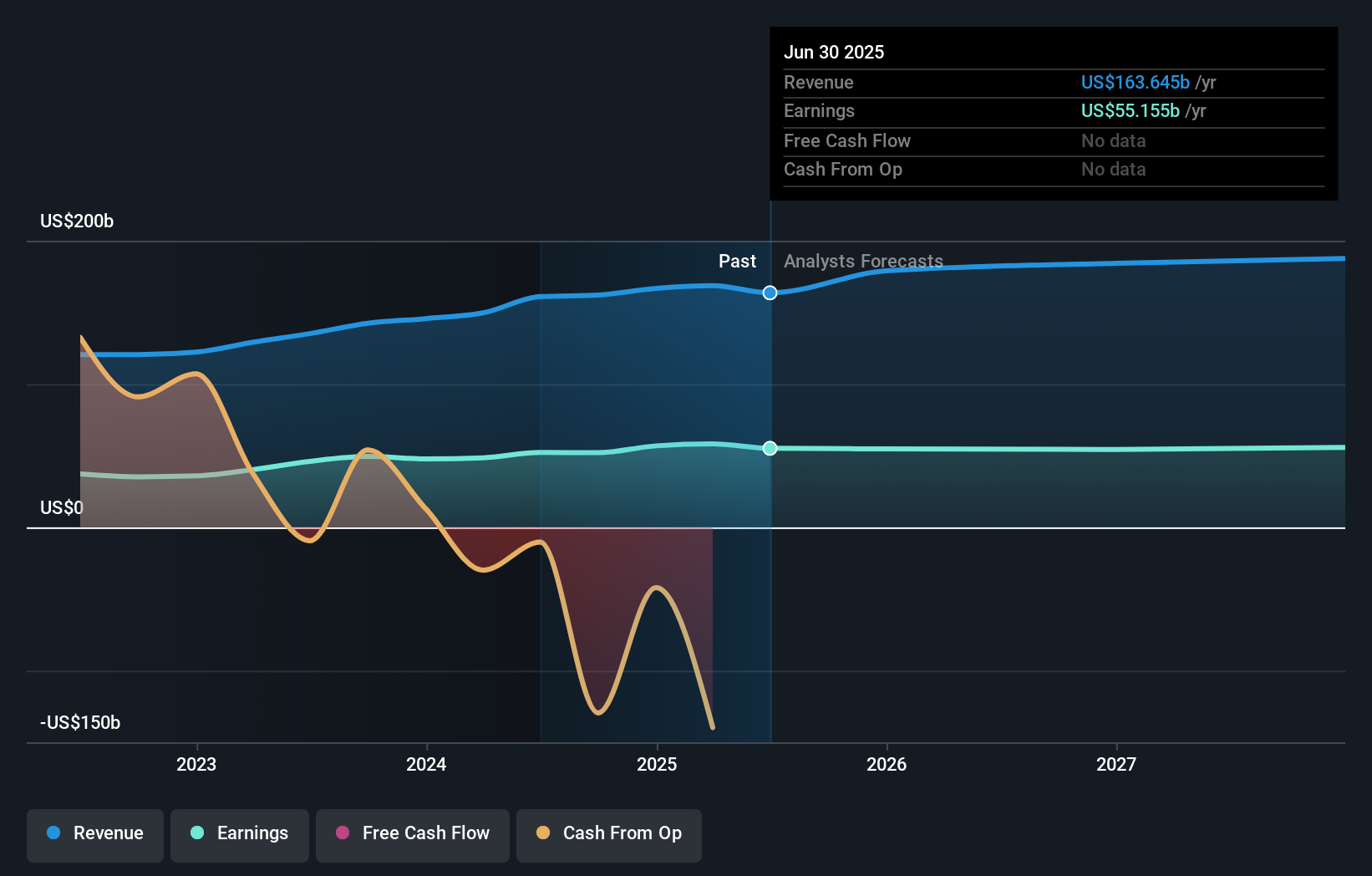

JPMorgan Chase has demonstrated strong financial performance with a net income of $18.1 billion and an EPS of $6.12 on revenue of $51 billion, achieving a Return on Tangible Common Equity (ROTCE) of 28%, as highlighted by Jeremy Barnum, Chief Financial Officer, in the latest earnings call. The company's revenue growth of 20% year-on-year, driven by strong performance in investment banking and asset management, underscores its resilience and strategic prowess. Notably, the firm’s Price-To-Earnings Ratio (11.5x) is favorable compared to the industry average (11.6x) and peers (14.3x). Additionally, JPM is trading at 37.4% below its estimated fair value of $336.76, reinforcing its attractiveness as an investment. The bank's reliable dividend payments, increasing over the past decade, further enhance its appeal to investors.

Weaknesses: Critical Issues Affecting JPMorgan Chase's Performance and Areas For Growth

JPMorgan Chase faces certain challenges. The firm's expenses have increased by 14% year-on-year, reaching $23.7 billion, which could impact profitability. Credit costs are also a concern, with net charge-offs amounting to $2.2 billion and a net reserve build of $821 million. Furthermore, the bank's net profit margins have declined from 34.1% to 32.4%, reflecting pressure on profitability. The forecasted decline in earnings over the next three years (-3% per year) and a lower-than-benchmark Return on Equity (13.4% forecasted in three years) suggest potential headwinds. Additionally, the target price being less than 20% higher than the current share price indicates limited upside potential in the short term.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

JPMorgan Chase has several opportunities to enhance its market position. The bank's expansion plans, including the addition of 25 new branches and over 150 new jobs in Iowa by 2030, demonstrate its commitment to growth and community engagement. The firm's strategic alliances and product-related announcements, such as the numerous fixed-income offerings, highlight its proactive approach to capitalizing on market trends. The planned increase in the quarterly common stock dividend from $1.15 to $1.25 per share in the third quarter of 2024 reflects confidence in its financial health and commitment to returning value to shareholders. Additionally, the dialogue on ECM and M&A activities indicates a favorable investment banking environment.

Threats: Key Risks and Challenges That Could Impact JPMorgan Chase's Success

JPMorgan Chase faces several external threats that could impact its growth and market share. The competitive environment remains intense, as highlighted by Jeremy Barnum, which could pressure margins and market positioning. Regulatory overhangs in advisory services and potential increases in charge-offs pose significant risks. The economic environment, characterized by cautious demand for new loans from middle market and large corporate clients, could hinder growth prospects. Furthermore, the bank's revenue growth forecast of 1.5% per year, slower than the US market average of 8.7%, suggests potential challenges in maintaining its competitive edge. These factors necessitate strategic vigilance to navigate the evolving financial landscape effectively.

To gain deeper insights into JPMorgan Chase's historical performance, explore our detailed analysis of past performance. To dive deeper into how JPMorgan Chase's valuation metrics are shaping its market position, check out our detailed analysis of JPMorgan Chase's Valuation.Conclusion

JPMorgan Chase's strong financial performance, characterized by a net income of $18.1 billion and a Return on Tangible Common Equity (ROTCE) of 28%, highlights its operational efficiency and strategic acumen. Challenges such as rising expenses and credit costs persist, but the bank's Price-To-Earnings Ratio (11.5x), lower than the industry and peer averages, and its trading position at 37.4% below its estimated fair value of $336.76, indicate it is a compelling investment opportunity. The firm's proactive expansion plans and strategic initiatives in investment banking and asset management are poised to drive future growth, although vigilance is required to navigate competitive and regulatory pressures. Overall, JPMorgan Chase's financial health and strategic initiatives position it well for sustained performance, albeit with a need to manage potential headwinds effectively.

Make It Happen

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives