- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (NYSE:JPM) Expands Affluent Banking With 14 New Financial Centers

Reviewed by Simply Wall St

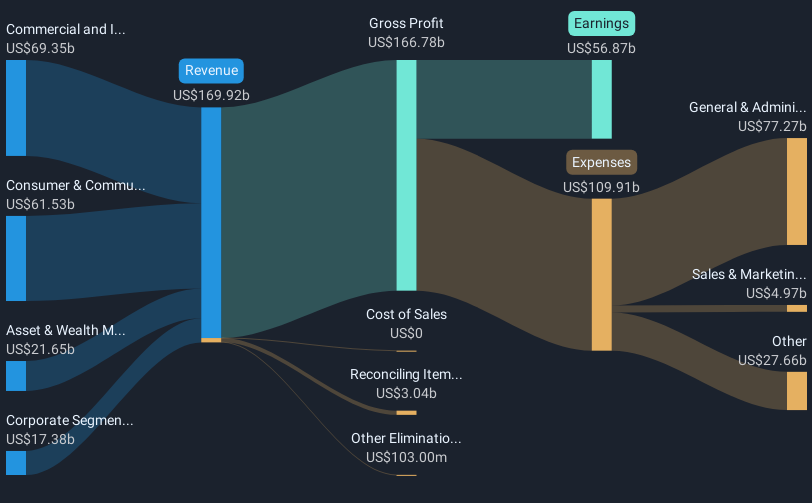

JPMorgan Chase (NYSE:JPM) recently announced the expansion of its affluent banking services, opening 14 new J.P. Morgan Financial Centers across key U.S. states, while also leasing new office space in Paris. These initiatives are expected to enhance client engagement and strengthen market presence. In tandem, the company unveiled the JPMorgan Chase Center for Geopolitics, focusing on global business trends, alongside updates in quantum research software. Amid a largely flat market, the company's shares rose 8.93% over the past month, with these events potentially adding weight to broader positive market movements.

The expansion of JPMorgan Chase's banking services and its foray into the geopolitics center may influence future revenue and earnings forecasts. These initiatives could enhance client engagement and potentially drive growth in key sectors, further supporting the company's market presence. However, despite these positive undertakings, increased allowances for credit losses and rising expenses might pressure future profitability, as outlined in the narrative. These factors indicate that while strategic moves are in play, economic challenges remain that might affect net income growth.

Over the past five years, JPMorgan Chase has delivered a total shareholder return of 208.17%, showcasing significant gains during this period. More recently, the company's stock outperformed the broader US Banks industry over the last year, which saw a return of 20.8%. This performance highlights JPMorgan's resilience amidst market fluctuations.

Considering the company's recent share price gain of 8.93% against its price target of $267.01, the current valuation appears near this target, with only a slight discount of approximately 0.65%. This alignment suggests that the market is optimistic about the company's near-term prospects, although longer-term factors such as anticipated rate cuts and higher credit losses will require close monitoring.

Explore historical data to track JPMorgan Chase's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives