- United States

- /

- Banks

- /

- NYSE:JPM

JPMorgan Chase (JPM): Is There Hidden Value in Its Current Stock Price?

Reviewed by Simply Wall St

JPMorgan Chase (JPM) has edged higher in recent days, landing on the radar for many investors looking to assess their next move in the banking sector. The bank’s modest price uptick has not been sparked by any headlines or dramatic earnings beats. Instead, it seems to reflect a confluence of steady business results and cautious optimism in the broader financial markets. When nothing dramatic makes the news, it often pays to look a little deeper, especially for a bank as influential as JPMorgan Chase.

Through the year, JPMorgan Chase has outperformed much of the financial sector, with a 38% return over the past twelve months and over 21% year-to-date. Recent weeks have seen momentum hold, even as larger banks grapple with regulatory changes and shifting interest rate expectations. Investors may remember last quarter’s solid revenue growth and the persistence of net income. These have helped power the stock’s longer-term climb, and, for now, that trajectory is holding its ground.

Is JPMorgan Chase simply benefitting from a favorable market mood, or is there lingering value in the shares that has yet to be recognized? Have expectations for future growth been fully priced in, or could today’s price offer a buying opportunity?

Most Popular Narrative: 4.7% Undervalued

According to the community narrative, JPMorgan Chase is seen as modestly undervalued relative to its fair value, based on a comprehensive analysis of potential future growth drivers and risks.

Ongoing investment and active participation in tokenization, stablecoins, and payment innovations, as detailed in the deposit token discussion, position JPMorgan to benefit competitively from the next wave of technology adoption in banking and payments. This is likely to support both future revenue resilience and margin improvement.

Curious what numbers fuel this bullish outlook? The key factors include bold assumptions about digital banking success, a tighter profit margin story, and an earnings multiple that points to industry leadership. Interested in how high analysts estimate growth rates and valuation multiples? The details behind this fair value may surprise you.

Result: Fair Value of $305.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent fintech competition and tougher regulations could quickly shift the outlook. This could put pressure on JPMorgan’s margins and long-term growth prospects.

Find out about the key risks to this JPMorgan Chase narrative.Another View: A Look Through the DCF Lens

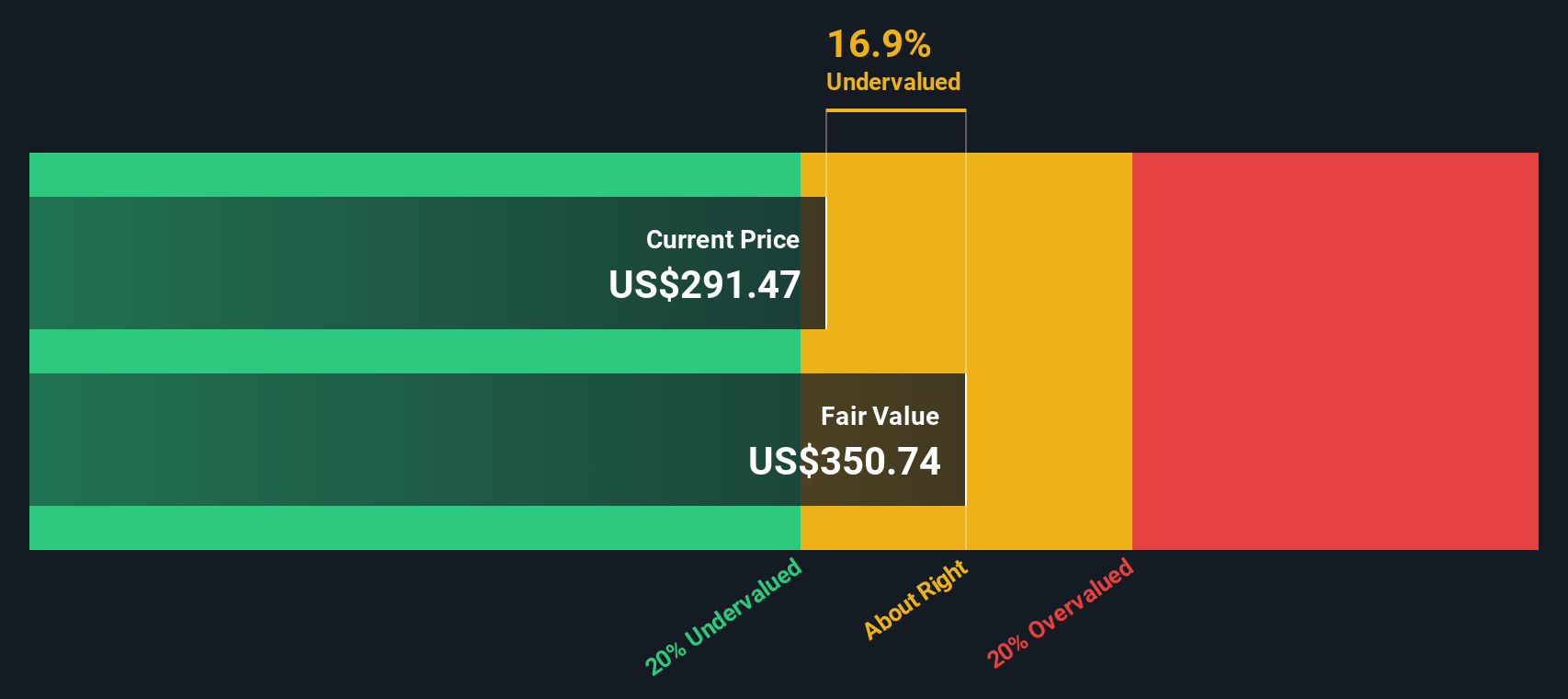

While analyst price targets use earnings ratios for banking giants like JPMorgan Chase, our DCF model takes a closer look at expected future cash flows. Interestingly, it finds the shares to be undervalued from this perspective as well. Does the market truly recognize that hidden value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JPMorgan Chase for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JPMorgan Chase Narrative

If the current analysis does not match your own views, or if you would rather develop your outlook firsthand, you can research and assemble your own narrative in just a few minutes. do it your way.

A great starting point for your JPMorgan Chase research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio to just one winner when there are so many opportunities in today’s market. Make the most of your next move by seizing exciting investment angles that others might overlook. Start reshaping your long-term strategy now with these smart, handpicked stock ideas:

- Uncover reliable income streams when you review dividend stocks with yields > 3%. This resource features companies with robust yields that can help stabilize your returns.

- Tap into the momentum of pioneering innovation by checking out AI penny stocks. Here, fast-moving businesses are changing the game with artificial intelligence breakthroughs.

- Capitalize on breakthrough discoveries in healthcare by exploring healthcare AI stocks. This selection spotlights firms fusing advanced AI with life-saving medical solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives