- United States

- /

- Banks

- /

- NYSE:JPM

Is JPMorgan Stock Fairly Priced as AI Investments Deliver $2B in Annual Savings?

Reviewed by Bailey Pemberton

Trying to decide what to do with JPMorgan Chase stock lately? You are not alone. With a last close at $305.53 and a five-year return of 242.0%, investors have plenty of reasons to pay close attention. While the past week saw JPMorgan dip by 0.7%, this barely dents a run that had the stock up 27.3% so far this year and an eye-catching 46.6% over the past twelve months. In other words, short-term noise aside, JPMorgan has been a winner for long-term holders.

There is more to this story than simply price moves. Recent headlines have highlighted how the bank continues to put money to work where it counts. CEO Jamie Dimon has been frank about the company's $2 billion annual investment in artificial intelligence, claiming that the efficiency gains are already matching those outlays dollar for dollar. At the same time, JPMorgan is in the thick of competition for roles in potential high-profile IPOs, showing how the bank can play offense even as industry winds shift.

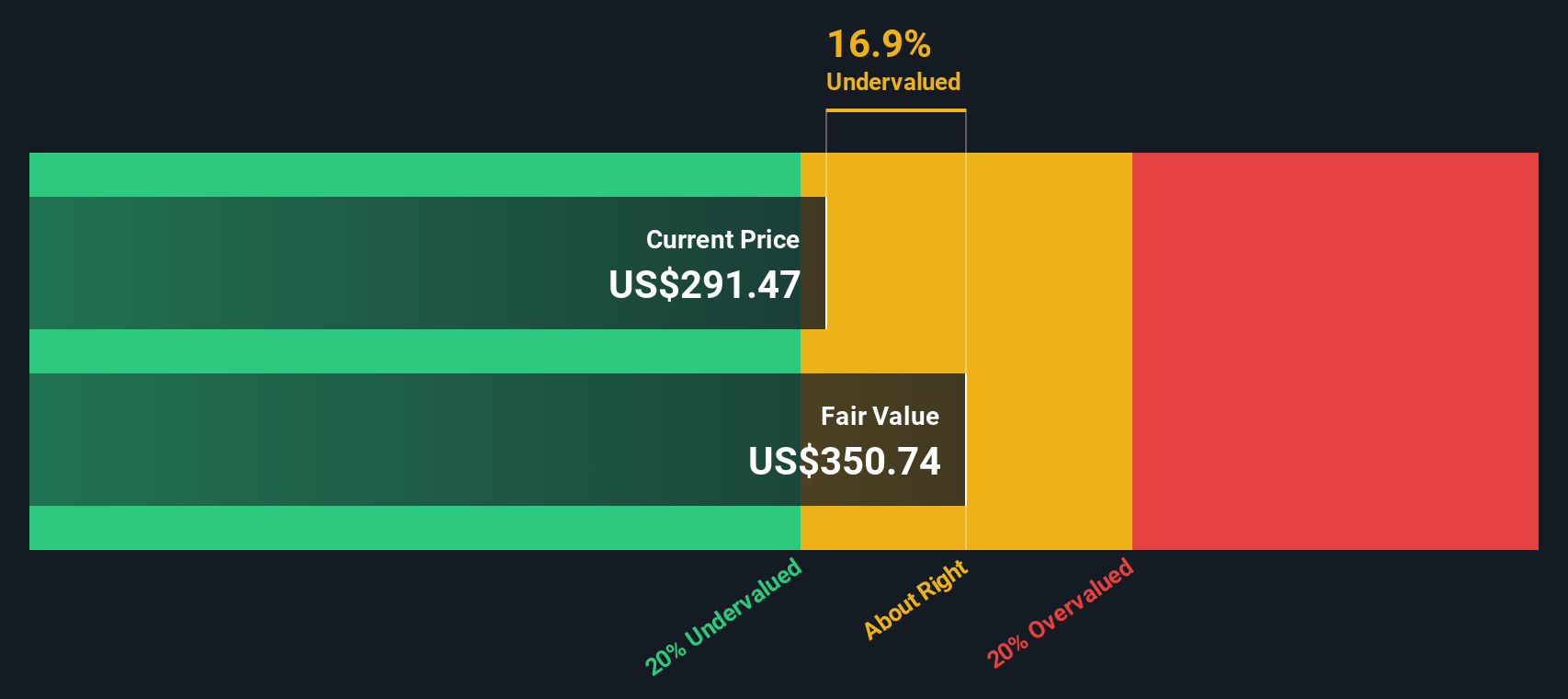

Of course, momentum and strong management are only part of the picture. The valuation score for JPMorgan comes in at 2 out of 6, which means only two of the major checks suggest the shares are undervalued. That sets the stage for a closer look at how the stock stacks up on several valuation fronts, from price-to-earnings to beyond. And make sure to stick around, because we will explore an even more insightful way to judge if JPMorgan is a true bargain by the end of this analysis.

JPMorgan Chase scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company generates returns above its cost of equity. By comparing the average return on equity to the required rate of return, this approach highlights whether management is creating genuine shareholder value over time.

For JPMorgan Chase, the model shows a robust average return on equity of 16.01%, well ahead of its cost of equity at $10.92 per share. With a stable EPS projection of $21.33 per share, based on consensus estimates from 11 analysts, and a steady book value per share of $122.51 (expected to rise to $133.20), the excess return is calculated as $10.41 per share. This represents meaningful value creation above what shareholders require for holding the stock.

Given these fundamentals, the estimated intrinsic value per share is $336.40. Compared to the current market price of $305.53, this implies JPMorgan Chase is roughly 9.2% undervalued according to the Excess Returns model. While not a massive disconnect, it does suggest some upside potential for investors seeking value in a leading bank stock.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out JPMorgan Chase's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: JPMorgan Chase Price vs Earnings

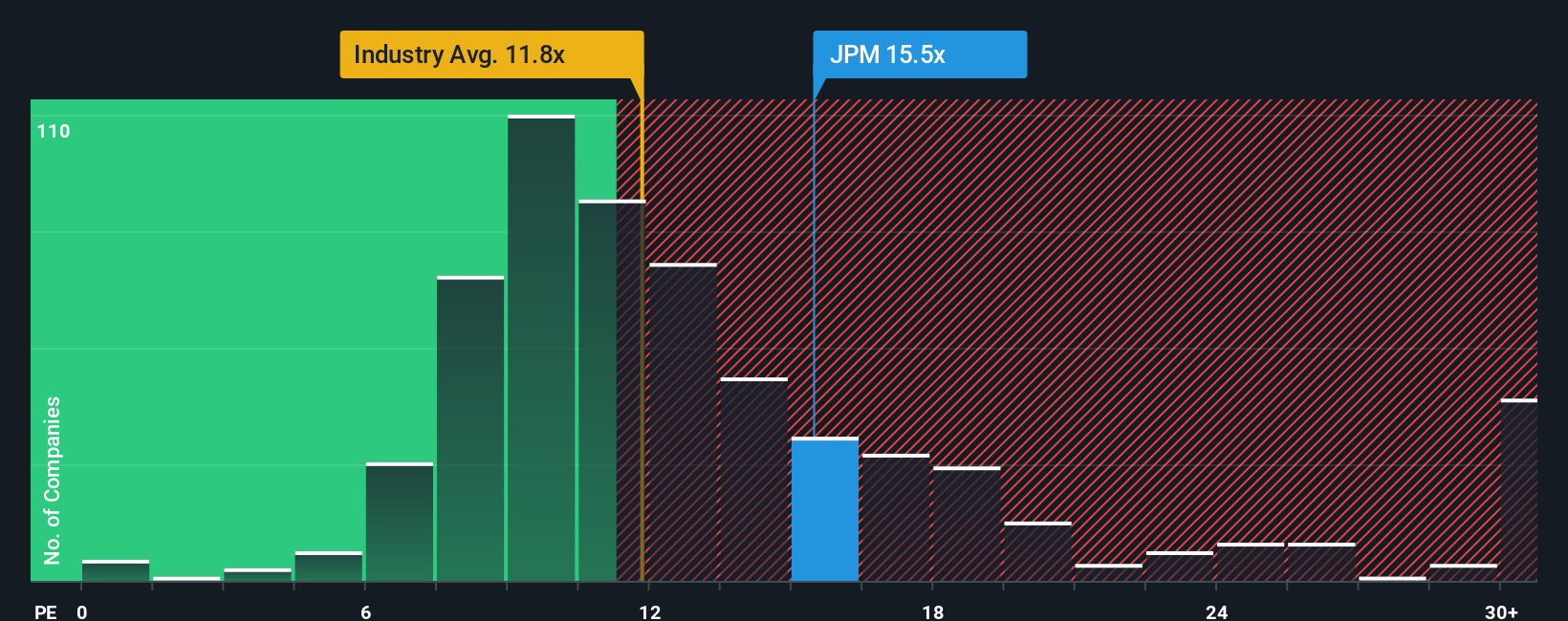

For profitable companies like JPMorgan Chase, the price-to-earnings (PE) ratio is a widely accepted way to value the stock. The PE ratio reveals how much investors are willing to pay today for each dollar of earnings, making it a direct window into market sentiment about the company's profitability and future prospects.

What sets the "right" PE multiple for a company is a combination of expected earnings growth and perceived risks. Higher growth companies or those seen as safer may warrant a higher PE, while lower growth or riskier businesses tend to trade at lower ratios. That is why it is important to weigh JPMorgan's current PE against meaningful benchmarks.

JPMorgan Chase currently trades at a PE ratio of 15.2x. This sits above the average for its bank industry peers at 13.0x, and even further above the broader industry average of 11.6x. While this premium might suggest JPMorgan is expensive, it does not tell the whole story because raw comparisons do not factor in company-specific qualities. That is where Simply Wall St’s “Fair Ratio” metric adds value, as it estimates the appropriate PE for JPMorgan by blending its growth, risk profile, market cap, profit margin and industry norms. For JPMorgan, the Fair Ratio is 15.5x, almost exactly aligning with its current PE. Because the difference between the Fair Ratio and JPMorgan’s actual PE is less than 0.10, this suggests the stock is valued about right by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

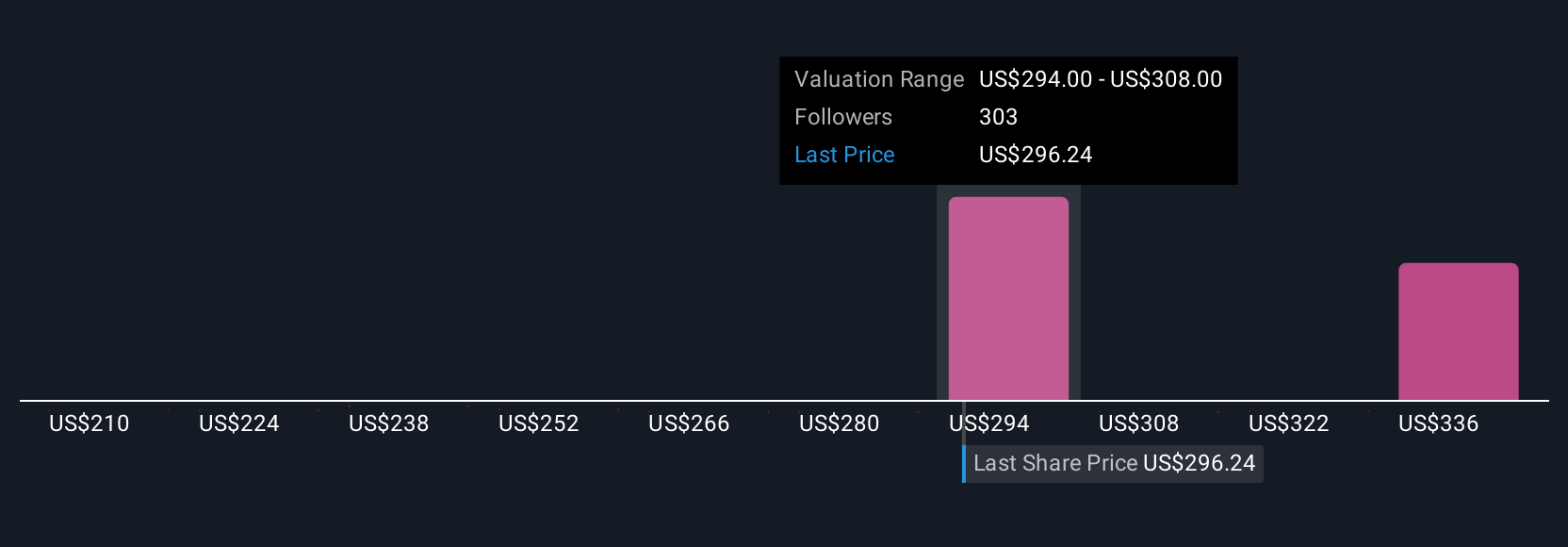

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. This is a powerful yet approachable method that gives you the story behind the numbers. A Narrative is your unique perspective on a company’s future, connecting its business story to a specific financial forecast and a justified fair value. On Simply Wall St’s Community page, millions of investors use Narratives to turn their views about JPMorgan’s tech investments, market share, or regulatory risks into concrete numbers like future revenue, earnings, and profit margins. These assumptions automatically update as new earnings or news arrives.

By comparing your Narrative’s Fair Value to the latest price, you can decide if it is time to buy, hold, or sell. This makes complex decisions much simpler and more transparent. Different investors, for example, see JPMorgan’s future very differently. Some expect strong digital banking growth and set fair values as high as $350, while others see more risk and a fair value as low as $247. Your Narrative helps you invest with conviction, grounded in your own logic, with all the numbers and assumptions clearly laid out and dynamically refreshed as the facts change.

For JPMorgan Chase, we will make it really easy for you with previews of two leading JPMorgan Chase Narratives:

Fair Value: $320.96

Approximate Undervalued Amount: 4.8%

Revenue Growth Assumption: 4.8%

- Analysts expect broad-based growth in wealth management, payments, and digital banking. This growth is anticipated to support higher fee revenue, improved customer acquisition, and margin expansion for JPMorgan Chase.

- Investments in financial technology and diversification across multiple business lines are projected to make the company resilient and able to outperform peers, even as the industry evolves.

- This narrative assumes continued steady revenue growth, modest margin compression, and a high but not excessive valuation multiple. The result is a fair price target just above the current share price.

Fair Value: $247.02

Approximate Overvalued Amount: 23.7%

Revenue Growth Assumption: 4.1%

- Rising credit loss allowances and elevated operating costs are expected to pressure JPMorgan Chase's net margins and constrain future earnings growth.

- Lower net interest income, potential rate cuts, and a cautious outlook for investment banking could limit revenue growth and negatively impact overall profitability.

- Bearish analysts believe that, despite current strength, the shares are already pricing in too much optimism. This leaves little room for upside and significant downside risk if negative scenarios play out.

Do you think there's more to the story for JPMorgan Chase? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives