- United States

- /

- Banks

- /

- NYSE:JPM

How Does JPMorgan Stack Up After Senators Probe H-1B Visa Hiring?

Reviewed by Bailey Pemberton

Thinking about whether to hold, buy, or sell JPMorgan Chase stock? You are not alone. The world’s largest bank by market cap has been on quite a ride, and it makes sense to dig a bit deeper if you are weighing your next move. In the past year alone, shares have surged 53.2%, making them one of the standout performers in the financial sector. Go back further, and the five-year return hits a jaw-dropping 242.4%. That is hardly the haul of a slow and steady blue-chip.

Of course, recent weeks have introduced some jitters. The stock dipped 1.9% this past week after a steady month-long climb of 2.6%. Part of this choppiness could be tied to headlines from Washington and corporate boardrooms. Senators are agitating for hearings over the bank’s historical ties, and questions about workforce practices have popped up in D.C. Meanwhile, expansion plans like their fresh push for new London office space remind us JPMorgan is not standing still in a competitive global market. Despite these mixed signals, the stock’s year-to-date return remains a strong 28.1%.

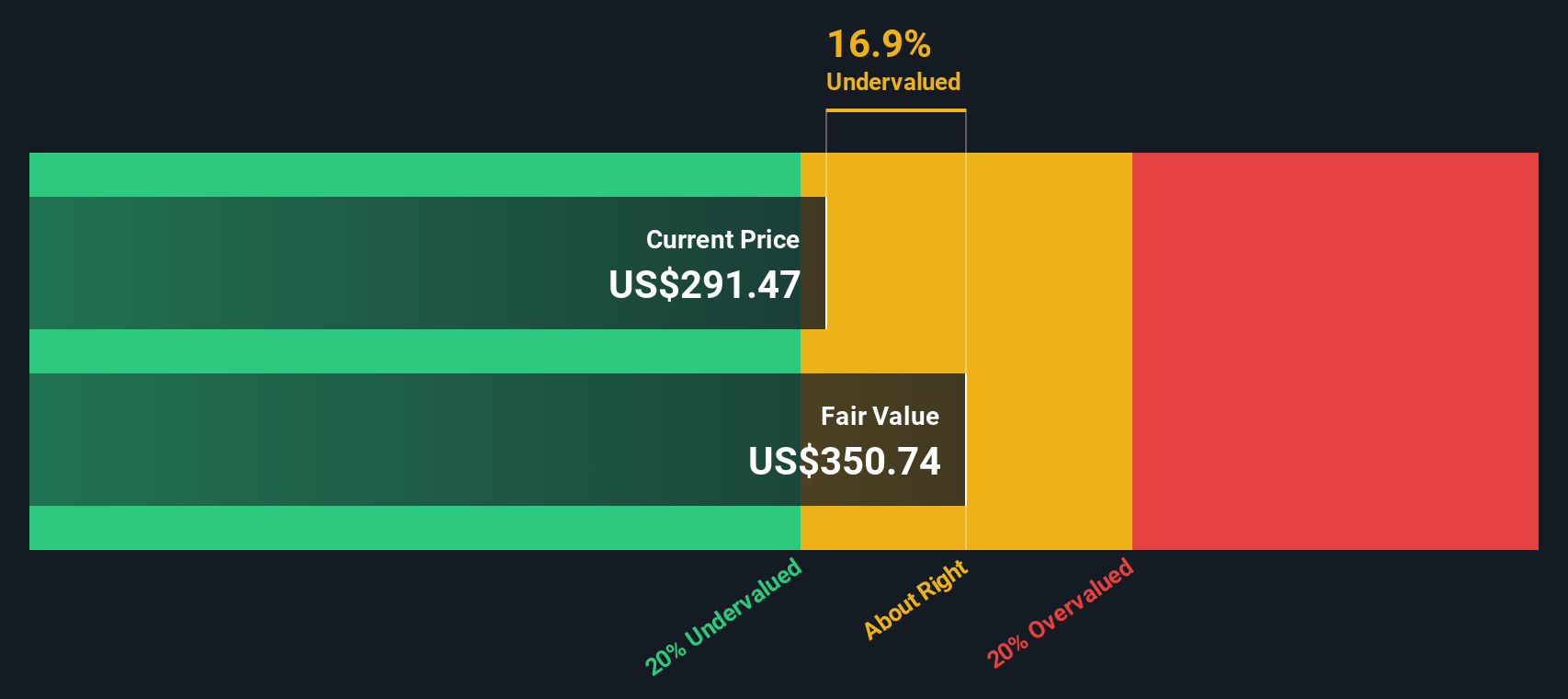

But looking at price movements alone never truly tells the full story about value. If you are hunting for undervalued opportunities, JPMorgan scores a 2 out of 6 on our valuation check system. That may not scream "cheap," but numbers do not exist in a vacuum, and not all valuation methods are created equal. Next, let’s explore exactly how these scores are calculated and which models matter most if you really want an edge. There is even one method that savvier investors often overlook.

JPMorgan Chase scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: JPMorgan Chase Excess Returns Analysis

The Excess Returns valuation model focuses on how much profit JPMorgan Chase generates above its cost of capital. This approach provides a deeper look at value creation beyond simple earnings or assets. It estimates the long-term impact of management’s ability to deploy capital efficiently and compares it to what shareholders would require as a minimum acceptable return.

For JPMorgan, the Excess Returns figures show:

- Book Value: $122.51 per share

- Stable EPS: $21.91 per share (Source: Weighted future Return on Equity estimates from 13 analysts.)

- Cost of Equity: $10.90 per share

- Excess Return: $11.01 per share

- Average Return on Equity: 16.49%

- Stable Book Value: $132.83 per share (Source: Weighted future Book Value estimates from 12 analysts.)

The model’s estimated intrinsic value for JPMorgan shares is $347.52, which is 11.5% above the current market price. This suggests the stock is 11.5% undervalued based on its ability to generate excess profits over time for shareholders. The model's output indicates that JPMorgan is running its business at an efficiency level well above its cost of capital, a positive sign for long-term investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests JPMorgan Chase is undervalued by 11.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: JPMorgan Chase Price vs Earnings (PE)

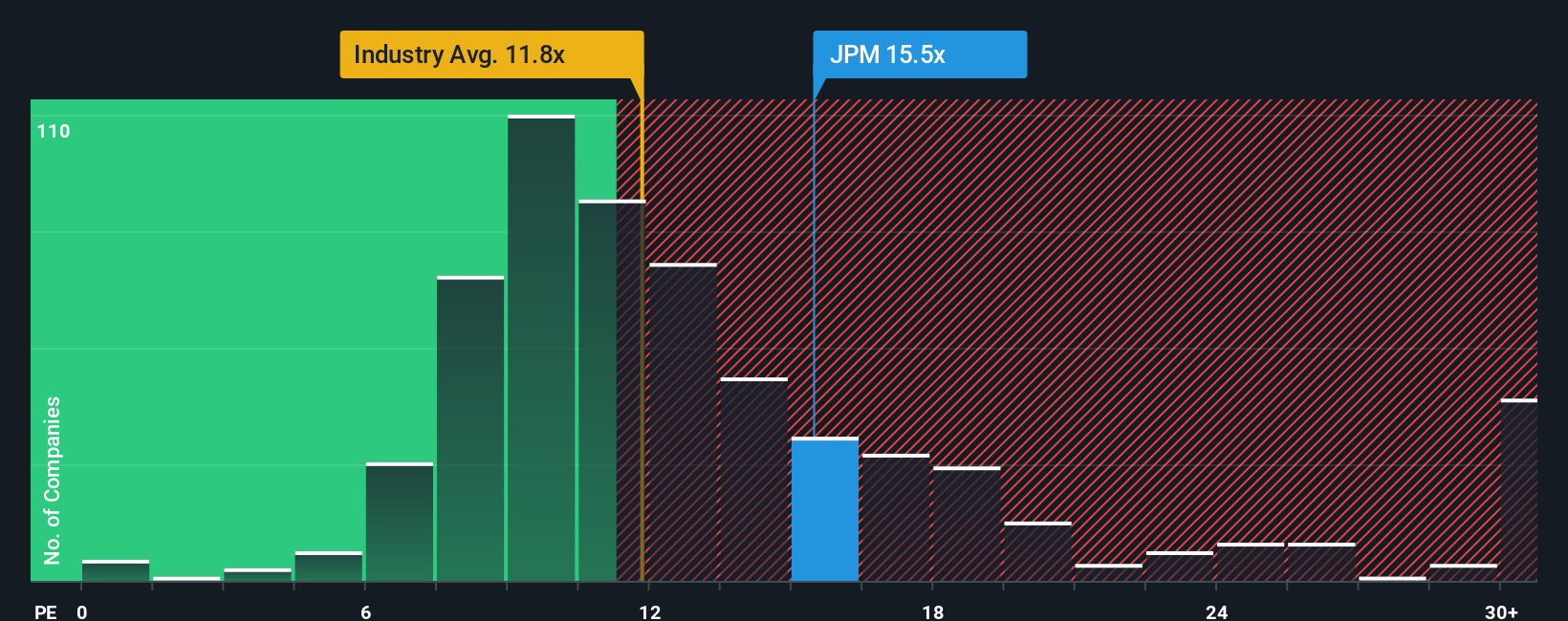

The Price-to-Earnings (PE) ratio is a favored valuation metric for profitable companies like JPMorgan Chase. It is especially useful because it relates a company’s current share price to its per-share earnings, directly tying valuation to the bottom line. For banks and other financials that generate steady profits, the PE ratio provides a quick reference for how the market is pricing their earnings power.

Growth expectations and risk play a big part in what a "fair" PE ratio should be. Higher growth rates or less perceived risk tend to justify higher multiples, while slower-growing or riskier firms typically command lower PE ratios. Comparing JPMorgan’s current PE of 15.3x to the broader banks industry average of 11.7x and a peer average of 13.1x, the stock appears to trade at a premium by conventional standards.

However, Simply Wall St's proprietary Fair Ratio adds another layer to this analysis. Unlike a basic benchmark, the Fair Ratio adjusts for JPMorgan’s earnings growth, profit margins, market cap, and risk. This approach provides a nuanced picture of what the right PE multiple should be for this specific business. For JPMorgan, the Fair Ratio is 15.4x, nearly identical to its actual PE. This alignment suggests the market’s current pricing accurately factors in the company’s strengths and business environment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your JPMorgan Chase Narrative

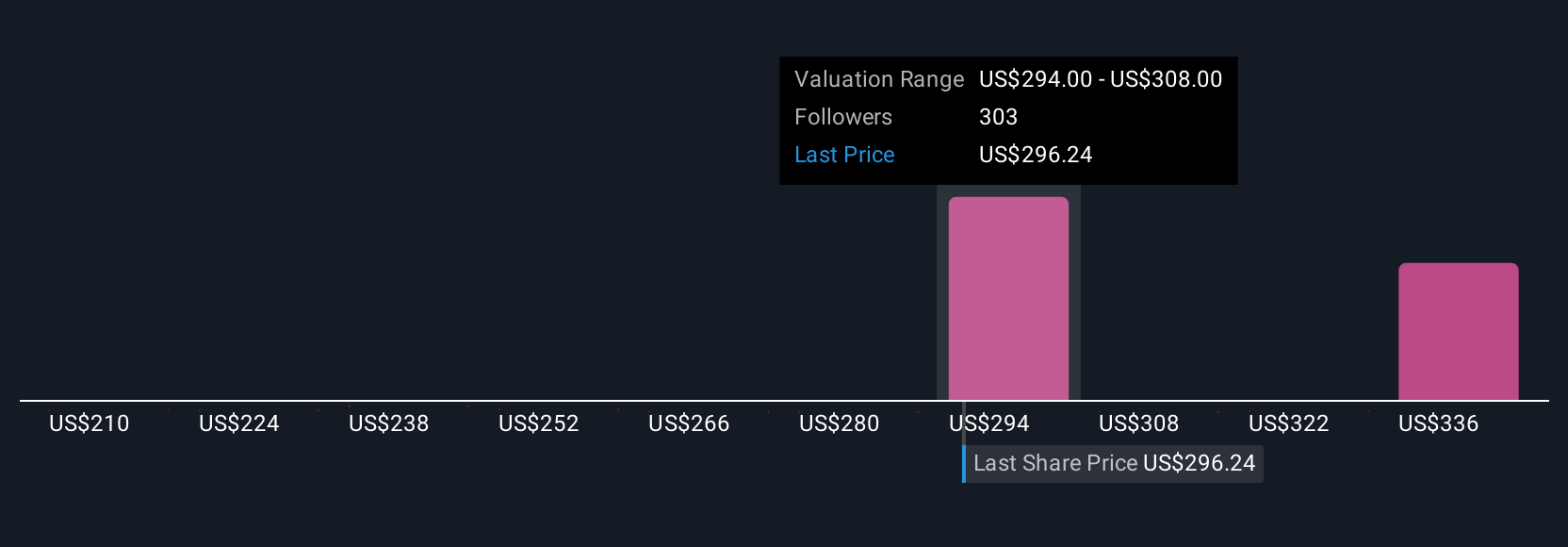

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that connects your perspective on a company's future to concrete numbers and a fair value estimate. A Narrative isn't just a story, but your own reasoned take on how a company's business might grow, change, or face challenges, paired with your estimates for future revenue, earnings, and margins.

Using Narratives, you link your view of JPMorgan Chase's strategy and industry position directly to a financial forecast, then see how that measures up to today's share price. Narratives are easy to use, accessible to everyone on Simply Wall St's Community page, and are updated in real time as new news or earnings are released. This helps you react faster and more confidently. By comparing the fair value suggested by your Narrative to the current price, you get a clear, dynamic indicator for whether to buy, hold, or sell.

For example, some investors believe JPMorgan's global digital expansion and tech innovation could justify a fair value as high as $350 per share, while others highlight credit losses and regulatory risks that put fair value closer to $235. Narratives empower you to choose which story and valuation reflects your own expectations, making your decisions smarter and more personal.

For JPMorgan Chase, we'll make it really easy for you with previews of two leading JPMorgan Chase Narratives:

Fair Value: $310.48

Current price is 0.9% below this fair value (undervalued by 0.9%)

Forecast Revenue Growth: 4.5%

- Digital banking, tokenization, and tech investments are expected to enhance profitability, expand margins, and increase fee-based revenue over the long term.

- A diversified business model and global expansion aim to strengthen resilience across market cycles and support ongoing earnings growth.

- Main risks include intensifying fintech competition, evolving regulations, and possible margin compression from product commoditization.

Fair Value: $247.02

Current price is 24.5% above this fair value (overvalued by 24.5%)

Forecast Revenue Growth: 4.1%

- Rising credit loss provisions and higher expenses are expected to squeeze net and operating margins, limiting future earnings.

- Anticipated interest rate cuts and a cautious investment banking outlook could restrict revenue growth and weaken profitability.

- Despite business strengths, analyst cohort sees the share price as running ahead of underlying fundamentals given current risks.

Do you think there's more to the story for JPMorgan Chase? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JPM

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives